The traditional routes of banking and credit can often feel cumbersome and rigid. This is where The Loan Company [Theloancompany.co.za], a dynamic player in the South African financial landscape, offers a refreshing alternative. Specializing in asset-based lending, this online lender caters to those who need quick, flexible financial solutions without the lengthy processes typical of traditional (physical) banks.

The Loan Company offers asset-based loans ranging from R5 000 to R150 000, with flexible repayment terms of up to 90 days. If you’re looking for a short-term loan secured against your assets, keep reading to find out whether it is the right option for your needs.

The Loan Company: Quick Overview

Loan Amount: R5 000 – R150 000 (Asset-Based Loans)

Loan Term: 61 – 90 days

Interest Rate: From 36% APR (Monthly rate approx. 5%)

Fees: Varies based on loan terms; early settlement allowed without penalties

Loan Types: Asset loans, loans against vehicles, business finance, loans secured against movable assets

About Arcadia Finance

Experience simplified loan acquisition through Arcadia Finance, offering connections to numerous banks and lenders. Submit a cost-free application and anticipate offers from as many as 19 different lenders. Our trusted lending partners are all licensed under South Africa’s National Credit Regulator.

The Loan Company Full Review

What is Asset-Based Lending?

Asset-based lending is a specific type of financing where loans are secured by an asset or multiple assets. In this arrangement, the borrower uses their assets, such as inventory, accounts receivable, machinery, or real estate, as collateral to obtain financing. The lender focuses primarily on the value and quality of the collateral rather than the creditworthiness of the borrower. If the borrower defaults on the loan, the lender has the right to seize the collateral to recoup the loan amount.

This form of lending differs significantly from traditional lending methods, which typically evaluate a borrower’s credit score, financial history, and repayment capacity. Traditional loans are often unsecured and based on the borrower’s ability to repay the debt from cash flow. Asset-based loans, on the other hand, are secured by tangible assets, which can result in larger loan amounts and potentially lower interest rates due to the decreased risk for the lender. This makes asset-based lending particularly attractive for businesses that hold significant physical assets or for those that need to free up working capital tied in assets to fuel growth or manage cash flow challenges.

Differences Between Asset-Based Lending and Traditional Lending

| Criteria | Asset-Based Lending | Traditional Lending |

|---|---|---|

| Focus | Value and quality of collateral | Creditworthiness and repayment capacity |

| Collateral | Secured by assets such as inventory, accounts receivable, machinery, real estate | Usually unsecured, though secured options exist |

| Risk Assessment | Based on the collateral’s value rather than borrower’s creditworthiness | Based on credit score, financial history |

| Typical Borrowers | Businesses with significant physical assets, those needing working capital | Individuals and businesses with strong credit profiles |

| Interest Rates | Potentially lower due to secured nature of loans | Varies, often higher for unsecured loans |

This table provides a clear contrast between the two lending methods, emphasizing the unique aspects and potential benefits of each.

Who Can Apply for The Loan Company?

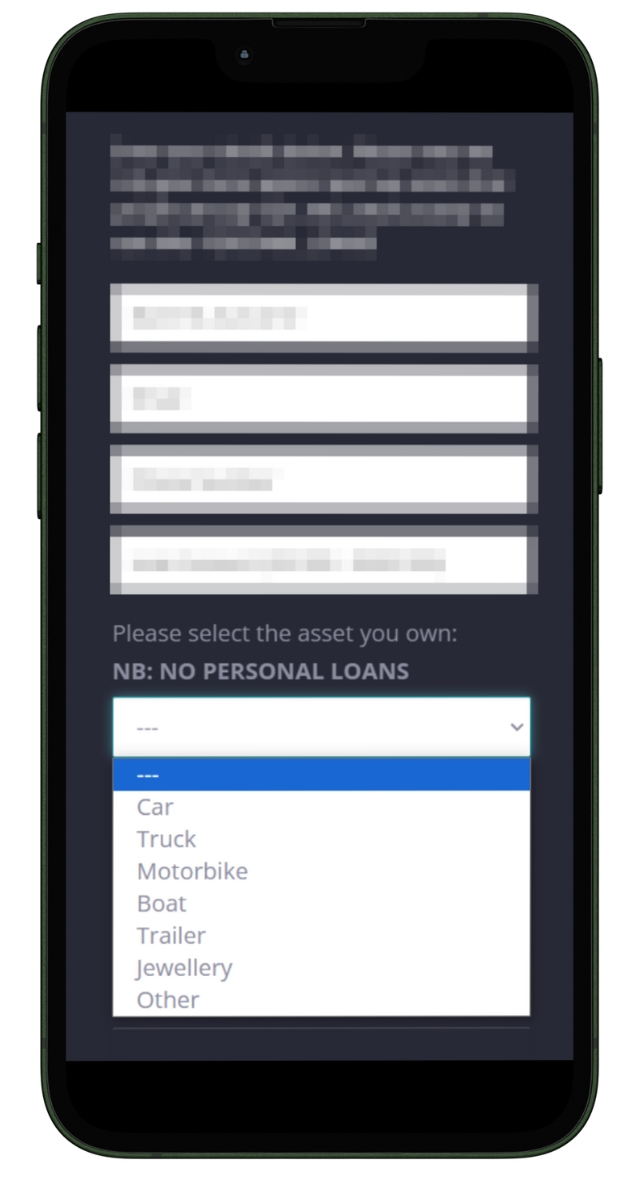

The Loan Company’s services are available to a broad range of clients, but there are some criteria to keep in mind. Primarily, applicants must own an asset that can be used as collateral for the loan. This includes, but is not limited to, vehicles like cars, trucks, and motorbikes, as well as other valuables like jewelry and boats.

The key requirement is that the asset must be fully paid up and in the applicant’s name. This makes their loans accessible to anyone who owns such assets, regardless of their credit history or employment status. It’s an inclusive approach that opens doors for many who might not qualify for traditional bank loans.

Criteria for Potential Borrowers

To apply for a loan with The Loan Company, the primary criterion is the ownership of a valuable asset. The asset is evaluated to determine the loan amount, with the process being transparent and straightforward. Here are the basic criteria:

- Ownership of a fully paid-up asset.

- Valid identification to verify ownership and personal details.

- The asset must be in good condition, as this affects the loan value.

- Only the registered owner of the asset is eligible to apply for an asset loan.

It’s essential to understand that your credit score or employment status is not a primary factor for loan approval, making it a viable option for those who might struggle with traditional loan approvals.

The Loan Company: What Makes It Unique?

The Loan Company distinguishes itself in the South African loan market with several unique features. Its uniqueness lies in its approach to lending, prioritizing asset-based loans over traditional credit-based loans. This model provides a lifeline for those who might not have access to conventional banking services due to various reasons like poor credit history or a lack of stable income.

Advantages of The Loan Company Comparison

When compared to other loan providers, several advantages of The Loan Company become apparent:

- Asset-Based Loans: This is a game-changer for many. Your loan is secured against assets you own, meaning your credit history isn’t the deciding factor.

- Quick Turnaround: The Loan Company processes loans swiftly, often within hours. This speed is crucial for emergency financial needs or business opportunities that require immediate funding.

- Flexible Loan Amounts: The amount you can borrow is based on the value of your asset, offering a range of loan sizes to suit different needs.

- Confidentiality and Privacy: This lender handles all client interactions and transactions with the utmost confidentiality, ensuring privacy and discretion in financial matters.

Types of Loans Offered by The Loan Company

The Loan Company specializes in several types of asset-based loans, each designed to cater to different needs and circumstances. Here’s a breakdown:

Asset Loans: Loans secured against movable assets like cars, motorcycles, boats, and jewelry. Ideal for quick access to cash for emergencies, unexpected expenses, or bridging finance until other funds become available.

Loans Against Cars: Specifically tailored loans where your car acts as collateral. Best for those who need immediate cash but want to keep using their car. Useful for urgent large expenses or as a stop-gap financial solution.

Business Finance: Loans designed for business owners, secured against business assets or personal valuables. These loans can be used for expanding business operations, managing cash flow during slow seasons, or urgent business-related expenses.

Loans Against Other Assets: This includes loans against assets like trucks, trailers, caravans, and even high-value jewelry.Useful for individuals who own these types of assets and need quick, short-term loans without the hassle of traditional credit checks.

Who Is The Loan Company Best For?

It is best suited for individuals who:

- Own fully paid-up assets such as cars, motorbikes, boats, or jewellery

- Need short-term, asset-backed loans ranging from R5 000 to R150 000

- Prefer a fast and flexible loan approval process

- May not qualify for traditional loans due to poor credit history or irregular income

- Want personalised service and secure handling of their collateral

Is The Loan Company a Safe and Good Option?

The Loan Company is a registered credit provider in South Africa that specialises in asset-based lending. It offers secured short-term loans ranging from R5 000 to R150 000, with repayment terms of up to 90 days. These loans are backed by movable assets such as cars, motorbikes, boats, and other valuables.

As an NCR-accredited lender, The Loan Company adheres to responsible lending regulations and prioritises customer protection. Unlike traditional lenders, it does not require a credit check or proof of income—approval is based primarily on the value of the asset offered as collateral. This makes it a suitable option for borrowers who may not qualify for unsecured credit due to poor credit history or lack of formal employment.

For those needing fast, secured funding with a straightforward application process, this company provides a reliable and regulated alternative.

Requirements for a Loan with The Loan Company

Applying for a loan with The Loan Company involves a straightforward process, but there are specific requirements and documents needed to ensure a smooth transaction.

Documents and Information Needed

To apply for a loan, you’ll need:

- Proof of Asset Ownership: Documents showing that the asset you’re using as collateral is fully paid up and in your name.

- Valid Identification: A South African ID or valid passport to verify your identity.

- Proof of Residence: Recent utility bill or similar document to confirm your address.

- Additional Documents for Business Loans: If you’re applying for business finance, you might need to provide business-related documents like company registration papers.

Assets Accepted

They primarily accept the following movable assets as collateral for your loan. The higher the value of your asset, the larger the loan amount you can receive.

- Cars

- Bakkies

- Motorbikes

- Boats

- Trucks

- All-Terrain Vehicles (ATVs)

It’s crucial to have these documents ready as they form the basis of your loan application and the valuation of your asset.

Simulation of a Loan at The Loan Company

Simulating a loan with The Loan Company isn’t complicated. Here’s a step-by-step guide:

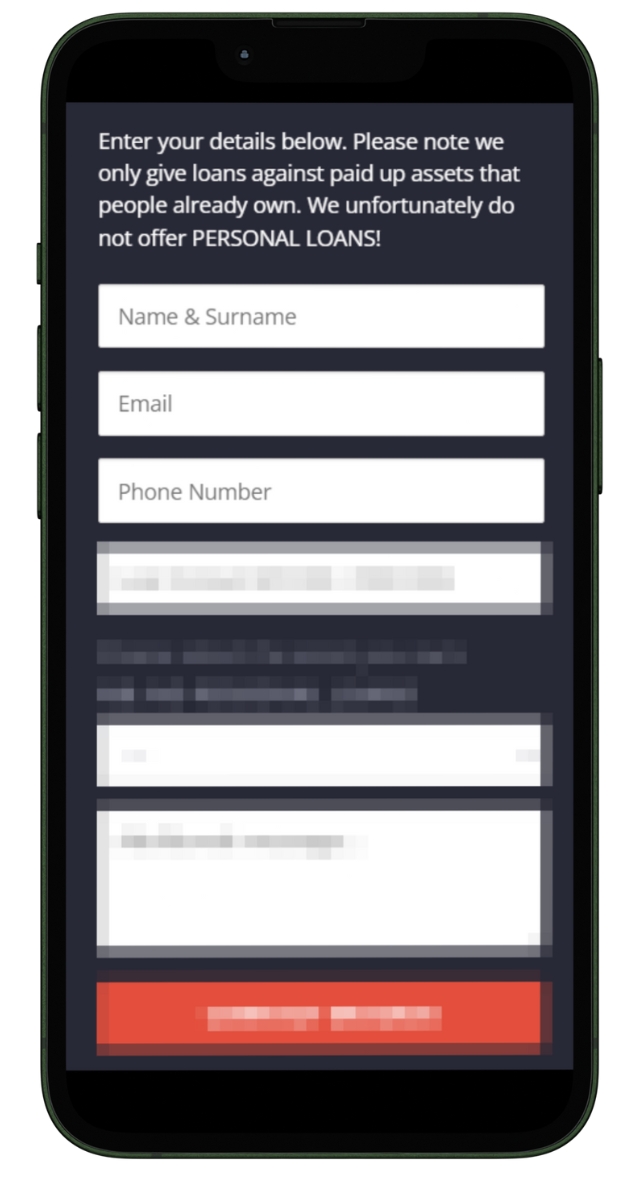

Step 1. Go to Theloancompany.co.za

Step 2. Enter your personal details

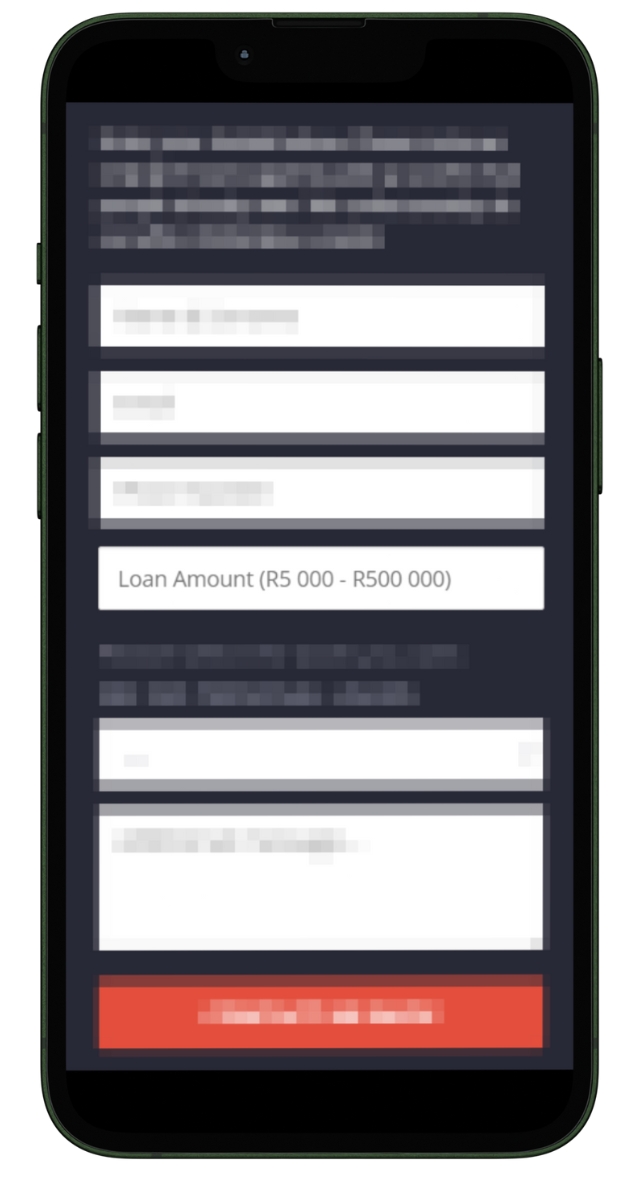

Step 3. Enter the amount you need

Step 4. Select which asset you own

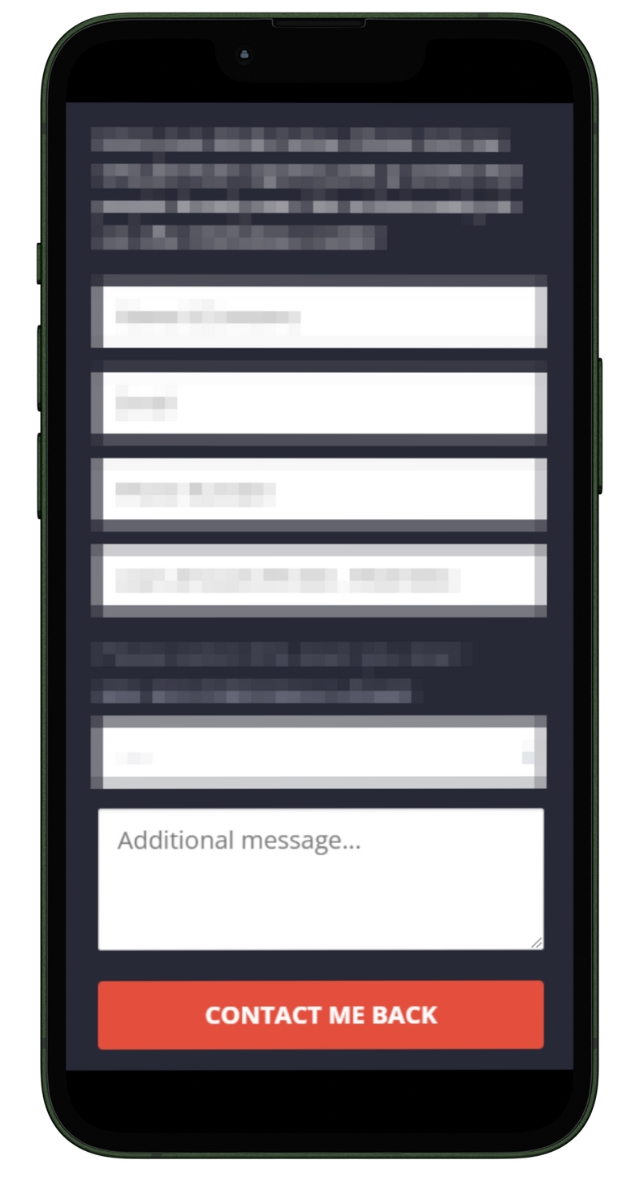

Step 5. Write any additional message you might have in relevance to your loan application. Press “Contact Me Back” when done.

Step 6. After submitting the form,you will receive a confirmation message indicating that your request has been successfully sent.

Step 7. They will assess the value of your asset to determine the loan amount. If your asset is approved, they will make a loan offer. Review and accept the terms if they meet your needs. Once everything is agreed upon and signed, you’ll receive the loan amount, typically within hours.

Eligibility Check

The Loan Company may not explicitly offer online tools for pre-checking eligibility, but their customer service can provide guidance. You can contact them directly to discuss your asset and get an informal idea of whether it qualifies for a loan and the potential amount. This initial conversation can be a useful step before you formally apply, saving time and ensuring you meet the basic requirements.

Remember, the primary eligibility criterion is owning a fully paid-up asset that can be used as collateral. This approach is to make the lending process as accessible and hassle-free as possible, focusing on the value of your assets rather than your credit history or income level.

Security and Privacy at The Loan Company

Theloancompany.co.za places the highest importance on the security of your personal and financial information. With data breaches a real concern, they have strong measures in place to protect your privacy and maintain trust.

They use advanced encryption to secure your data whenever you submit it, whether online or during the application process. This means your information is safely coded to prevent unauthorised access, both in transit and at rest.

Access to your data is strictly limited to authorised staff who need it to process your application or manage your account. These employees are fully trained in data protection and confidentiality.

Privacy Policies and Data Handling

The Loan Company’s privacy policies are clear and transparent, explaining how your information is collected, used, and stored. They only gather what is necessary for your application and never share your details with third parties without your consent, unless legally required.

Their data handling practices comply with all relevant regulations, and they regularly update their security measures to stay ahead of potential threats, ensuring your information remains protected at all times.

How Much Money Can I Request from The Loan Company?

At The Loan Company, you can apply for loans ranging from R5 000 to R150 000. These loans are secured against assets you own, such as cars, motorcycles, trailers, trucks, boats, or caravans. The loan amount you’re eligible for depends on the value of the asset you provide as collateral. Once approved, funds can be disbursed within hours.

But it’s not just about numbers. This lender also considers the individual needs and circumstances of each applicant. For instance, if you’re a business owner facing a temporary cash flow challenge, the company might offer terms that provide more flexibility in repayments. This personalised approach ensures that the loan offer you receive is not only competitive but also aligned with your specific financial situation and requirements.

How Long Does It Take to Receive My Money from The Loan Company?

One of the standout features of The Loan Company is the speed at which they process loan applications. On average, once your asset has been evaluated and your loan approved, you can expect to receive the funds within hours. This rapid turnaround is especially beneficial in emergency situations where you need immediate access to cash.

Factors Affecting Withdrawal Speed

While The Loan Company strives for quick payouts, there are a few factors that can influence the speed of withdrawal:

- Asset Valuation: The time it takes to assess and value your asset can vary, especially if it’s a unique or rare item.

- Verification of Documents: Ensuring that all provided documents are genuine and accurate can take some time, especially if there are discrepancies that need to be addressed.

- Banking Procedures: While The Loan Company processes approved loans swiftly, there might be delays from the banking side, especially if transactions are conducted outside of regular banking hours.

How Do I Repay My Loan from The Loan Company?

Repaying a loan from The Loan Company is designed to be as straightforward and flexible as the initial borrowing process. The company typically sets out a clear repayment plan at the start of the loan agreement, tailored to suit the borrower’s financial situation and the loan amount. This plan includes the total amount to be repaid, the repayment period, and the agreed-upon monthly instalments.

Repayment options usually vary depending on the type of loan and the individual’s circumstances. Generally, borrowers can make payments via direct bank transfers, debit orders, or even in-person payments at designated locations. This Company often works with clients to establish the most convenient repayment method, ensuring that the process is manageable and aligned with the borrower’s financial capabilities.

Possible Fees and Penalties

It’s important to be aware of any additional fees and penalties that might apply. Late payments or defaults on loan repayments can incur extra charges, which will be outlined in the loan agreement. The Loan Company aims to be transparent about all potential fees to avoid any surprises. Borrowers are encouraged to read their loan agreements carefully and discuss any concerns with the company before finalising the loan.

The Loan Company Lender Overview

| Name | The Loan Company |

|---|---|

| Financial | Privately Owned & Registered Credit Provider |

| Product | Asset-Backed Loans |

| Minimum age | >18 years |

| Minimum amount | R5 000 |

| Maximum amount | R150 000 |

| Minimum term | 61 days |

| Maximum term | 90 days |

| APR | 36% – 60% |

| Monthly Interest Rate | 5% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific requirements |

| NCR Accredited | Yes |

| Our Opinion | ✔️ Efficient and fast approval process ✔️ Flexible loan terms based on asset value ⚠️ Limited to asset-backed loans only, not suitable for unsecured needs |

| User Opinion | ✔️ Secure storage of assets ⚠️ High-interest rates for short-term loans |

Online Reviews of The Loan Company

When evaluating The Loan Company, it’s essential to consider the feedback from customers who have used their services. Online reviews offer valuable insights into both the strengths and areas for improvement. Below are two examples each of positive and negative feedback commonly found in customer reviews:

Positive Reviews

- Efficient Service: Many customers appreciate the efficiency and speed of The Loan Company’s loan approval process. They often mention how quickly their applications were processed and funds disbursed, making it a reliable option for those needing fast financial solutions.

- Helpful Customer Support: Several reviews highlight the helpfulness of The Loan Company’s customer service team. Customers note that the staff are knowledgeable, responsive, and willing to assist with any questions or issues that arise during the loan application and repayment process.

Negative Reviews

- High Interest Rates: Some customers express dissatisfaction with the interest rates offered by The Loan Company. While the rates are competitive within the industry, they can still be higher than expected for borrowers who are accustomed to more traditional loan options or who have strong credit profiles.

- Lack of Transparency: A few customers have reported concerns about the transparency of the loan terms. They mention feeling that the full cost of the loan, including fees and potential penalties, was not made clear upfront, leading to unexpected expenses during repayment.

Customer Service at The Loan Company

This lender is known for its strong customer service, which is a critical aspect of their business model. They understand that dealing with financial matters can be stressful and confusing, so they place a high emphasis on being accessible, friendly, and helpful. Whether you need more information about a loan product, assistance with the application process, or have queries about your existing loan, their customer service team is equipped to provide the support you need.

Contact Channels

Phone number:

Office: 087 654 4868

Cell: 079 159 4389

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

Office 2, DGE Building,

90 Sovereign Drive,

Route 21 Corporate Park,

Irene, South Africa

Alternatives to The Loan Company

While The Loan Company offers a unique set of services, especially in asset-based lending, it’s always wise to consider other options available in the market. There are several other credit comparison portals and financial institutions in South Africa that provide various loan products, which might suit different needs or preferences.

Comparison Table

| Lender | Minimum Loan Amount | Maximum Loan Amount | Interest Rates | Repayment Terms |

|---|---|---|---|---|

| The Loan Company | R5 000 | R150 000 | From 36% | Up to 90 days |

| Absa | R250 | R350 000 | Approx. 10% to 21% | 12 to 84 months |

| African Bank | Not specified | R250 000 | 15% to 27.75% | 7 to 72 months |

| Capitec | Not specified | R250 000 | 12.9% to 24.5% | Unspecified |

| Sanlam | R5 000 | R300 000 | 8.5% – 24.5% (15% – 25% PA) | 24 months – 6 years |

| Vecto Finance | R500 | R15 000 | From 26.9% to 28% | 6 to 18 months |

| Wesbank | R5 000 | R300 000 | 19.25% – 29.25% | 24 – 72 months |

History and Background of The Loan Company

Brief History and Establishment

Theloancompany.co.za was founded with the primary objective of offering swift and flexible financial solutions to both individuals and businesses in South Africa. The company’s establishment was motivated by a clear recognition of the constraints present in the traditional banking sector, especially for those requiring immediate financial support but facing challenges in meeting the stringent criteria of conventional lenders.

Company’s Mission and Vision

Mission: This company is dedicated to providing accessible, efficient, and secure lending solutions, placing a distinct emphasis on asset-based loans.

Vision: The company aspires to contribute to a financial services landscape where the value of personal and business assets can be effectively utilized to address immediate financial needs. This vision is characterized by overcoming the typical obstacles associated with traditional credit scoring and loan approval processes.

Pros and Cons of The Loan Company

Pros of The Loan Company

- Quick and Easy Process: The Loan Company’s asset-based approach facilitates a faster and simpler application process compared to traditional loans.

- Flexible Loan Amounts: Loans are customized based on the assessed value of the asset, offering a variety of options for borrowers.

- Personalised Customer Service: The company’s focus on individual customer needs ensures a more personalised and tailored borrowing experience.

Cons of The Loan Company

- Asset Requirement: Loans are contingent on owning a valuable asset, which may not be feasible for all potential borrowers.

- Limited Loan Types: The company primarily focuses on asset-based lending, and options such as unsecured personal loans or long-term mortgages are not available.

- Risk of Asset Loss: Since loans are secured against personal or business assets, there is a risk of losing these assets in case of default. Borrowers need to carefully consider this potential risk.

Conclusion

The Loan Company emerges as a commendable option for individuals seeking swift financial assistance, especially if they possess assets eligible for collateral. The company stands out for its efficient and personalized service, coupled with a flexible range of loan amounts. However, potential borrowers must carefully evaluate the inherent risk associated with using personal or business assets as collateral. It is imperative to assess whether this type of loan harmonizes with long-term financial objectives. For those meeting the criteria and comprehending the terms, The Loan Company establishes itself as a dependable and efficient lending partner.

Frequently Asked Questions

You can use various assets such as cars, motorcycles, boats, and jewellery as collateral for a loan.

If your application is successful, you can often receive funds within hours.

No, since loans are secured against assets, your credit score is not a primary factor for loan approval.

Yes, in most cases, you can continue using your car even when it serves as collateral for your loan.

If you’re unable to repay the loan, there is a risk of losing the asset you used as collateral. It’s important to consider this risk before taking out a loan.