In a reality where financial uncertainties are part of everyday life, having a reliable and straightforward lending partner is a significant relief. Unifi Credit [Unifi.credit]positions itself as such a partner, offering unsecured lending solutions that are designed to be smarter, easier, and faster. Catering primarily to the underserved markets across Sub-Saharan Africa, Unifi Credit brings a breath of fresh air to the personal credit landscape, with a strong emphasis on innovation and customer-centricity.

Unifi Credit provides borrowers with loan amounts ranging from R250 to R8 000, with repayment terms of up to 6 months. If this seems like a suitable option, read on to learn more about this lender and whether they meet your needs.

Unifi Credit: Quick Overview

Loan Amount: R250 – R8 000

Loan Term: Up to 6 months

Interest Rate: 95.9% – 121.1% APR (Starting at 3% per month)

Fees: Information on fees not explicitly provided

Loan Types: Unsecured personal loans

About Arcadia Finance

Arcadia Finance streamlines the loan acquisition process, enabling clients to effortlessly secure financing from a diverse array of banks and lenders. Complete our loan application and receive proposals from as many as 19 distinct lenders. Rest assured, each of our lending partners adheres to the stringent standards set by the National Credit Regulator of South Africa.

Unifi Credit Full Review

Experiences with Unifi Credit Loan

Navigating the landscape of personal loans can often be a journey filled with complexities and uncertainties. However, with Unifi Credit, the experience is tailored to be as straightforward and supportive as possible. Borrowers find themselves engaging with a lender that prioritises their needs, ensuring that the loan application and approval processes are conducted with utmost clarity and efficiency. The company’s approach is not just about facilitating a financial transaction; it’s about providing a lifeline, a reliable support system that empowers borrowers to navigate life’s financial uncertainties with confidence and peace of mind.

Who can apply for a Unifi Credit Loan?

Unifi Credit’s loan services are accessible to a wide array of individuals, but there are certain criteria that potential borrowers must meet. Primarily, the loans are offered to formally employed individuals residing in the countries where the lender operates, such as South Africa, Zambia, Uganda, and Kenya. The focus is on ensuring that the loans are accessible to those who have a stable source of income, enabling them to manage repayments effectively. The application process is designed to be simple and quick, allowing borrowers to access the funds they need with minimal hassle.

Differences from other loan providers

What sets this lender apart from other loan providers is their commitment to simplicity and customer-centricity. Unlike traditional lenders, Unifi Credit prioritises the borrower’s experience, ensuring that the services are not only efficient but also respectful and supportive. The company’s innovative approach leverages technology to streamline the lending process, making it easier for borrowers to apply for and manage their loans. This focus on innovation and customer experience is a defining characteristic of this lender, positioning it as a lender that truly understands and caters to the needs of its borrowers.

Unifi Credit is known for its innovative services and customer-friendly loan solutions, but how does it stack up against other market leaders? Compare it directly with other top loan providers in South Africa, ensuring you choose the lender that best fits your financial needs.

Unifi Credit Loan

What makes the Unifi Credit loan unique?

Unifi Credit’s loans are crafted with a strong emphasis on simplicity and speed. The company utilises world-class data analytics and technology to streamline the lending process, ensuring that borrowers can access the funds they need without unnecessary complications or delays. This focus on technological innovation allows Unifi Credit to offer loans that are distinctively easy to access and manage, making the borrowing experience smoother and more pleasant for customers.

Types of Loans Offered by Unifi Credit

Unifi Credit specialises in fast and simple personal loans. These loans are primarily aimed at formally employed individuals, ensuring that a broader segment of society can access financial support when they need it. The loans are designed to be as accessible as possible, available through various channels, including branches, websites, and apps.

The personal loans they offer are versatile and can be used for various purposes, such as handling emergencies, covering unexpected expenses, or facilitating important life events. The focus is on providing a flexible financial solution that empowers borrowers to navigate life’s challenges with greater ease and confidence.

Requirements for a Unifi Credit Loan

To apply for a loan with this lender, borrowers are required to furnish several documents and details to facilitate the evaluation of their application.

- Proof of Identity: A valid passport, national ID card, or driver’s licence.

- Proof of Income: Recent payslips or bank statements that show a consistent income.

- Proof of Address: A utility bill or any official document confirming your current residential address.

- Employment Details: Include the name of your employer, your job title, and how long you’ve been employed.

- Purpose of the Loan: A brief explanation of what the loan will be used for, allowing them to tailor the loan terms accordingly.

Who Is Unifi Credit Best For?

Unifi Credit is best for borrowers who:

- Require Small, Short-Term Loans

- Are Formally Employed

- Prefer a Fast, Paperless Application

- Need Unsecured Loans

- Want Quick Access to Funds

Is Unifi Credit a Safe and Good Option?

Unifi Credit is a registered credit provider offering unsecured personal loans to formally employed individuals in South Africa and other Sub-Saharan African countries. With a fully online application process and secure encryption technology, borrowers can apply quickly and receive loan amounts ranging from R250 to R8 000, with repayment terms of up to 6 months. The fast approval process allows for same-day fund disbursement in many cases.

While Unifi Credit’s interest rates are higher than traditional bank loans, the company is transparent about fees and repayment terms. It provides a simple and accessible lending solution for those needing short-term financial support. For borrowers seeking a fast and secure loan option, this lender is a reliable choice.

Step-by-step Guide to Applying for a Loan with Unifi Credit

Step 1. Visit Unifi Credit’s official website

Step 2. Adjust the loan amount you wish to apply for

Step 3. Select the repayment term in months

Step 4. Check the estimated monthly payment

Step 5. Input your ID number and submit the application

Step 6. Unifi Credit will review the application and documents

Step 7. Once approved, the loan amount will be disbursed to the borrower’s bank account.

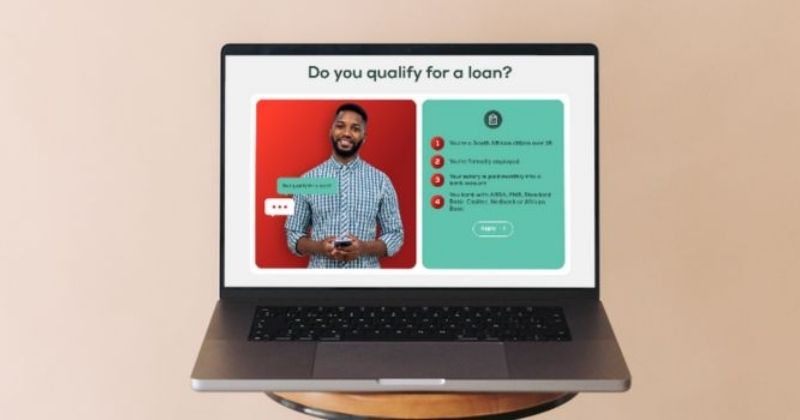

Eligibility Check

Unifi Credit understands the importance of time and the need for borrowers to know their eligibility swiftly. To facilitate this, they offer an online eligibility checker on their website. By inputting basic details such as income, employment status, and the desired loan amount, potential borrowers can get a preliminary idea of their eligibility for a loan. This tool provides a quick assessment, ensuring borrowers don’t go through the entire application process only to find out they don’t meet the criteria.

Security and Privacy

Safeguarding personal and financial information is crucial, and Unifi.credit prioritises this security. The company employs robust security measures, including advanced encryption technologies, to ensure the integrity and confidentiality of borrowers’ data during the loan application and management processes. Their systems are meticulously designed to be resilient against various cybersecurity threats, ensuring that sensitive information remains secure and protected against unauthorised access or interception.

This lender demonstrates a strong commitment to maintaining the privacy of its borrowers. Their privacy policies and data handling practices are meticulously crafted, establishing clear guidelines on the collection, use, and storage of personal and financial data. Unifi Credit ensures that data is handled ethically and responsibly, used solely for intended purposes, and not disclosed to unauthorised parties. This steadfast commitment to privacy and data security fosters a trustworthy environment, enabling borrowers to engage with this lender services with confidence and peace of mind.

How much money can I request from Unifi Credit?

Unifi Credit allows borrowers to apply for personal loans ranging from R250 to R8 000, making it a suitable option for covering short-term financial needs such as unexpected expenses, bills, or urgent purchases. The loan amount you qualify for may depend on factors such as your income, credit profile, and repayment history with Unifi Credit if you’re a returning customer. All applications are processed online, and if approved, the funds are usually paid out quickly, sometimes within the same day.

How Long Does It Take to Receive Funds

The speed at which you can access funds from Unifi.credit is a testament to their commitment to providing quick and efficient lending solutions. The average processing times are impressively swift, reflecting their dedication to ensuring borrowers can address their financial needs promptly.

However, it’s essential to note that various factors can affect the withdrawal speed, such as the verification of provided documents and the finalisation of the loan agreement. Despite these variables, this lender strives to expedite these processes, ensuring that borrowers receive their funds as quickly as possible.

Unifi Credit – Loan Overview

| Category | Details |

|---|---|

| Financial Institution | Unifi Credit, a registered credit provider in South Africa |

| Product | Personal microfinance loans |

| Minimum Age | 18 years |

| Minimum Amount | R250 |

| Maximum Amount | R8 000 |

| Minimum Term | Flexible, with options for early repayment without penalty |

| Maximum Term | 6 months |

| APR | Ranges from 95.9% to 121.1% |

| Monthly Interest Rate | Starts at 3% |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | High, with weekly or monthly repayment options |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick and convenient online application process |

| ✅ Competitive interest rates and flexible repayment terms | |

| ✅ No collateral required for loan approval | |

| User Opinion | ✅ Useful for immediate financial needs |

| ⚠️ High APR rates compared to some other financial products |

Repayment Process

Repaying a loan from Unifi Credit is designed to be as straightforward and hassle-free as the borrowing process. Borrowers are presented with various repayment options and plans, allowing them to choose a strategy that aligns with their financial capabilities and preferences.

It’s also crucial to be aware of potential fees and penalties that may apply during the repayment process. this lender maintains transparency in this aspect, ensuring that borrowers are fully informed of any additional costs that may be incurred during repayment, allowing them to plan and manage their finances effectively.

Online Reviews of Unifi Credit

Online reviews serve as a window into customer satisfaction and the overall performance of Unifi Credit’s services. They offer valuable insights into the real-world experiences of borrowers, shedding light on the aspects that this lender excels at, as well as areas where there might be room for improvement.

Customers often highlight the simplicity and speed of the loan application process, the professionalism of the Unifi Credit team, and the helpfulness of the customer service. These reviews underscore their dedication to making the lending process as seamless and supportive as possible, ensuring that borrowers feel valued and respected throughout their journey. There are also negative comments relating to slow turnaround and lack of response.

Thank you to the lady that guide me good service i received my money hope can do so in the future.

I applied for a loan and have received my funds successfully. I was also called to confirm. They are not bad at all.

Really disappointed in your services this time it’s been more than 7 days since I applied with you guys my application has been on 93% you send me a message saying you want certain documents which I send to you ever since no feedback nothing.

The worst service ever you guys don’t respond to your clients emails or calls ….. I wouldn’t recommend this to anyone.

Customer Service

Customer service is a cornerstone of Unifi Credit’s approach, ensuring that every borrower has access to the support and information they need. If you have further questions or require clarification on any aspect of the loan process, their customer service team is readily available to assist.

Contact Channels

Do you have further questions? Their team is equipped to provide detailed answers, guide you through the loan application process, and assist with any challenges or uncertainties you might encounter.

Phone number

Office: +27 21 110 0600

Hours of Operation

Monday to Friday: 08:00 – 17:00

Postal Address

2nd Floor, Golden Mile Building, 265 Durban Road, Oakdale, Bellville, 7530

Alternatives to Unifi Credit

While Unifi Credit offers a range of beneficial features and services, it’s also worth considering alternative lenders to make an informed decision that best suits your financial needs. There are various other credit comparison portals available that provide a multitude of offers, enabling potential borrowers to explore a diverse array of loan options and terms. These platforms allow for a broader perspective, facilitating a comparison of interest rates, loan terms, and other essential factors, ensuring that borrowers can secure terms that align optimally with their financial circumstances and objectives.

Comparison Table

| Lender | Maximum Loan Amount | Interest Rate | Repayment Period | Special Features |

|---|---|---|---|---|

| Unifi Credit | R8 000 | Starts at 3% per month | Up to 6 months | Quick approval, Online application |

| Capitec Bank | R250 000 | 12.9% p.a. | Up to 84 months | Flexible repayment, Online application |

| African Bank | R250 000 | 15% p.a. | Up to 60 months | Fixed repayments, No penalties for early repayment |

| Nedbank | R300 000 | 10% p.a. | Up to 60 months | Flexible repayment terms, Online application |

| Virgin Money | R250 000 | From 12.9% per annum | From 12.9% per annum | Quick application, funds available immediately after approval |

History and Background of Unifi Credit

Unifi Credit has carved a niche in the lending industry with its innovative and customer-centric approach to personal loans. Established with a vision to bring smarter, easier, and faster unsecured lending solutions to underserved markets across Sub-Saharan Africa, Unifi Credit has been steadfast in its mission to redefine personal credit with a touch of innovation and simplicity. The company’s journey has been marked by a commitment to making life easier for borrowers, ensuring that they have access to quick and reliable financial solutions that resonate with their needs and circumstances.

Mission and Vision

This company’s mission and vision are anchored in the principles of dignity, simplicity, and trust. They aim to offer credit solutions that not only meet immediate financial needs but also foster a sense of respect and support among borrowers, ensuring that the lending process is a smooth and respectful experience. Unifi Credit strives to make a positive impact on the lives of individuals in Sub-Saharan Africa by providing accessible and transparent credit solutions that empower borrowers to navigate financial challenges with confidence.

The company’s focus on innovation and simplicity reflects its dedication to staying ahead in the dynamic landscape of personal lending. By leveraging technology and understanding the unique needs of its diverse customer base, this company continues to redefine the borrowing experience, setting new standards for efficiency, accessibility, and customer satisfaction.

Pros and Cons of Choosing Unifi Credit

Choosing Unifi Credit as a lending partner comes with its own set of advantages and disadvantages, which are essential to consider for making an informed decision.

Pros of Unifi Credit

- Quick and Straightforward Applications: Offers quick and straightforward loan applications, ensuring that borrowers can access funds promptly when they need them.

- Innovation and Technology: Their focus on innovation and technology means that the lending process is streamlined and efficient, enhancing the overall customer experience.

- Transparency and Credibility: Transparency and credibility are strong traits of this lender, ensuring that borrowers are always well-informed and treated with respect.

Cons of Unifi Credit

- Focus on Unsecured Personal Loans: Primarily focuses on unsecured personal loans, which might limit options for those looking for a broader variety of loan types.

- Targeted Towards Formally Employed Individuals: Their services are primarily tailored towards formally employed individuals, which might exclude certain groups of potential borrowers from accessing their services.

Conclusion

Unifi Credit’s commitment to quick and straightforward lending solutions is commendable, ensuring that borrowers can navigate through life’s uncertainties with a reliable financial partner. Their use of technology and innovation to streamline the lending process also stands out, enhancing the overall customer experience and ensuring that the borrowing process is smooth and hassle-free.

Frequently Asked Questions

This lender specialises in unsecured personal loans. These loans are designed for formally employed individuals, addressing various financial needs such as emergencies, unexpected expenses, or significant life events.

While processing times are generally quick, the exact timing may vary based on document verification and finalising the loan agreement. The company prioritises a fast and efficient disbursement process.

Applicants need to provide several documents, including proof of identity, proof of income, proof of address, and details about employment and the purpose of the loan. These documents enable a comprehensive evaluation of the loan application.

This company offers various repayment options, allowing borrowers to choose a plan that suits their financial capabilities. Borrowers should be aware of potential fees and penalties during the repayment process, ensuring effective financial management.

Yes, Unifi Credit provides an online eligibility checker on their website. This tool allows potential borrowers to input basic details and receive a preliminary assessment of their eligibility, enabling informed decisions before proceeding with the full application process.