In the contemporary and fast-paced world, the demand for reliable and accessible financial services is more critical than ever, especially in the dynamic economic landscape of South Africa. Nora Finance, a rising name in the industry, positions itself as a significant player in providing comprehensive financial solutions. This review aims to explore Nora Finance’s offerings, specifically its personal and business loan services, insurance solutions, and overall customer experience.

Experiences with Nora Finance

When selecting a financial service provider, real-world experiences and customer feedback play a pivotal role. Nora Finance, with its focus on both personal and business financial solutions, has successfully carved out a niche in the South African market. Customers frequently commend the simplicity of the application process and the clarity of information provided as significant advantages. The company’s customer service approach, which prioritizes understanding and anticipating client needs, also garners frequent praise. However, as with any service, experiences can vary, and some customers have noted areas for improvement, particularly in terms of personalized service and response times during peak periods.

This comprehensive review aims to provide a nuanced understanding of Nora Finance’s strengths and potential areas for enhancement. If there are specific details or adjustments you would like me to include, please let me know.

Who can apply for a Nora Finance?

Nora Finance’s services are predominantly tailored for residents of South Africa, encompassing both individuals seeking personal loans and Small and Medium Enterprises (SMEs) in search of business loans or insurance products. The eligibility criteria for individuals are straightforward, requiring a South African ID number, a bank account, and recent proof of income. This inclusive approach makes Nora Finance’s services accessible to a diverse audience, ranging from individuals requiring swift financial assistance for emergencies to those seeking manageable loans for personal expenses.

The company’s focus on simplicity in eligibility requirements aligns with its commitment to providing accessible financial solutions to a broad spectrum of South African residents. If you have any specific details or adjustments you would like me to make, please let me know.

Criteria for Potential Borrowers

Nora Finance sets forth straightforward criteria for potential borrowers, aiming to ensure a wide range of the population can easily access their services. The essential requirements for personal loans include:

- Valid South African ID number.

- Personal bank account.

- Most recent proof of income (to assess repayment capability).

For businesses, particularly Small and Medium Enterprises (SMEs), the criteria may encompass factors such as business viability, financial health, and the intended purpose of the loan, which could span from expansion initiatives to securing working capital. This emphasis on accessibility and clear-cut criteria is a significant advantage, contributing to making financial services more inclusive and accessible to a diverse clientele.

Differences from Other Loan Providers

Nora Finance stands out from other loan providers in the market through several key differentiators:

Target Audience: Their pronounced focus on Small and Medium Enterprises (SMEs) and deep understanding of the small business sector distinguish Nora Finance. This focus on SMEs is particularly notable in a market where many lenders predominantly target individual borrowers.

Simplified Process: Nora Finance takes pride in a streamlined loan application process, minimizing the typically laborious and time-consuming paperwork associated with traditional lending. The emphasis on simplicity enhances the overall customer experience.

Transparency: Emphasizing transparency, Nora Finance commits to a fee structure with no hidden charges. This transparent approach builds trust, especially for customers who are cautious about the intricate details that often accompany financial products.

Flexible Loan Amounts: Nora Finance offers loan amounts tailored to both new and existing customers, coupled with flexible repayment terms. This adaptability makes their products suitable for a diverse range of financial needs.

Comprehensive Services: Beyond loans, Nora Finance extends its services to encompass a range of insurance products, positioning itself as a one-stop financial solution platform for both individuals and businesses. This comprehensive approach enhances the convenience for customers seeking holistic financial solutions.

Nora Finance’s commitment to SMEs, simplified processes, transparency, flexibility, and a comprehensive service offering collectively contribute to its distinctiveness in the financial services landscape. If there are specific details or adjustments you would like me to make, please feel free to let me know.

About Arcadia Finance

Streamline your loan acquisition journey with Arcadia Finance. Submitting an application is completely free, and it allows you to explore options from up to 19 distinct lenders. Rest assured, all lenders we partner with are reputable and adhere to the regulations set by the NCR, guaranteeing compliance and trustworthiness within South Africa’s financial sector.

Nora Finance

Nora Finance has emerged as a noteworthy player in this sector, offering a variety of financial services tailored to the unique needs of South Africans.

What Sets Nora Finance Apart?

Nora Finance’s distinctiveness arises from its deep understanding of its clientele. Their previous experience as contractors has equipped them with insights into the business clients’ needs, often enabling them to foresee and address these requirements before they even arise. This proactive approach is complemented by their commitment to excellent client service. The application process for their financial products is simplified, reducing the administrative burden on the applicant. Transparency is at the core of their operations. Unlike many other financial institutions, Nora Finance ensures there are no hidden charges, providing customers with a clear picture of what they’re signing up for.

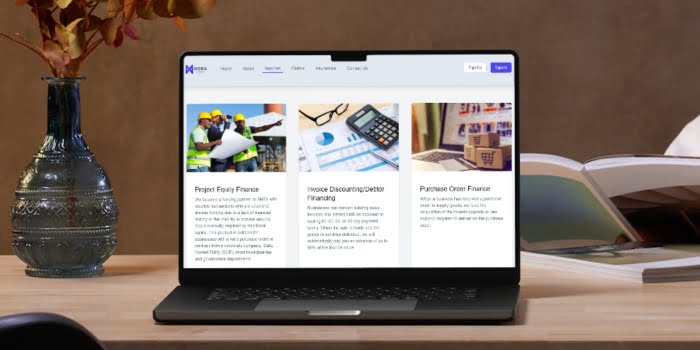

Types of Loans Offered by Nora Finance

Nora Finance offers a diverse range of loan products to meet the varied needs of its clientele.

Personal Loans

These are unsecured loans, meaning they don’t require any collateral. They are ideal for individuals who need quick cash for emergencies, unexpected expenses, or even planned expenditures like holidays or home renovations. The loan amounts vary, with new customers being able to apply for up to R2,500, and existing customers having the option to apply for up to R5,000. Both come with a repayment period of 35 days.

Business Loans

Tailored for SMEs, these loans are designed to support businesses in their growth and operational needs. Whether it’s for expansion, purchasing inventory, or managing cash flow, Nora Finance’s business loans offer a lifeline to enterprises. The loans range from R50,000 to a substantial R5,000,000, making them suitable for businesses of various sizes and stages.

Insurance Loans

Beyond the traditional personal and business loans, Nora Finance also ventures into the insurance sector. They provide insurance solutions for both personal and commercial markets. This comprehensive approach ensures that both individuals and businesses can safeguard their assets and future.

Nora Finance’s varied financial products ensure that both individuals and businesses have access to the funds they need when they need them. Their commitment to transparency, customer service, and understanding the unique needs of their clientele sets them apart in the crowded financial services sector. Whether you’re an individual in need of a personal loan or a business seeking capital for expansion, Nora Finance offers solutions tailored to your needs.

Requirements for a Nora Finance Loan

When considering a loan from Nora Finance, understanding the requirements is crucial. This ensures a smooth application process and increases the likelihood of approval.

Documents and Information Needed

To apply for a loan with Nora Finance, you’ll need to provide several key pieces of information and documents. These include:

- A valid South African ID number: This is essential to verify your identity and eligibility.

- Bank account details: Your loan funds will be deposited into this account, so it needs to be active and in your name.

- Most recent proof of income: This could be a payslip or a bank statement, showing your ability to repay the loan.

Having these documents ready before you start your application will streamline the process, making it faster and more efficient.

Simulation of a Loan at Nora Finance

Simulating a loan before applying can provide you with a clear idea of the repayment terms, interest rates, and monthly installments. Nora Finance’s website likely features a loan calculator tool where you can input the desired loan amount and repayment period to obtain an estimated repayment plan. This simulation helps in planning your finances and deciding whether the loan terms are suitable for your situation.

Step-by-Step Guide to Applying for a Loan with Nora Finance

Applying for a loan with Nora Finance is designed to be a straightforward process:

- Visit the Nora Finance website: Start by going to their official website.

- Choose the loan type: Select whether you need a personal or business loan.

- Fill in the application form: Enter all the required details, including your personal information, loan amount, and repayment period.

- Submit necessary documents: Upload or provide your South African ID, bank details, and proof of income.

- Review and submit your application: Double-check all the information for accuracy and submit your application.

- Wait for approval: Nora Finance will review your application and inform you of their decision. If approved, the funds will be deposited into your bank account.

Eligibility Check

Before applying, it’s wise to check your eligibility. Nora Finance might offer tools or methods on their website to pre-check your eligibility. This could be in the form of an initial questionnaire on their website, asking for basic information like your income, employment status, and credit history. This pre-check doesn’t guarantee approval but can give you a good indication of whether you should proceed with the full application.

Security and Privacy at Nora Finance

In the digital age, where personal and financial information is often shared online, the security and privacy of this data become paramount. Nora Finance, understanding the importance of these aspects, implements several measures to ensure the safety and confidentiality of its clients’ information.

Ensuring the Security of Personal and Financial Information

Nora Finance takes the security of personal and financial information seriously. They employ robust encryption technologies to protect data transmitted over the internet. This means that when you submit your personal details, such as your ID number, bank account information, and income proof, the data is encrypted, making it difficult for unauthorized parties to intercept or access.

Additionally, the company likely uses secure servers where client data is stored. These servers are typically protected both physically and digitally, reducing the risk of data breaches. Regular security audits and updates are part of their protocol to ensure that they stay ahead of potential cyber threats.

Privacy Policies and Data Handling Practices

The privacy of clients is a key concern for Nora Finance. Their privacy policy, which should be readily available on their website, outlines how they collect, use, store, and protect client information. It’s important for clients to review this policy to understand their rights and the extent to which their information is used.

Nora Finance’s data handling practices are designed to comply with relevant data protection laws and regulations. This compliance ensures that your personal information is not only secure but also used in a manner that’s lawful and ethical. The company typically requires explicit consent from clients before using their data for purposes other than the loan application, such as marketing or promotional activities.

In terms of sharing information with third parties, Nora Finance is expected to do so only when necessary, such as for credit checks or as required by law. Even in these cases, the amount of information shared is limited to what is essential, maintaining client confidentiality as much as possible.

Loan Amounts at Nora Finance

When considering a loan from Nora Finance, one of the primary questions potential borrowers have is regarding the amount they can request. Understanding the minimum and maximum loan amounts available can help align your financial needs with what Nora Finance offers.

Minimum and Maximum Amounts

Nora Finance caters to a diverse clientele, offering a range of loan amounts to suit various financial needs. For new customers, the loan amounts can start from as low as R500, which is ideal for those needing a small financial boost, perhaps to cover an unexpected expense or a short-term cash shortfall. On the other end of the spectrum, existing customers who have established a trust and repayment history with Nora Finance can apply for larger amounts, up to R5,000. This higher limit is beneficial for covering more significant expenses or emergencies.

Receiving Offers

One of the standout features of Nora Finance is the creation of personalized loan offers. This means that instead of a one-size-fits-all approach, the loan offers are tailored to the individual’s financial situation, repayment history, and current needs. This personalization ensures that the loan you receive aligns well with your capacity to repay, thereby reducing the financial strain and enhancing the chances of a positive borrowing experience.

Receiving Funds from Nora Finance

The time it takes to receive money from Nora Finance after a loan has been approved is a crucial factor for many borrowers, especially those in urgent need of funds.

Average Processing Times

Nora Finance is known for its quick processing times, which is a significant advantage in urgent financial situations. Once a loan application is approved, the funds are typically disbursed swiftly. The average time from approval to receiving the funds can be as short as 24 to 48 hours. This efficiency is part of Nora Finance’s commitment to providing fast financial solutions to its clients.

Factors Affecting Withdrawal Speed

Several factors can influence the speed at which you receive your loan from Nora Finance:

Application Accuracy: Providing accurate and complete information during the application process can speed up approval times. Any discrepancies or missing information might lead to delays.

Bank Processing Times: The speed with which your bank processes incoming transfers can also affect how quickly you receive the funds. Different banks may have varying processing times.

Time of Application: Applications submitted during business hours or on working days are likely to be processed faster than those submitted over weekends or public holidays.

Repaying a Loan from Nora Finance

Understanding the repayment process is as crucial as the loan application itself. Nora Finance offers structured repayment options and plans designed to make the process as straightforward and manageable as possible for borrowers.

Repayment Options and Plans

Nora Finance typically structures its loan repayments to align with the borrower’s income schedule, thereby easing the repayment process. The repayment plans are usually clear from the outset, with fixed installments due either monthly or as agreed upon in the loan terms. This structured approach helps borrowers plan their finances and ensures they’re not caught off guard by unexpected demands.

Borrowers can usually make repayments through direct bank transfers or debit orders, which can be convenient and reduce the risk of missing a payment. It’s essential for borrowers to ensure that sufficient funds are available in their accounts on the due dates to avoid any issues with late payments.

Possible Fees and Penalties

Like most financial institutions, Nora Finance may impose certain fees and penalties in specific situations. These can include late payment fees, which are charged if a borrower fails to make a repayment on time. There might also be additional charges for processing payments or for providing certain services. It’s important for borrowers to read the loan agreement carefully to understand all the potential fees and penalties. Being aware of these charges can help in managing the loan more effectively and avoiding any unexpected costs.

Online Reviews of Nora Finance

Online reviews can provide valuable insights into the experiences of other customers with Nora Finance. These reviews often highlight the strengths and weaknesses of the lender from a borrower’s perspective.

What Customers Say About Nora Finance

Customers often praise Nora Finance for its quick and easy application process, noting that the speed of receiving funds can be particularly helpful in emergency situations. The clarity and transparency of the loan terms are also frequently mentioned, with borrowers appreciating the straightforwardness of the repayment plans and the absence of hidden charges.

However, like any service, there are areas where customers feel improvements could be made. Some reviews point out that customer service can be variable, with experiences depending on the individual staff members handling the queries. Others have mentioned that the interest rates and fees, while competitive, can still be a burden, especially for those already in tight financial situations.

Overall, the majority of online reviews for Nora Finance are positive, with many customers recommending their services for short-term financial needs. The personalized approach to loan offers and the company’s understanding of individual circumstances are often highlighted as key factors in these positive experiences. As with any financial decision, potential borrowers are advised to consider both the positive and negative reviews to get a well-rounded understanding of what to expect from Nora Finance.

Customer Service at Nora Finance

When it comes to financial services, having access to responsive and helpful customer service is crucial. Nora Finance recognizes this need and offers various channels through which customers can get in touch for support or with queries. Typically, these include phone support, email, and possibly a live chat feature on their website. The effectiveness of customer service is often reflected in online reviews, where customers share their experiences of interaction with the team. While most feedback indicates satisfactory service, the quality can vary depending on the specific staff members and the complexity of the issues raised.

Further Questions for Nora Finance

If you have additional questions or need clarification on any aspect of Nora Finance’s services, reaching out to their customer service is advisable. Whether it’s a query about loan eligibility, repayment terms, or the application process, their team is generally well-equipped to provide the necessary information. For detailed queries or issues, it might be beneficial to contact them directly via phone or schedule a face-to-face meeting, if possible.

Alternatives to Nora Finance

While Nora Finance offers a range of financial services, it’s always wise to explore other options and compare what’s available in the market. Other credit providers and comparison portals can offer different terms, interest rates, and loan products that might be more suited to your specific financial situation.

Other Credit Comparison Portals and Their Offers:

Several online portals allow you to compare different loan offers from various lenders. These platforms typically provide a user-friendly interface where you can input your loan requirements (such as loan amount, purpose, and repayment term) and receive a list of potential lenders with their corresponding offers. This comparison can include factors like interest rates, fees, loan terms, and customer reviews. Using these portals can help you make an informed decision by directly comparing the costs and benefits of different loans.

Comparison Table

| Loan Provider | Minimum – Maximum Loan Amount | Interest Rate (Per Annum) | Repayment Period |

|---|---|---|---|

| Nora Finance | R2,500 (new customers) – R5,000 (existing customers) | Not specified | Up to 35 days |

| Makanda Finance | Up to R5500 | From 60% | Up to 45 days |

| Cash Converters | Up to R4000 | Varies | Up to 30 days |

| MiPayDayLoans | R4000 (based on individual assessment) | Varies | Up to 31 days |

| Barko Loans | up to R8,000 for existing clients and up to R3,000 for new clients | Varies | Up to 30 days |

History and Background of Nora Finance

Nora Finance, founded in 2012, initially operated as a goods and services provider before strategically transitioning into the financial services sector. This shift was a response to the increasing demand for accessible financial solutions in South Africa.

Company’s Mission and Vision

Nora Finance is dedicated to offering clear and accessible financial solutions to individuals and businesses alike. Their vision centers around becoming a trusted partner for financial growth and stability. They prioritize customer-centric services and the development of innovative financial products to achieve this vision.

Pros and Cons

Pros

- Customer Service: Nora Finance receives commendation for its responsive and helpful customer service, ensuring a positive experience for its clients.

- Ease of Application: The loan application process is straightforward and user-friendly, making it convenient for customers to navigate and complete.

- Tailored Financial Solutions: Nora Finance distinguishes itself by offering personalized loan products that cater to individual customer needs and circumstances, providing tailored financial solutions.

- Transparency: The company is recognized for its commitment to clear communication. Nora Finance ensures transparency in conveying loan terms, fees, and repayment expectations to its customers.

Cons

- Interest Rates and Fees: While Nora Finance’s interest rates and fees are competitive, some customers may find them relatively higher compared to offerings from other financial institutions.

- Loan Amount Limits: New customers may face limitations on the maximum loan amount, potentially lower than what some competitors might offer. This could impact those seeking larger financial assistance.

- Availability: As a South African company, Nora Finance’s services are restricted to residents within the country. This limitation might not be suitable for individuals residing outside South Africa who are seeking financial services.

Conclusion

Nora Finance emerges as a standout player in the financial services sector, characterized by its streamlined application process, prompt fund disbursement, and transparent loan terms. The company’s dedication to providing personalized financial solutions and a diverse product range positions it as a robust contender in the market.

Frequently Asked Questions about Nora Finance

Interest rates can vary based on the loan type and your personal circumstances. It’s recommended to check directly with Nora Finance or use their online tools for specific rates tailored to your situation.

Yes, like most lenders, including Nora Finance, early repayment of loans is generally allowed. However, it’s advisable to confirm any potential fees or penalties associated with early repayment.

Currently, Nora Finance primarily serves the South African market. For information on services in other countries, it’s best to contact them directly or check their official website.

Late payments may result in additional fees and could impact your credit score. Nora Finance likely has a policy outlining the consequences of late payments, which should be reviewed before taking a loan.

Loan adjustments post-approval depend on the lender’s policies and your financial situation. For inquiries about increasing your loan amount, it’s recommended to contact Nora Finance directly to discuss your specific case.