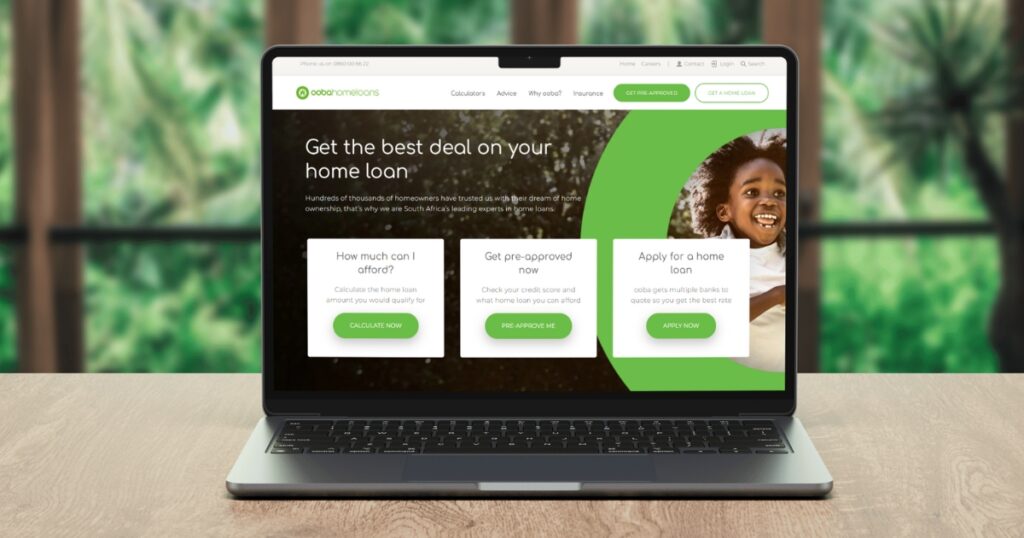

In South Africa, choosing the right home loan provider is crucial, and ooba [ooba.co.za], formerly known as MortgageSA, has become a significant player in the mortgage industry, assisting many South Africans in securing financing for their homes. As a full-service provider, ooba streamlines the complex process of obtaining a home loan, serving both first-time buyers and property investors. We will detail their offerings, compare them with competitors, and offer insights to help make informed financial decisions regarding home ownership.

Ooba Home Loans – Comprehensive Overview

| Financial | Detail |

| Product | Home Purchase Loans |

| Minimum age | 18 years old |

| Minimum amount | R100,000 |

| Maximum amount | R5,000,000 |

| Minimum term | 5 years |

| Maximum term | 30 years |

| APR | Variable, starting at 7%* ⬇ |

| Monthly Interest Rate | Typically linked to the prime rate |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | High, with options to increase or decrease payments |

| NCR Accredited | Yes |

| Our Opinion | ✅ Competitive interest rates suited for long-term loans |

| ⚠️ Higher initial fees may apply | |

| User Opinion | ✅”Great support and flexible terms” |

What Makes ooba Home Loans Unique?

Ooba stand out in the South African financial market due to their specialised approach to property financing. A key feature they offer is their ‘Home Loans’ service, which offers a variety of pre-approval and financing options tailored to the property market. One notable aspect is their role in providing pre-qualification certificates, which help buyers assess their purchasing power before they begin house hunting. This pre-qualification not only gives buyers a clear view of their budget but also strengthens their negotiating position with sellers, making the home buying process more efficient and targeted.

In addition, ooba’s approach goes beyond just financing. They offer a range of supplementary services that cover nearly every part of the home-buying journey. From expert advice on property transfer and registration to comprehensive property insurance solutions, this lender provides a streamlined experience for home buyers. This integration of services simplifies the often complex process of buying a home, ensuring that clients not only secure financing but also navigate and manage all the associated processes of home ownership. This level of support distinguishes this lender from traditional financial institutions that may focus solely on the loan without offering additional assistance throughout the home buying process.

Types of Loans Offered by ooba

Ooba.co.za offers a range of loan products designed to address various needs within the housing market. Each type of loan is tailored to meet specific customer requirements and purposes:

Home Purchase Loans

These are the primary product offered by ooba, ideal for buying a new home or acquiring a second property.Their home loans feature competitive interest rates and flexible repayment terms that can be customised to fit individual financial situations.

Building Loans

For those interested in constructing a new home rather than buying an existing one, this lender provides building loans. These loans cover the expenses associated with building a new house, allowing payments to be made progressively as construction milestones are achieved.

Transfer and Bond Costs Loans

Understanding that the costs of transferring property and registering a bond can be significant, ooba offers loans specifically for these expenses. This makes it easier for buyers to manage their finances without impacting their investment.

Further Advance/Bond Extension Loans

Current customers who wish to access the equity in their homes for renovations or significant purchases can apply for further advance loans. These loans utilise the property’s equity to provide additional financing.

About Arcadia Finance

Effortlessly secure your loan with Arcadia Finance. Take advantage of no application fees and choose from 19 trusted lenders, all compliant with South Africa’s National Credit Regulator. Enjoy a smooth process with reliable options designed to meet your financial goals.

Requirements for an ooba Loan

To apply for any of their loans, applicants must meet specific criteria and provide various documents. These requirements are in place to ensure responsible lending and compliance with legal and regulatory standards.

Documents and Information Needed

- Proof of Income: Recent payslips or bank statements from the last three months to verify income.

- Proof of Identity: A valid South African ID or smart ID card.

- Proof of Residence: A recent utility bill or similar document confirming your residential address.

- Credit Report: They may require consent to access a credit report to evaluate creditworthiness.

- Property Details: For home purchase loans, details of the property being purchased, including the offer to purchase document.

- Banking Details: For loan disbursement and repayment arrangements.

Step-by-step guide to Applying for a Loan with ooba

Step 1. Go to their official website to access the loan application forms.

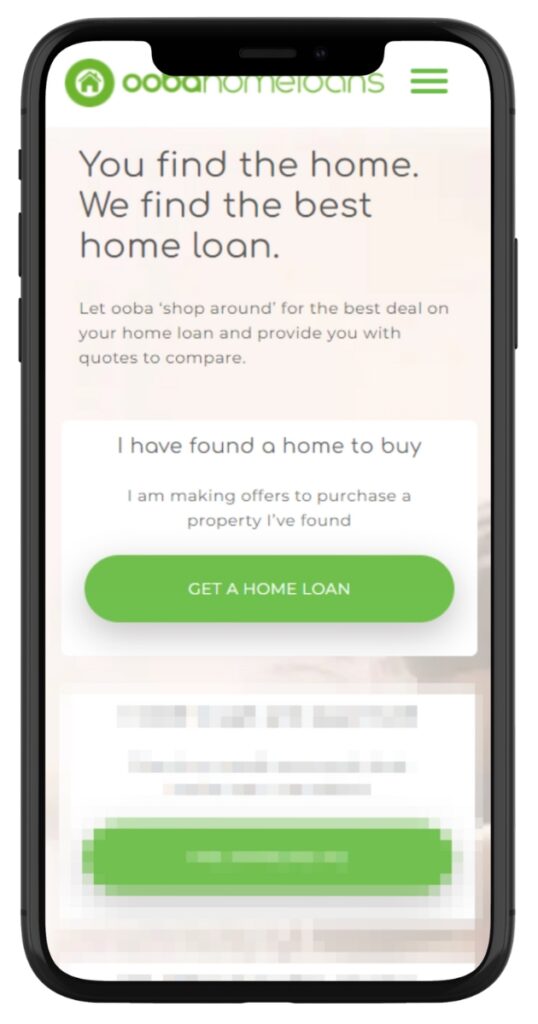

Step 2. Start your home loan application by clicking on the “Apply Now” button.

Step 3. Select whether you found a home and click “Get a Home Loan.”

Step 4. Complete the online application form or contact an expert.

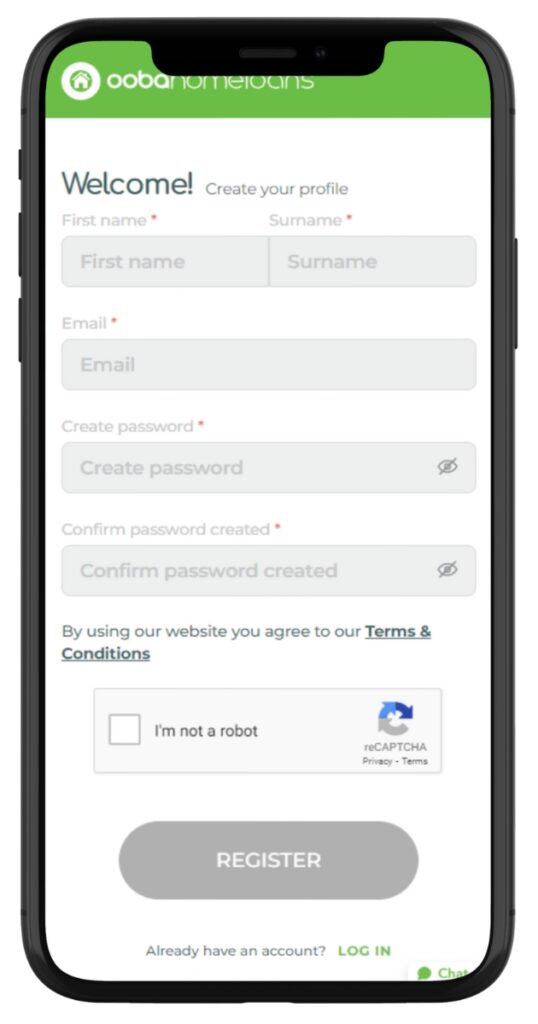

Step 5. Create a profile by registering with your personal details or click login.

Step 6. Upload the necessary documents, including your ID, proof of income, and proof of residence.

Step 7. They will evaluate your application and creditworthiness to determine eligibility.

Step 8. If you qualify, you will receive a pre-approval for your loan amount.

Step 9. After finding a property or finalising your building plans, submit any additional documents required for final approval.

Step 10. Once all approvals are in place, the loan amount will be disbursed to the appropriate parties.

Eligibility Check at ooba

This lender offers several tools and methods to help potential borrowers assess their eligibility for a loan before applying formally. These resources are designed to make the pre-application process informative and straightforward.

Bond Indicator

This lender’s Bond Indicator is an online tool that provides a quick and easy way to check your eligibility. By entering basic financial information, such as your income and expenses, this tool estimates the amount you may qualify for in terms of home financing.

Home Loans Calculator

ooba’s Home Loans Calculator is another valuable resource for prospective borrowers. It assists in calculating potential loan amounts and provides insights into monthly repayments and interest rates. This calculator helps individuals understand what they can afford, aligning their expectations with their financial reality.

Prequalification Certificate

They also offer a Prequalification Certificate, which provides a detailed assessment of your borrowing potential. By submitting a formal application with your financial documentation, they evaluate your credit history, income, and other factors to issue a certificate indicating the loan amount you pre-qualify for. This certificate can be very useful during house hunting, as it provides both you and the property sellers with confidence in your ability to secure financing.

Using these tools, prospective clients can gain a clear understanding of their potential loan options and approach the housing market with greater confidence and preparation.

How Much Money Can I Request from ooba?

- Minimum Loan Amount: R100,000

- Maximum Loan Amount: R5,000,000

These amounts are designed to accommodate a wide range of financing needs, from purchasing modest properties to acquiring high-value homes.

Receiving Offers

Ooba.co.za creates personalised loan offers based on an individual’s financial situation, property value, and current market conditions. By assessing your creditworthiness, income, and existing debts, this lender customises loan offers to ensure they are affordable and sustainable.

Loan Processing Times

The average time from application to disbursement is generally between 4 to 8 weeks. This period allows for a comprehensive assessment, approval, and completion of the necessary legal paperwork.

Factors Affecting Withdrawal Speed

- Accuracy of Application: Errors or incomplete information can cause delays.

- Property Valuation: The time required for property valuation can impact the overall timeline.

- Legal Checks: Legal verifications related to the property and borrower may also extend processing times.

This loan provider offers flexible repayment plans that can be tailored to fit your financial situation. Options include:

- Standard Monthly Payments: Fixed payments over the loan term.

- Flexible Payments: Adjust your payments up or down based on your financial flow.

Possible Fees and Penalties

Possible fees and penalties with them include early settlement fees and late payment penalties. While they allow early repayment, certain conditions may apply. Additionally, missing repayment deadlines may result in extra costs due to late payment penalties.

Pros and Cons of Choosing ooba for Home Loans

When considering ooba for your home loan needs, it’s important to weigh the advantages and disadvantages to make an informed decision. Here’s a balanced view:

Pros

- Competitive Interest Rates: offers interest rates that are competitive within the market, often linked to the prime rate, which can be financially advantageous for borrowers.

- Comprehensive Service Offering: From prequalification to insurance, this lender provides a one-stop-shop experience for all home buying needs, simplifying the process.

- High Flexibility in Loan Terms: With terms ranging from 5 to 30 years and flexible repayment options, borrowers can tailor their loans to suit their specific financial situations.

- Prequalification Services: Their prequalification tools help buyers understand their financial standing and borrowing capacity before committing to a purchase.

- NCR Accredited: Accreditation by the National Credit Regulator (NCR) adds a layer of trust and ensures compliance with local financial regulations.

Cons

- Initial Fees: Some borrowers might find that the initial processing and application fees are higher compared to other financial institutions.

- Complexity for First-Time Buyers: The extensive range of options and information can be overwhelming for first-time homebuyers without proper guidance.

- Property Valuation Dependence: The loan amount and approval are heavily reliant on the property valuation, which might not always be favourable for the borrower.

- Limited to Property-Related Financing: Unlike banks that offer a variety of loan products, this loan provider specialises solely in property-related financing, which may not suit those looking for a broader range of financial products.

- Variable Rates Subject to Market Changes: Although competitive, the variable interest rates are subject to market fluctuations, which could lead to unpredictable increases in costs over time.

Customer Service at ooba

ooba is dedicated to delivering outstanding customer service to ensure that all your queries and concerns are addressed efficiently and thoroughly. Whether you require detailed information about loan products, assistance with the application process, or support after securing a loan, their customer service team is ready to assist.

Do You Have Further Questions for Them?

If you have any specific questions or need detailed information not covered in this review, this loan provider encourages you to reach out through their available channels. They are committed to providing the support you need to make informed decisions about your home financing options.

Contact Channels

Phone number:

Office: 0860 00 66 22

Hours of operation:

Monday to Friday: 08:00 – 17:00

Postal address:

Office 2, DEG Building, 33 Bree Street, Cape Town, Route 21 Corporate Park, Irene, South Africa

Customer Reviews of ooba Home Loans

ooba Home Loans consistently receive positive feedback from customers, as reflected in reviews and ratings on platforms like Hellopeter. Here’s a summary of what customers typically say about their experiences:

Positive Feedback

- Professionalism and Support: The professionalism of their staff is frequently praised. Customers appreciate the high level of support they receive, which often surpasses their expectations, making the home-buying journey smoother and more manageable.

- Efficiency: Reviews often highlight the speed and efficiency of their service. Customers are impressed with how quickly their applications are processed and how effectively they communicate updates and important information.

Critical Feedback

- Cost Concerns: While less common, some customers have raised concerns about the initial costs and fees associated with securing a loan through them, including appraisal fees and other upfront costs that may be higher compared to some other lenders.

- Complexity of Terms: A few reviewers have noted that the terms and conditions of some of their loan products can be complex and difficult to understand. However, these customers generally find that the loan provider’s staff are helpful in clarifying any confusion.

Comparison Table for Home Loan Providers

| Provider | Max Loan Amount | Interest Rate Offers | Loan Term | Special Features |

|---|---|---|---|---|

| ooba | R5,000,000 | Discounted rates based on credit score | Up to 30 years | Prequalification tool, compares multiple banks to find the best rates |

| SA Home Loans | 100% financing available | Credit-linked, with discounts for government employees | Up to 30 years | 50% off bond attorney fees, interest-only option for 3 years |

| Nedbank | Up to 100% | 0.25% discount for main bank clients | Up to 30 years | Cash-back offer of up to R15,000 |

| Absa | Up to 106% | 0.25% discount | Up to 20 years | FLISP assistance, 50% bond registration discount |

| Standard Bank | Up to 100% | Based on credit score | Up to 30 years | Quick approval, homeowners insurance required |

| FNB | Up to 110% | 0.25% discount | Up to 30 years | 50% off registration costs |

| Investec | Up to 100% | Competitive rates for high credit scores | Up to 30 years | Tailored for high-net-worth clients, reduced legal fees |

History and Background of ooba

ooba, formerly known as MortgageSA, was founded in 1999 in South Africa. It was established during a period of significant growth and transformation in the country’s property market, with the goal of simplifying the home-buying process for South Africans. In 2008, the company rebranded to ooba to better represent its expanded range of services beyond mortgage facilitation. This rebranding marked a strategic shift towards providing a comprehensive suite of property and financial services, making them a one-stop shop for prospective homebuyers.

Company’s Mission and Vision

ooba’s mission is to lead in enabling home ownership and insurance solutions in South Africa. The company aims to simplify the home buying and loan application processes, demystifying what can often be a complex experience. Their vision is to make the home buying process as accessible and efficient as possible, empowering more South Africans to achieve their home ownership goals. The company is committed to continuously innovating in the field of home finance, offering tailored products that address the diverse needs of their clients.

Conclusion

ooba is a leading provider in the South African home loan market. Known for its strong emphasis on customer service and a comprehensive range of services, they offes a streamlined and supportive home buying experience. The company’s innovative tools, such as the Bond Indicator and Home Loans Calculator, provide valuable assistance for customers navigating the home financing process. Although some may find the fees and complex terms challenging, overall feedback and satisfaction rates from customers are very positive. Given these factors, this lender comes highly recommended for potential homebuyers seeking reliable and effective home financing solutions.

Frequently Asked Questions

This home loan provider offers a range of home loan products, including home purchase loans, building loans, transfer and bond costs loans, and further advance or bond extension loans. These options are tailored to meet the varied needs of homebuyers and property investors.

To apply for a loan with them, visit their website and complete the online application form. You will need to provide personal and financial information, upload required documents such as proof of income and ID, and then submit your application for processing.

Yes, they offer pre-qualification services through tools like the Bond Indicator and Home Loans Calculator. These tools help potential borrowers understand their buying power and what they can afford before starting the home buying process.

Interest rates for home loans are variable and linked to the prime rate in South Africa. The specific rate you receive will depend on factors such as your credit profile and the details of the loan product you choose.

Yes, they provide a range of additional services including property insurance, life insurance, and expert advice on property transfer and registration. These services are designed to offer comprehensive support for homebuyers.