Oloan [Oloan.co.za] is a South African lender specialising in providing quick and easy access to personal loans through its user-friendly online platform. With a focus on convenience, they connect borrowers with a range of registered credit providers, offering tailored loan solutions for various financial needs. Whether you’re looking to cover unexpected expenses or manage short-term cash flow issues, Oloan’s streamlined application process and flexible repayment options make it a practical choice for South Africans seeking financial assistance.

At a glance, Oloan offers to compare loan amounts ranging from R100 to R350 000. If this sounds like something you are interested in, keep reading to find out everything you need to know about this lender and whether they’re the right option for you.

Oloan: Quick Overview

- Loan Amount: R500 – R8,000

- Loan Term: 1 to 3 months

- Interest Rate: Varies between 7.9% and 18.9% per month (149% to 698% per annum)

- Fees:

- Initiation Fee: Varies based on loan amount

- Service Fee: Varies based on loan amount

- Credit Protection Fee: Varies based on loan amount

- Loan Types: Short-term personal loans

Oloan Lender Full Review

Oloan stands out as a lender due to its convenient online platform that simplifies the borrowing process for South Africans. Instead of dealing with lengthy paperwork or visiting physical branches, it allows borrowers to apply for personal loans entirely online, saving time and effort. By acting as a facilitator, Oloan connects applicants with a network of registered credit providers, ensuring that each loan offer complies with South African regulations. This approach not only gives borrowers access to a variety of loan options but also increases their chances of finding a loan that meets their specific financial needs. The focus on simplicity and speed makes them an attractive option for those looking for quick financial relief without unnecessary hassle.

Another unique aspect of Oloan is its tailored loan solutions. The platform is designed to provide personalised options based on the applicant’s financial profile, ensuring that borrowers can access the right loan amount with terms that suit their budget. Additionally, Oloan’s transparency about fees and repayment terms helps borrowers make informed decisions without unexpected surprises. Whether you need funds for medical emergencies, education, or home repairs, their system ensures a seamless experience by matching you with credit providers that align with your specific requirements. This combination of accessibility, personalisation, and regulatory compliance sets Oloan apart in the South African lending market.

About Arcadia Finance

Get the loan you need with ease at Arcadia Finance. With no application fees and access to 19 trusted lenders, all registered with South Africa’s National Credit Regulator, you can secure financing confidently. Enjoy a hassle-free process tailored to your financial goals.

Types of Loans Offered by Oloan

Oloan provides access to a variety of personal loan options through its network of registered credit providers. These loans are designed to cater to different financial needs, offering flexibility and tailored solutions for South African borrowers.

Short-Term Loans

Short-term loans are ideal for covering urgent financial needs or unexpected expenses. These loans typically come with smaller amounts and shorter repayment periods, making them suitable for situations like paying for medical bills, car repairs, or emergency home maintenance. Borrowers benefit from a quick application process and fast approval, allowing them to address pressing financial demands without delay.

Debt Consolidation Loans

For individuals looking to simplify their finances, Oloan offers access to debt consolidation loans. These loans allow borrowers to combine multiple debts into a single repayment plan, reducing the stress of managing several payments. By consolidating debts, you can often secure better repayment terms, lower interest rates, and a more manageable monthly instalment. This option is especially helpful for those aiming to improve their cash flow or work towards becoming debt-free.

Personal Loans

Oloan facilitates access to personal loans for a variety of general purposes, such as paying for education, home improvements, or family events. These loans come in flexible amounts, allowing borrowers to choose an amount that matches their specific financial requirements. Whether you’re funding a child’s school fees or upgrading your home, this type of loan offers the versatility to meet diverse personal expenses.

Requirements for an Oloan Loan

To apply for a loan through Oloan, you’ll need to meet certain requirements and provide the necessary documents. These ensure that you meet the criteria set by the credit providers in Oloan’s network. Below are the key requirements:

- South African ID: A valid South African identity document.

- Proof of Income: Recent payslips or bank statements showing your income.

- Bank Account Details: A valid bank account for disbursing the loan.

- Proof of Residence: A recent utility bill or other documentation showing your residential address.

- Contact Information: A working phone number and email address.

Simulation of a Loan at Oloan

Here’s a step-by-step guide to applying for a loan with Oloan:

- Visit the Oloan Website: Go to Oloan.co.za

- Select Loan Amount and Term: Use the online calculator to choose your desired loan amount and repayment term.

- Complete the Application Form: Fill out your personal, financial, and contact details.

- Submit Supporting Documents: Upload required documents like your ID and proof of income.

- Receive Loan Offers: Get matched with credit providers and review their offers.

- Accept a Loan Offer: Choose the loan option that suits you and accept the terms.

- Disbursement of Funds: Once approved, the funds are sent to your bank account.

Eligibility Check

Oloan offers a simple online eligibility calculator that allows potential borrowers to pre-check whether they qualify for a loan. By entering basic information such as your income and monthly expenses, you can quickly determine if you’re eligible and what loan options might be available. This tool helps borrowers avoid unnecessary applications and ensures that they can focus on loans they’re likely to secure.

How Much Money Can I Request from Oloan?

Oloan connects borrowers with credit providers offering loans that cater to a wide range of financial needs. You can typically request loan amounts starting from as low as R500, with maximum amounts reaching up to R350 000, depending on your financial profile and the credit provider’s terms. This flexibility allows you to choose an amount that aligns with your specific requirements, whether it’s for emergency expenses, debt consolidation, or planned purchases.

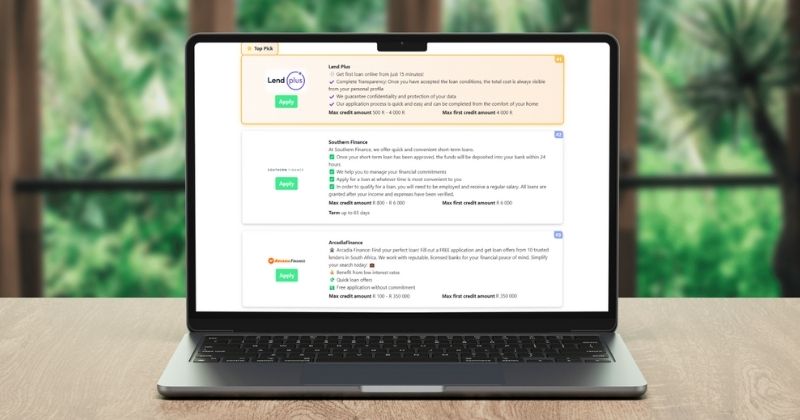

Receive Offers

Oloan creates personalised loan offers by assessing the information you provide during the application process. Once you submit your application and documents, it matches you with a network of registered credit providers based on your income, creditworthiness, and desired loan terms. Borrowers can then review multiple offers and choose the one that best suits their needs. This system ensures that you receive tailored solutions without the hassle of applying to multiple lenders individually.

Oloan – Loan Overview in Detail

| Name | Oloan |

|---|---|

| Financial | Oloan.co.za |

| Product | Personal Loans |

| Minimum Age | 18 years |

| Minimum Amount | R500 |

| Maximum Amount | R350 000 |

| Minimum Term | 3 months |

| Maximum Term | 18 months |

| APR | Varies between 149% to 698% per annum |

| Monthly Interest Rate | Between 7.9% and 18.9% per month |

| Early Settlement | Policies may vary; refer to specific lender terms |

| Repayment Flexibility | Tailored to meet specific requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and user-friendly online application process ✅ Access to a wide range of loan amounts and terms ⚠️ High-interest rates compared to traditional banks |

| User Opinion | ✅ Convenient access to funds ⚠️ Interest rates may be higher than traditional lenders |

How Long Does It Take to Receive My Money from Oloan?

Oloan is known for its fast processing times, with many borrowers receiving their funds within 24 to 48 hours after approval. The exact time can vary depending on:

- Document Submission: Providing all necessary documents upfront speeds up the process.

- Credit Provider Processing: Each lender in Oloan.co.za’s network may have its own timelines.

- Bank Clearance: The time taken by your bank to clear the funds into your account.

By ensuring that your application is complete and accurate, you can minimise delays and receive your money as quickly as possible.

How Do I Repay My Loan from Oloan?

Repaying your loan through Oloan is a straightforward process. Borrowers generally repay their loans via monthly debit orders, which are automatically deducted from the bank account linked during the application. The repayment terms depend on the loan amount and the specific credit provider, with options ranging from 3 to 72 months. In some cases, flexible repayment schedules can be arranged to suit your financial circumstances.

If you miss a repayment, penalties or additional fees may apply based on the terms of your loan agreement. Certain credit providers may allow for early repayment without penalties, though this depends on the lender’s policies. Additionally, monthly service fees, as detailed in your loan terms, may be included as part of your repayment plan.

Pros and Cons

Pros of Oloan

- Convenient online application process that saves time and effort.

- Access to a wide network of registered credit providers, increasing the chances of finding a loan that suits your needs.

- Flexible loan amounts and repayment terms ranging from R500 to R350 000 and 3 to 72 months.

- Fast processing times, with many loans approved and disbursed within 24 to 48 hours.

- Transparent terms and conditions, helping borrowers make informed decisions.

- Loan solutions tailored to individual financial profiles and needs.

Cons of Oloan

- Interest rates may be higher for borrowers with lower credit scores.

- Late payment fees and penalties can add to overall costs if repayments are missed.

- Loan approval and processing times depend on the specific credit provider, which can vary.

- No physical branches, which may not appeal to those who prefer in-person service.

Customer Service

If you have further questions about Oloan or need assistance during the loan application process, you can easily contact their customer service team. Oloan provides support via their online platform, ensuring you have access to reliable assistance whenever needed. For more information, visit their website at Oloan.co.za or use the contact details provided there to get in touch with their team.

Online Reviews of Oloan

Oloan has received a mix of positive and critical feedback from South African borrowers. Customers often praise the platform for its ease of use and quick application process, highlighting how straightforward it is to apply for a loan without visiting a physical branch. Many users also appreciate the fast disbursement times, with some reporting that funds were transferred to their accounts within 24 hours of approval.

However, some borrowers have expressed concerns about the interest rates offered by certain credit providers in the network, especially for individuals with lower credit scores. Overall, the platform is recognised for its convenience, but experiences can vary depending on the credit provider selected through Oloan’s system.

Alternatives to Oloan

For borrowers seeking similar services, there are other credit comparison portals available in South Africa that connect users to various lenders. Some of the notable alternatives include:

Comparison Table

| Feature | Oloan | Capitec Bank | Wonga | African Bank | Nedbank |

|---|---|---|---|---|---|

| Loan Amounts | R500 – R350 000 | Up to R250 000 | Up to R8 000 | Up to R350 000 | Up to R300 000 |

| Repayment Terms | 3 – 72 months | 1 – 84 months | 4 – 6 months | 6 – 72 months | 6 – 60 months |

| Application Process | Fully online | Online and in-branch | Fully online | Online and in-branch | Online and in-branch |

| Processing Time | 24 – 48 hours | 24 hours | Same day | 24 – 48 hours | 24 – 48 hours |

| Network of Providers | Yes | No | No | No | No |

| More Info | Capitec Bank Review | Wonga Review | African Bank Review | Nedbank Review |

History and Background of Oloan

Oloan was established with the goal of simplifying the borrowing process for South Africans by providing a fully online loan comparison platform. The company partners with a network of registered credit providers to offer borrowers a wide range of loan options, ensuring compliance with South African lending regulations.

The mission of Oloan is to make financial assistance more accessible and transparent for South Africans, connecting borrowers with tailored loan solutions to meet their specific needs. Their vision is to continue improving the user experience by leveraging technology to offer a seamless and efficient borrowing process for individuals across the country.

Conclusion

Oloan provides a reliable and convenient platform for South Africans seeking personal loans, offering access to a wide network of registered credit providers. With its user-friendly online application process, flexible loan options, and quick disbursement times, Oloan simplifies borrowing for various financial needs. While it may not appeal to those who prefer in-person assistance, its tailored solutions and transparency make it a practical choice for borrowers looking for efficiency and flexibility in the lending process. By comparing multiple offers through Oloan, you can make an informed decision that aligns with your financial goals.

Frequently Asked Questions

Oloan is an online platform that connects borrowers with a network of registered credit providers in South Africa. It facilitates loan applications and helps borrowers find tailored loan offers that suit their needs.

You can borrow between R500 and R350 000, depending on your financial profile and the credit provider’s terms.

Loan approval typically takes 24 to 48 hours, but processing times may vary depending on the credit provider and the completeness of your application.

You’ll need a valid South African ID, proof of income, proof of residence, bank account details, and your contact information.

Oloan does not charge fees for using its platform. However, the credit providers you are matched with may charge initiation fees, service fees, and interest, as outlined in their loan agreements.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.