Nedbank is one of South Africa’s leading banking institutions, with a rich history and a strong presence in the financial landscape. When it comes to loans, many South Africans consider Nedbank as a go-to option. In this review, we’ll delve deep into the various loan products offered by Nedbank, shedding light on their features, customer experiences, and how they compare with other major banks in the country. Whether you’re considering a personal loan for an unexpected expense, a home loan for your dream house, or a business loan to expand your venture, this review aims to provide you with a clear and unbiased perspective on what Nedbank has to offer.

Experiences with Nedbank Loan

Many individuals and businesses across South Africa have turned to Nedbank for their borrowing needs. The experiences vary, but a common thread among most borrowers is the bank’s commitment to clarity and customer service. From the initial application process to the final repayment, Nedbank ensures that its customers are well-informed and comfortable with their loan terms. The bank’s digital platforms, coupled with its extensive branch network, make the loan application and management process smooth for most customers. Additionally, the feedback from many borrowers highlights the bank’s transparent fee structure and competitive interest rates, which are often cited as reasons for choosing Nedbank over other lenders.

Who Can Apply for a Nedbank Loan?

Nedbank’s loan products are designed to cater to a wide range of customers. Whether you’re an individual looking for a personal loan, a business owner seeking funds to expand, or someone wanting to buy their dream home, Nedbank has a loan product tailored for you. South African residents, both salaried and self-employed, can apply for a loan with Nedbank. The bank also offers specialized loan products for students and vehicle financing, ensuring that a broad spectrum of financial needs is covered.

Nedbank Loan Eligibility Criteria

Nedbank, like all responsible lenders, has a set of criteria that potential borrowers must meet. Firstly, the applicant must be a legal resident of South Africa and be at least 18 years old. They should have a valid South African ID and provide proof of a stable income, which can be through payslips or bank statements. The bank also assesses the applicant’s credit history to determine their creditworthiness. A good credit score increases the chances of loan approval and might also fetch better interest rates. However, Nedbank also considers other factors, such as the applicant’s current financial situation and their ability to repay the loan.

Differences from Other Loan Providers

Nedbank sets itself apart from other loan providers in several ways. One of the standout features is its commitment to financial education. The bank offers resources and tools to help borrowers understand the nuances of loans, ensuring they make informed decisions. Additionally, Nedbank’s loan products are flexible, allowing borrowers to choose repayment terms that suit their financial situation. The bank’s digital platforms are user-friendly, enabling customers to manage their loans, check balances, and make repayments online without visiting a branch. Nedbank’s interest rates are competitive, and its transparent fee structure means there are no hidden charges, making the overall borrowing experience more predictable and manageable for customers.

About Arcadia Finance

Arcadia Finance is your pathway to easy loan access. Fill out our cost-free application and get offers from up to 19 various lenders. We ensure a reliable process by collaborating with only NCR-licensed, established lenders in South Africa.

Nedbank Loan

Nedbank, as one of South Africa’s premier banking institutions, has carved a niche for itself in the loan market. With a blend of innovative products and customer-centric services, Nedbank loans stand out in a crowded marketplace.

What Makes the Nedbank Loan Unique?

The uniqueness of Nedbank loans lies in their approach to financial solutions. Rather than offering a one-size-fits-all product, Nedbank focuses on understanding the individual needs of its customers and tailoring loan products accordingly. This personalized approach ensures that borrowers get the most suitable loan for their specific situation. Additionally, Nedbank’s commitment to transparency means that customers are always aware of the terms of their loan, from interest rates to repayment schedules, ensuring there are no surprises down the line. The bank’s robust digital platforms also allow customers to manage their loans seamlessly, from application to repayment, making the entire process smooth and hassle-free.

Advantages of the Nedbank Loan Comparison

When comparing Nedbank loans with those from other providers, several advantages come to the fore. Firstly, Nedbank’s competitive interest rates ensure that borrowers get value for their money. The bank’s transparent fee structure, with no hidden charges, further enhances this value proposition. Additionally, the flexibility offered by Nedbank in terms of repayment terms and loan amounts allows borrowers to choose a loan that fits their financial situation perfectly. The bank’s emphasis on financial education, providing resources and tools to help borrowers make informed decisions, is another significant advantage. This focus on customer empowerment sets Nedbank apart in the loan market.

Types of Loans Offered by Nedbank

Nedbank offers a diverse range of loan products to cater to the varied needs of its customers. These include:

Personal Loans: These are unsecured loans that individuals can use for a variety of purposes, from consolidating debt to funding a vacation. The flexibility of use makes personal loans one of the most popular products offered by Nedbank.

Auto Loans: For those looking to purchase a new or used vehicle, Nedbank’s auto loans are the perfect solution. With tailored interest rates and a straightforward application process, getting behind the wheel of your dream car has never been easier.

Business Loans: Catering to the needs of entrepreneurs and business owners, these loans provide the necessary capital to start or expand a business. Nedbank understands the challenges faced by businesses and offers products that help them achieve their growth objectives.

Student Loans: Education is a significant investment, and Nedbank’s student loans ensure that finances are not a barrier to achieving one’s academic goals. These loans cover tuition, accommodation, and other related expenses, helping students focus on their studies.

Requirements for a Nedbank Loan

When considering a loan application, Nedbank, like most reputable financial institutions, has a set of requirements that potential borrowers must meet. These requirements are in place to ensure that both the bank and the borrower have a clear understanding of the loan terms and that the borrower is in a position to repay the loan without undue financial strain.

Documents and Information Needed

- Proof of Identity: A valid South African ID card or passport is essential. This confirms the applicant’s identity and legal status in the country.

- Proof of Income: This can be in the form of recent payslips for salaried individuals or bank statements for self-employed individuals. This helps Nedbank assess the applicant’s financial stability and ability to repay the loan.

- Proof of Residence: A recent utility bill or a lease agreement can serve as proof of residence. This confirms the applicant’s current address.

- Credit History: While you don’t need to provide this yourself, Nedbank will conduct a credit check to assess your creditworthiness. A good credit history can enhance your chances of loan approval and might result in more favorable interest rates.

- Details of Existing Financial Commitments: If you have other loans or financial obligations, you’ll need to provide details of these. This helps Nedbank assess your overall financial health and ensures that taking on another loan won’t overburden you.

- Purpose of the Loan: Depending on the type of loan you’re applying for, you might need to provide details about the purpose of the loan. For instance, if it’s a home loan, details about the property, its value, and any down payment you’re making will be required.

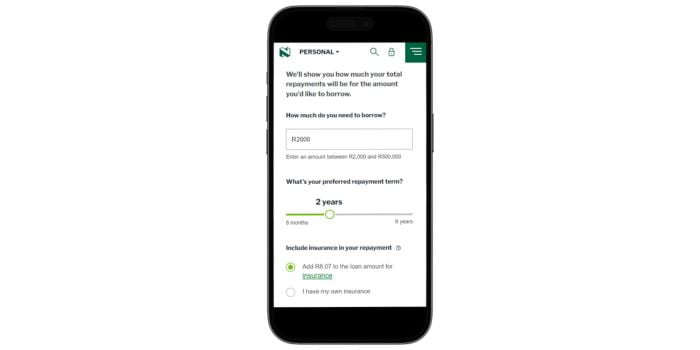

Simulation of a Loan at Nedbank

Step 1: Determine Your Need

Before diving into the application process, it’s essential to have a clear understanding of why you need the loan and how much you need. This clarity will guide you in selecting the right loan product from Nedbank’s diverse offerings.

Step 2: Visit the Nedbank Website or Branch

You can start your loan application process either by visiting the Nedbank website or by walking into one of their branches. The website offers a user-friendly interface where you can find all the information related to different loan products.

Step 3: Eligibility Check

Before submitting a full application, it’s wise to check if you meet the basic eligibility criteria for the loan. Nedbank offers tools and resources to help potential borrowers determine their eligibility.

Step 4: Gather Necessary Documents

Ensure you have all the required documents, such as proof of identity, income, residence, and any other specific documents related to the type of loan you’re applying for.

Step 5: Complete the Application Form

Fill out the loan application form with all the necessary details. Ensure that the information provided is accurate to avoid any delays or issues in the approval process.

Step 6: Submit the Application

Once you’ve filled out the form and attached all the necessary documents, you can submit your application. If you’re applying online, you’ll receive a confirmation immediately. If you’re applying at a branch, the bank representative will provide you with the next steps.

Step 7: Wait for Approval

After submitting your application, Nedbank will review it, which includes checking your credit history. Once the review is complete, the bank will inform you of its decision.

Step 8: Loan Disbursement

If your loan is approved, Nedbank will disburse the funds to your account or provide them in the manner specified in your loan agreement.

Tools or Methods Offered by Nedbank to Pre-check Eligibility

Nedbank acknowledges the significance of time and the importance of offering customers tools to streamline the loan application process. In assisting potential borrowers, Nedbank provides an online eligibility checker on its website. By entering basic information like income, existing financial commitments, and the desired loan amount, individuals can receive a preliminary indication of their eligibility for a Nedbank loan. This tool yields an immediate response, empowering customers to proceed with their application with increased confidence. It’s a proactive approach by Nedbank to ensure customers have a hassle-free experience right from the outset.

Security and Privacy at Nedbank

In today’s digital age, the security of personal and financial information is paramount. Nedbank recognizes this importance and has implemented robust measures to ensure that its customers’ data remains protected at all times.

How Nedbank Ensures the Security of Personal and Financial Information

Nedbank employs state-of-the-art encryption technologies to safeguard the data transmitted between the customer and the bank. This ensures that any shared information, whether personal details or financial transactions, remains confidential and inaccessible to unauthorized parties.

The bank also utilizes advanced firewalls and intrusion detection systems to shield its servers and databases from potential threats. Regular security audits and assessments are conducted to identify and rectify any vulnerabilities, ensuring that the bank’s systems remain impervious to breaches.

Nedbank has implemented multi-factor authentication for its online and mobile banking platforms. This adds an extra layer of security, guaranteeing that only the rightful owner of an account can access it. Customers are also educated about secure banking practices, such as not sharing passwords or PINs and being cautious of phishing attempts.

Privacy Policies and Data Handling Practices

Nedbank is dedicated to respecting and safeguarding the privacy of its customers. The bank’s privacy policy outlines how customer data is collected, used, and stored. Nedbank ensures that any personal information provided by customers is used exclusively for the intended purpose, such as processing loan applications or providing banking services.

The bank does not sell or share customer data with third parties for marketing purposes without explicit consent. Any third-party service providers collaborating with Nedbank are bound by stringent confidentiality agreements, ensuring adherence to the same high standards of data protection. Nedbank also complies with all relevant data protection regulations and laws in South Africa. Customers have the right to access their personal data held by the bank and can request corrections or deletions if necessary.

How Much Money Can I Request from Nedbank?

When considering a loan from Nedbank, the amount you can request largely depends on the type of loan and your financial profile. While specific amounts might vary based on individual circumstances and the latest bank policies, Nedbank generally offers a broad range of loan amounts to meet diverse needs.

Minimum and Maximum Amounts

For personal loans, Nedbank typically offers amounts starting from a few thousand rand, addressing small, immediate needs. On the higher end, depending on the borrower’s creditworthiness and repayment capacity, the bank can offer loans up to several hundred thousand rand. Home loans and business loans, given their nature, can extend into the millions, depending on the property value or business requirements.

Receive Offers

Nedbank aims to provide its customers with the best possible loan offers tailored to their unique financial situations.

How Nedbank Creates Personalized Loan Offers

Nedbank employs a combination of factors to craft personalized loan offers. This includes the applicant’s credit score, income level, existing financial commitments, and the purpose of the loan. Through a thorough analysis of these factors, Nedbank can ascertain the most suitable loan amount, interest rate, and repayment term for the borrower. This personalized approach ensures that borrowers receive offers that align precisely with their financial capabilities and needs.

How Long Does It Take to Receive My Money from Nedbank?

Average Processing Times

Once your loan application is approved, Nedbank typically disburses the funds promptly. For personal loans, the money can be in your account within a few business days. Home loans and business loans might take a bit longer due to the additional documentation and verification processes involved.

Factors Affecting Withdrawal Speed

Several factors can impact the speed at which you receive your loan amount. These include the completeness and accuracy of the documentation provided, the type of loan applied for, and any bank-specific processing times. Additionally, any discrepancies in the application can lead to delays, emphasizing the importance of providing accurate and complete information.

How Do I Repay My Loan from Nedbank?

Repayment Options and Plans

Nedbank offers multiple repayment options to accommodate the diverse needs of its borrowers. Customers can set up automatic monthly debits from their Nedbank accounts, ensuring timely repayments. Alternatively, borrowers can use the bank’s online and mobile platforms to make manual payments. For those who prefer offline methods, payments can also be made at Nedbank branches.

Possible Fees and Penalties

While Nedbank is transparent about its fee structure, it’s essential to be aware of any potential fees and penalties associated with loan repayments. Late payment fees might be levied if a borrower misses a repayment deadline. Additionally, early repayment of the loan might attract a fee, depending on the terms of the loan agreement. It’s always advisable to read the loan agreement carefully and clarify any doubts with the bank to avoid unexpected charges.

Online Reviews of Nedbank

Navigating the vast world of banking can be a daunting task, and one of the most reliable ways to gauge the effectiveness and reliability of a bank is through the experiences of its customers. Let’s delve into what customers are saying about Nedbank.

What Customers Say About Nedbank

Nedbank, one of the prominent financial institutions in South Africa, has received a mix of reviews from its customers. On Trustpilot, a platform where customers can share their experiences, Nedbank has garnered a range of feedback.

Some customers have praised the bank for specific services, mentioning successful refund processes and the efficiency of certain departments. For instance, one customer mentioned a swift refund process, expressing satisfaction with the outcome.

However, like any large institution, Nedbank has also faced criticism. Some customers have expressed dissatisfaction with the bank’s responsiveness, especially regarding the mobile app. Issues with transaction references and OTPs not coming through have been highlighted, causing inconvenience to the users.

Another area of concern for some has been the bank’s credit card division. There were instances where customers felt that the bank added unnecessary service costs, making the process of closing accounts challenging.

Despite the challenges, there were also positive reviews. Some customers have had long-standing relationships with Nedbank and have appreciated specific services, especially in the savings department. They’ve highlighted offerings like the “Just Invest” feature, which provides a 7% return, as particularly beneficial.

Customer Service at Nedbank

Nedbank’s customer service is designed to assist clients in navigating their financial journey. Whether it’s about opening a new account, seeking information about loans, or addressing any concerns, Nedbank’s team is equipped to provide guidance. With multiple channels of communication, including phone support, online chat, and branch visits, customers have various avenues to seek assistance.

Do You Have Further Questions for Nedbank?

If you have more queries or need clarification on any aspect of Nedbank’s services, it’s recommended to reach out directly to their customer service. They have a dedicated helpline, and their website also offers a comprehensive FAQ section that addresses common questions. Additionally, visiting a local Nedbank branch can provide in-person assistance, ensuring that all your concerns are addressed.

Alternatives to Nedbank

While Nedbank is a prominent financial institution in South Africa, there are other banks and financial service providers in the region. Some of the notable alternatives include:

- Standard Bank: Known for its wide range of services, from personal banking to investment solutions.

- ABSA: Offers a diverse portfolio, including personal, corporate, and investment banking.

- First National Bank (FNB): Renowned for its innovative banking solutions and digital platforms.

Comparison Table: A Side-by-Side Comparison of Nedbank with Top Competitors

| Bank Name | Services Offered | Unique Feature |

|---|---|---|

| Nedbank | Personal banking, business banking, wealth management, and investment solutions. | Greenbacks rewards program focusing on sustainable and eco-friendly rewards. |

| Standard Bank | Personal and business banking, wealth creation, and insurance. | UCount Rewards program offering points for everyday spending. |

| ABSA | Retail, business, corporate, and investment banking. | ABSA Rewards program where customers earn cash back for using their debit or credit card. |

| First National Bank (FNB) | Personal, business, and private banking, along with wealth and investment services. | eBucks rewards program, one of the most popular loyalty programs in South Africa. |

| Fundi | Education-specific financing, Tuition, accommodation, books, and devices | Fundi card |

History and Background of Nedbank

Nedbank, a name synonymous with banking in South Africa, has roots dating back to the early 19th century. Established in 1888 as the Netherlands Bank of South Africa, it was formed to cater to the booming gold industry. Over the years, through mergers, acquisitions, and strategic growth, it evolved into the Nedbank Group, becoming one of the country’s four largest banking groups.

The bank’s rich history reflects its commitment to the economic development of South Africa. Over the decades, Nedbank has been at the forefront of numerous financial innovations, always aiming to meet the changing needs of its clientele.

Company’s Mission and Vision

Nedbank’s mission is to use its financial expertise to do good for individuals, families, businesses, and society. The bank believes in making the dreams, aspirations, and financial goals of its customers its objectives. Its vision is to be the most admired financial services provider in Africa, recognized for its commitment to excellence, stakeholder value creation, and societal relevance.

Pros and Cons

Advantages of Choosing Nedbank

- Long-standing Reputation: With over a century of experience, Nedbank has a proven track record in the banking industry.

- Diverse Services: From personal banking to corporate solutions, Nedbank offers a comprehensive range of services.

- Innovative Solutions: Nedbank has been known for its forward-thinking approach, often being early adopters of new banking technologies.

- Community Focus: The bank has numerous initiatives aimed at community development and sustainability.

Disadvantages of Choosing Nedbank

- Size Can Be a Drawback: Being a large institution, some customers feel that the bank lacks the personal touch of smaller banks.

- Digital Platform Issues: Some users have reported glitches and issues with the bank’s online and mobile platforms.

- Customer Service Variability: While many praise the bank’s customer service, others have had less than satisfactory experiences.

Conclusion

Nedbank, with its rich history and commitment to excellence, remains a formidable force in the South African banking landscape. Its dedication to innovation, coupled with its focus on community and sustainability, makes it a preferred choice for many. However, like all institutions, it has its challenges. Potential customers should weigh the pros and cons, considering their individual needs, before making a decision.

Frequently Asked Questions about Nedbank

Opening an account with Nedbank is straightforward. You can visit any of their branches with the required documents, such as proof of identity and proof of address. Alternatively, some account types might be available for online registration via the Nedbank website.

Nedbank offers a range of digital banking solutions, including online banking, a mobile banking app, and various digital payment methods.

Nedbank provides multiple channels for customer support, including a helpline, email support, and in-person assistance at their branches.

Yes, like most banks, Nedbank might have monthly maintenance fees for some account types. It’s best to check their official website or contact their customer service for detailed information.

If your card is lost or stolen, it’s crucial to report it immediately. You can do this by calling Nedbank’s helpline or using their mobile app.