When it comes to choosing a loan, the options can be overwhelming. You want a lender that’s straightforward, trustworthy, and understands your needs. That’s where Virgin Money steps in. This review aims to shed light on what Virgin Money offers in terms of loans, how their process works, and most importantly, whether they’re the right fit for your financial needs.

Experiences with Virgin Money

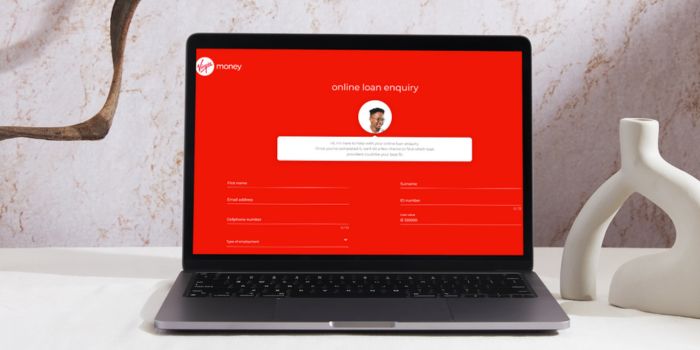

When it comes to personal experiences with Virgin Money, borrowers often highlight a few key aspects. Ease of use and customer service stand out as significant positives. Many users appreciate the straightforward online application process, which saves time and hassle. The website’s user-friendly interface makes it easy for anyone, regardless of their tech-savviness, to apply for a loan.

Customers also frequently mention the clarity of information provided by Virgin Money. This transparency is crucial when dealing with financial products, as it helps borrowers understand exactly what they’re signing up for, including interest rates, repayment terms, and any fees.

However, it’s not all smooth sailing. Some borrowers have noted delays in the loan approval process or in getting responses from customer service. While these experiences aren’t universal, they’re worth considering, especially if you’re in a hurry to get funds.

This review provides an overview of the general experiences users have had with Virgin Money, emphasizing both positive and potentially challenging aspects. As with any financial decision, it’s essential to weigh the pros and cons based on your specific needs and circumstances.

Who Can Apply for a Virgin Money Loan?

Virgin Money caters to a broad range of borrowers, but like any lender, they have specific criteria. Generally, to apply for a loan with Virgin Money, you need to:

- Be at least 18 years old: This is a standard requirement across most financial institutions.

- Have a regular income: Virgin Money needs to know that you can afford to repay the loan. This doesn’t necessarily mean you need a traditional 9-to-5 job, but you should have some form of steady income.

- Have a good credit history: Your credit score and history will play a significant role in not just whether you’re approved, but also the terms and interest rate of your loan.

Criteria for Potential Borrowers

The criteria for potential borrowers are pretty straightforward. Virgin Money looks at:

- Credit score and history: A higher credit score increases your chances of approval and possibly gets you better loan terms.

- Income and employment status: You need to demonstrate that you have the means to repay the loan. This includes having a stable job or a consistent source of income.

- Debt-to-income ratio: This is the ratio of your monthly debt payments to your monthly income. A lower ratio typically means you’re less of a risk to lenders.

Differences from Other Loan Providers

Virgin Money stands out from other loan providers in several ways:

- Customer-focused approach: They often receive praise for their customer service and the ease with which customers can manage their loans.

- Transparency: Virgin Money is known for being upfront about their fees, charges, and loan terms.

- Innovative solutions: They frequently update their offerings and services to meet the evolving needs of their customers, often incorporating technology to improve the borrowing experience.

In comparison to other lenders, Virgin Money tries to simplify the loan process, making it more accessible and less intimidating for the average person. Their focus on transparency and customer service can be a significant draw for those tired of the traditional, often cumbersome, loan application processes of other banks and financial institutions.

About Arcadia Finance

Arcadia Finance assists in the easy procurement of loans from various banks and lenders. Fill out an application at no cost and be presented with offers from up to 19 different lenders. Our lending partners are all reputable and regulated by the National Credit Regulator of South Africa.

Virgin Money

Virgin Money has carved a niche for itself in the financial world by offering services that are tailored to the needs of its customers. Their approach to banking and lending is different from many traditional institutions, and this has earned them a loyal customer base.

What Makes Virgin Money Unique?

What sets Virgin Money apart is their commitment to transparency and customer service. They have a reputation for being upfront about their fees, charges, and loan terms, ensuring that customers know exactly what they’re getting into. Their online platform is designed to be user-friendly, making the loan application process smooth and hassle-free. Virgin Money frequently updates its offerings to meet the evolving needs of its customers, often incorporating technology to enhance the borrowing experience.

Advantages of the Virgin Money Comparison

Comparing loan options with Virgin Money is beneficial for several reasons. Firstly, their transparent approach means you get a clear picture of the loan terms, interest rates, and any associated fees. This makes it easier to understand the total cost of the loan. Secondly, their range of loan products caters to various needs, from buying a new car to renovating a home. Lastly, their online tools and resources help borrowers make informed decisions, ensuring they choose a loan that aligns with their financial situation.

Types of Loans Offered by Virgin Money

Virgin Money offers a range of loan products to cater to the diverse needs of its customers. Each loan type is designed with specific purposes in mind, ensuring that borrowers get the best possible terms for their requirements.

Personal Loans

These are unsecured loans that can be used for a variety of purposes, from consolidating debt to funding a holiday. The flexibility of a personal loan means you can use it as you see fit, without any restrictions on its use. Ideal for those who need funds for personal expenses, be it a wedding, a holiday, or unexpected medical bills.

Home Loans

Designed for those looking to buy or refinance a property, home loans from Virgin Money come with competitive interest rates and flexible repayment options. Suitable for individuals or families looking to purchase a new home, invest in property, or refinance their existing mortgage. It’s tailored to ensure borrowers get the best terms for their property needs.

Auto Loans

If you’re in the market for a new car, an auto loan from Virgin Money can help you get behind the wheel sooner. Designed for those looking to purchase a vehicle. Whether you’re buying your first car or upgrading to a newer model, this loan type ensures you get competitive financing options.

Requirements for a Virgin Money Loan

Applying for a loan with Virgin Money involves meeting certain requirements and providing specific documents. Understanding these requirements upfront can help streamline the application process.

Documents and Information Needed

To apply for a loan with Virgin Money, you typically need to provide:

- Proof of Identity: A valid ID document or passport to verify your identity.

- Proof of Income: Recent payslips or bank statements to demonstrate your income.

- Proof of Address: A utility bill or similar document to confirm your address.

- Credit History: Virgin Money will check your credit score and history as part of the application process.

- Employment Details: Information about your current employment, including your employer’s name and your job title.

Having these documents ready can help speed up the application process.

Simulation of a Loan at Virgin Money

Virgin Money’s website often provides tools for simulating a loan, giving you an idea of the interest rates, monthly repayments, and total loan cost. Here’s a step-by-step guide to applying for a loan with Virgin Money:

- Visit the Virgin Money Website: Start by going to their official website.

- Choose the Loan Type: Select the type of loan you’re interested in (e.g., personal, home, auto).

- Enter Loan Details: Input the amount you wish to borrow and your preferred repayment period.

- View Your Loan Simulation: The tool will display an estimated monthly repayment amount, interest rate, and total amount repayable.

- Decide if You Want to Proceed: If you’re happy with the simulation, you can move on to the actual application.

Following these steps can help you navigate through the loan application process with Virgin Money, allowing you to make informed decisions about your borrowing needs.

Eligibility Check

Virgin Money may offer tools or methods to pre-check your eligibility for a loan. These tools typically require you to enter some basic information about yourself, your income, and your credit history. Based on this information, you’ll get an indication of whether you’re likely to be approved for a loan, and what terms you might expect. This pre-check is a useful way to gauge your chances of approval without impacting your credit score.

Security and Privacy

When it comes to dealing with financial services, the security and privacy of your personal and financial information are paramount. Virgin Money understands this and has put in place robust measures to ensure that all customer data is handled securely and with the utmost respect for privacy.

Ensuring the Security of Personal and Financial Information

Virgin Money employs a range of security measures to protect your information. These include advanced encryption technologies to safeguard data during online transactions and communications. Their systems are designed to prevent unauthorized access, ensuring that your sensitive financial details are kept confidential and secure.

In addition to technical safeguards, Virgin Money also adheres to strict internal protocols regarding the handling of customer information. Employees are trained in data protection and are committed to maintaining the confidentiality and integrity of customer data.

Privacy Policies and Data Handling Practices

Virgin Money’s privacy policies are crafted to be transparent and easy to understand, providing customers with clear information about how their data is used, stored, and protected. The company is committed to complying with all relevant data protection laws and regulations, ensuring that they not only meet but exceed the required standards for data privacy.

The privacy policy details the types of information collected, the purposes for which it is used, and how it is shared. Virgin Money places great emphasis on using customer data responsibly and ensures that any sharing of information is done with the customer’s consent and in accordance with legal requirements.

Customers are also given control over their personal information. Virgin Money provides options for customers to manage their data, including the ability to access, correct, or delete their personal information, as per the applicable data protection laws.

How Much Money Can I Request from Virgin Money?

When you’re considering taking out a loan, one of the first questions that comes to mind is how much money you can borrow. Virgin Money offers a range of loan amounts to suit different financial needs and circumstances.

The minimum and maximum loan amounts available from Virgin Money can vary depending on the type of loan you’re applying for. For instance, personal loans might have different limits compared to home loans or auto loans.

Generally, personal loans from Virgin Money start at a lower limit, suitable for small financial needs, and can extend to a higher limit for more significant borrowing requirements.

It’s always advisable to check the latest figures directly with Virgin Money, as these can change based on their lending policies and market conditions.

Receive Offers

Virgin Money is known for creating personalized loan offers. This means that the loan amount, interest rate, and repayment terms you’re offered will be tailored to your individual financial situation.

Factors like your credit score, income, employment status, and the amount you wish to borrow all play a part in shaping these personalized offers.

This bespoke approach helps ensure that the loan you get is suited to your ability to repay, reducing the risk of financial strain.

How Long Does It Take to Receive My Money?

The time it takes to receive your loan from Virgin Money can vary, but they generally work to process loans as quickly as possible.

Average Processing Times

The average processing time for a loan from Virgin Money can depend on several factors.

Typically, once you’ve submitted your application with all the required documentation, you might expect to receive a decision within a few business days.

However, this is just an average estimate and can be quicker or slower depending on individual circumstances.

Factors Affecting Withdrawal Speed

Several factors can affect how quickly you can access the funds from your Virgin Money loan:

- Application Accuracy: Ensuring that your application is filled out accurately and completely can help speed up the process. Missing or incorrect information can lead to delays.

- Response Time: How quickly you respond to any requests for additional information or documentation can also impact the processing time.

- Loan Type: Different types of loans may have different processing times. For example, a secured loan like a home loan might take longer to process than an unsecured personal loan due to the additional verification and collateral valuation required.

- Internal Processes: Virgin Money’s internal processing times can also influence how quickly you receive your money. This includes the time taken for credit checks, approval processes, and fund disbursement.

How Do I Repay My Loan from Virgin Money?

Repaying your loan from Virgin Money is designed to be as straightforward and flexible as possible, with several options available to suit different financial situations. The repayment plans are typically structured around your income and budget, allowing for manageable monthly payments.

When you take out a loan, Virgin Money will agree with you on a repayment schedule. This schedule usually involves monthly repayments, which consist of part of the principal amount you borrowed plus interest. The amount you pay each month, the interest rate, and the loan term (how long you have to pay back the loan) are all agreed upon at the start of your loan.

Repayment Options and Plans

Virgin Money often provides a few different ways to make your repayments. Direct debit is a common method, where your monthly repayment amount is automatically deducted from your bank account on a set date. This method is convenient as it reduces the risk of missing a payment. Additionally, you might have the option to make extra payments if you find yourself in a position to pay off your loan quicker than anticipated. It’s worth checking with Virgin Money if this is possible and if there are any fees for early repayment.

Possible Fees and Penalties

It’s important to be aware of any potential fees and penalties associated with your loan. Virgin Money, like many lenders, may charge fees for late payments. If you think you might be unable to make a repayment, it’s best to contact Virgin Money as soon as possible to discuss your options. They might be able to offer a solution or adjust your repayment plan to better suit your current situation. Additionally, there could be charges for processing certain transactions or for early repayment of the loan, depending on the terms and conditions of your specific loan agreement.

Online Reviews of Virgin Money

Online reviews can provide valuable insights into what customers think about Virgin Money and its services. Generally, many customers appreciate the transparency and clarity that Virgin Money offers regarding loan terms, fees, and repayment options. The ease of the application process and the speed of loan disbursement are also frequently mentioned positives.

However, like any service, there are mixed reviews too. Some customers have expressed dissatisfaction, particularly regarding customer service experiences or delays in the loan process. It’s not uncommon to see some negative reviews focusing on specific personal experiences with customer service or misunderstandings about loan terms and conditions.

When reading online reviews, it’s helpful to remember that individual experiences can vary widely. A single negative review doesn’t necessarily represent the overall quality of the service, just as one positive review might not capture the full picture. Prospective borrowers might find it useful to consider the general trend in customer feedback while also paying attention to how recent the reviews are, as companies can change over time.

Customer Service

Virgin Money places a strong emphasis on providing top-notch customer service. They understand that when it comes to financial matters, customers need clear, prompt, and helpful responses. Whether you’re facing an issue with your loan application, have questions about repayment, or simply need guidance on their products, Virgin Money’s customer service team is equipped to assist.

Their team is trained to handle a wide range of queries, ensuring that customers get accurate and timely information. They also use feedback from customers to continuously improve their services, ensuring that the customer experience is always at the forefront of their operations.

Do You Have Further Questions for Virgin Money?

If you have more questions or need clarification on any aspect of Virgin Money’s services, reaching out to their customer service is a good starting point. They offer multiple channels of communication, including phone support, email, and online chat. Their website also features a comprehensive FAQ section, which addresses many common queries and concerns. It’s always advisable to get in touch directly for specific or personalized information.

Alternatives to Virgin Money

While Virgin Money offers a range of financial products and is known for its customer-centric approach, it’s always a good idea to explore other options to ensure you’re getting the best deal. There are several other credit comparison portals and lenders in the market, each with its own set of offerings, terms, and conditions.

Comparison Table

To help you get a clearer picture of how Virgin Money stacks up against other lenders, here’s a simplified comparison table:

| Criteria | Virgin Money | Sanlam | Cashfin | Unifi Credit |

|---|---|---|---|---|

| Loan Amounts | R100 to R250,000 | Up to R300,000 | Up to R150,000 | R2,000 to R8,000 |

| Interest Rates | Starting at 12.90% | Fixed (not specified) | Max APR 32% per annum | 3% per month, with an APR ranging from 104% to a maximum of 212% |

| Repayment Terms | 1 to 84 months | 12 months to 6 years | 12 to 60 months | 6 months |

| Eligibility Criteria | 18+ years, SA resident, valid ID, proof of income, active checking account | SA ID, residential address proof, recent bank statements or payslips | 18-65 years old, permanent SA resident, permanently employed, salary paid into bank account, recent payslip, home address proof, 3 months’ bank statements | South African citizens over 18, formally employed, with their salary paid monthly into a bank account. |

| More Info | Sanlam Review | Unifi Credit Review |

Each of these lenders has specific terms and conditions that might affect the final loan offer, including interest rates and repayment terms, which are based on the individual’s credit profile and other assessment criteria. For more detailed information and to apply, it’s best to contact the lenders directly or visit their websites.

History and Background of Virgin Money

Virgin Money was established as part of the Virgin Group, founded by Sir Richard Branson. It began as a financial services brand and has experienced significant growth over the years. The company’s foundation lies in the principles of providing value for money, fostering innovation, and challenging the traditional banking sector.

Company’s Mission and Vision

The mission of Virgin Money has consistently been to enhance banking services. They strive to offer straightforward, transparent banking and financial services that prioritize customer needs. Their vision encompasses a commitment to responsible banking, excellent customer service, and innovative solutions aimed at challenging the status quo in the financial services industry.

Pros and Cons

Pros

- Diverse Loan Products: Virgin Money provides a wide array of loan products, catering to various needs.

- Customer Service: The company is renowned for its excellent customer service and user-friendly approach.

- Transparency: Virgin Money is transparent about its fees, charges, and loan terms.

Cons

- Interest Rates: Depending on your credit profile, the interest rates might be higher compared to some competitors.

- Availability: Some of their products or services may not be available in all regions or to all customers.

- Processing Times: Loan processing times can vary, and some customers might experience delays.

Conclusion

Virgin Money presents a solid option for individuals seeking financial products, especially in prioritizing customer service and transparency. While their interest rates may not always be the lowest, and product availability could vary, Virgin Money’s dedication to customer satisfaction and a diverse range of financial services positions them as a viable choice in the financial services market.

Frequently Asked Questions about Virgin Money

Virgin Money offers a variety of financial products, including personal loans, home loans, auto loans, savings accounts, and insurance products.

Interest rates at Virgin Money are competitive but can vary based on the loan type and your personal credit profile. It’s advisable to compare rates with other banks to find the best deal for your situation.

Yes, one of Virgin Money’s strengths is its transparency regarding fees, charges, and loan terms, helping customers make informed decisions.

Yes, Virgin Money offers an online application process for most of its loan products, making it convenient and accessible.

The approval time can vary depending on the type of loan and individual circumstances. While Virgin Money aims to process loans promptly, some customers might experience delays.