Vodacom [Vodacom.co.za] stands out as one of South Africa’s leading mobile network providers. Beyond its core mobile services, Vodacom has ventured into financial services with Vodalend Personal Loans, a product designed to assist South Africans in addressing various financial needs. Whether you aim to cover unexpected expenses, finance a home improvement project, or consolidate existing debt, Vodacom’s personal loans may be a viable option to explore.

Vodacom – Loan Overview

| Name | Vodacom |

| Financial | Publicly Traded Company (Vodacom) |

| Product | Unsecured Personal Loans |

| Minimum age | >18 years |

| Minimum amount | R500 |

| Maximum amount | R250 000 |

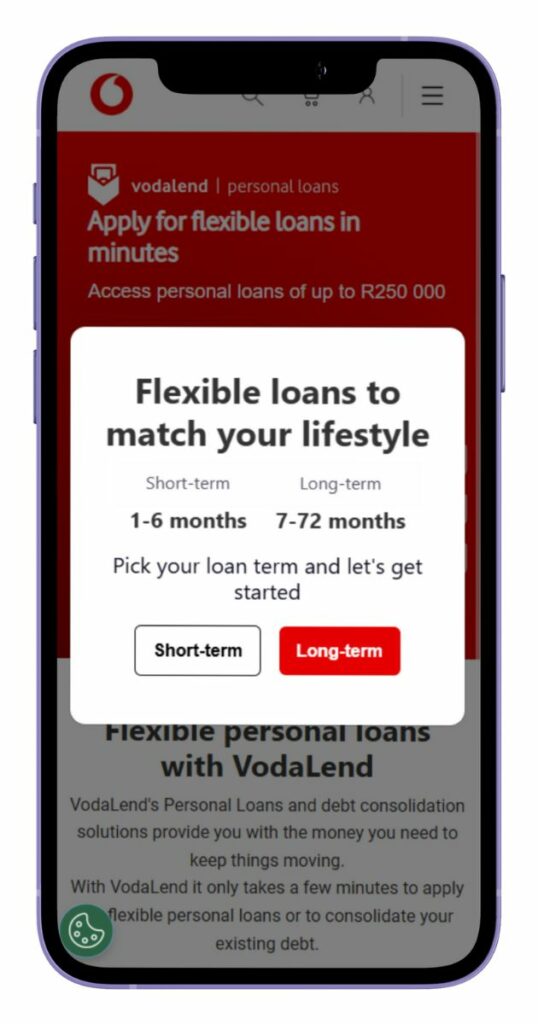

| Minimum term | 3 months |

| Maximum term | 72 months |

| APR | 24% – 25% per annum |

| Monthly Interest Rate | Variable depending on individual credit profile |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Adjustable to suit customer needs |

| NCR Accredited | Yes |

| Our Opinion | ✅ Quick approval process ✅ Flexible repayment options ⚠️ High-interest rates for some customers |

| User Opinion | ✅ Easy application process ⚠️ Limited to unsecured loans, so may have higher rates |

What Makes The Vodacom Loan Unique?

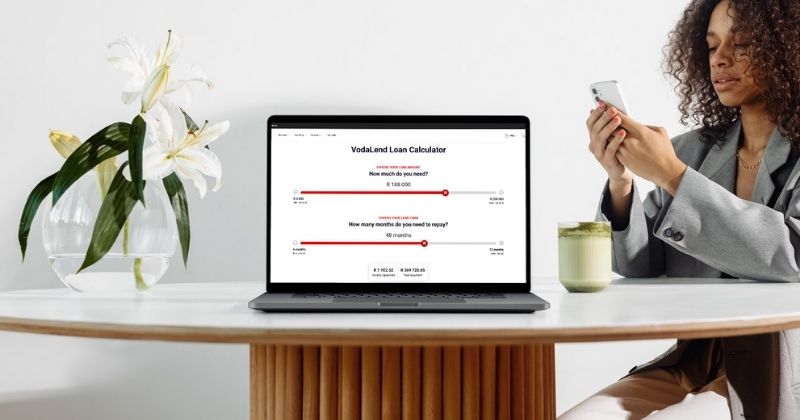

Vodacom’s VodaLend personal loan distinguishes itself through seamless integration with technology and a strong focus on customer convenience. Users can easily apply for a loan, track their application status, and manage repayments via the VodaPay app, eliminating the need to visit a physical branch. This streamlined process often leads to quick approvals, with funds typically disbursed shortly after approval. The digital-first approach allows borrowers to apply from anywhere, making it an efficient choice for busy individuals or those in remote areas.

Additionally, their partnership with Old Mutual adds an extra layer of trust, as the loans are backed by a reputable financial institution, ensuring the service’s security and reliability.

Another notable feature of VodaLend is its flexible repayment terms, which range from 3 to 72 months. This flexibility allows customers to tailor their repayment schedules based on their financial circumstances. Moreover, borrowers can benefit from early settlement options without incurring penalties, enabling them to pay off their loans more quickly. As these loans are unsecured, no collateral is required, broadening accessibility to a wider audience. However, it’s important to note that interest rates and fees are adjusted according to the applicant’s credit profile, meaning those with stronger credit histories may receive more favourable rates.

About Arcadia Finance

Arcadia Finance makes securing a loan hassle-free, featuring no application fees and access to 19 trusted lenders, all NCR-compliant in South Africa, for a fast, secure, and personalized lending experience.

Types of Loans Offered by Vodacom

Vodacom, through its VodaLend service, offers a variety of personal loans tailored to meet the diverse financial needs of South African customers. These loans are designed to assist individuals in different situations, whether for covering unexpected expenses or for long-term financial planning. Below is a breakdown of the key types of loans available through VodaLend.

VodaLend Personal Loans

VodaLend personal loans provide unsecured financial assistance without requiring collateral, making them ideal for a variety of personal expenses. Use these loans for debt consolidation to simplify repayments, home renovations without mortgaging your property, covering unexpected medical bills, funding large events like weddings, or paying for education fees. Loan amounts range from R500 to R250,000, with flexible repayment terms between 3 to 72 months, allowing you to tailor the loan to your financial situation.

Device Financing Loans

Vodacom’s Device Financing Loans are designed for customers who want to purchase the latest smartphones, tablets, or laptops and pay in affordable monthly installments. This financing option helps spread the cost of expensive gadgets, making it easier to upgrade without the burden of a large upfront payment. Whether it’s a new smartphone or other electronic gadgets, this flexible plan ensures that you can access the technology you need while staying within your budget.

Airtime and Data Credit Loans

Vodacom provides Airtime and Data Credit Loans, a convenient solution for immediate communication needs. If you run out of airtime or data, you can borrow credit, with the amount automatically deducted from your next recharge or monthly bill. This short-term loan ensures you stay connected for urgent work tasks or personal communications without upfront payments, offering a practical way to manage unexpected data or airtime needs.

VodaLend Compare Loan Offers

Vodacom.co.za provides a service known as VodaLend Compare, which enables customers to compare personal loan quotes from various lending partners. This feature is especially beneficial for individuals looking to make informed financial decisions.

Requirements for a Vodacom Loan

To apply for a Vodacom Personal Loan through the VodaLend service, you must meet specific eligibility criteria and provide necessary documentation. Below are the key requirements and documents needed for a successful application.

Eligibility Criteria

- Age Requirement: You must be at least 18 years old at the time of application.

- Income Requirement: A minimum monthly income of R2,500 is required.

- Employment Status: You should be permanently or contractually employed for at least 3 months.

- Credit Criteria: You must pass affordability and credit checks, as your credit history will be evaluated.

Required Documents

To facilitate a smooth loan application process, prepare the following documents:

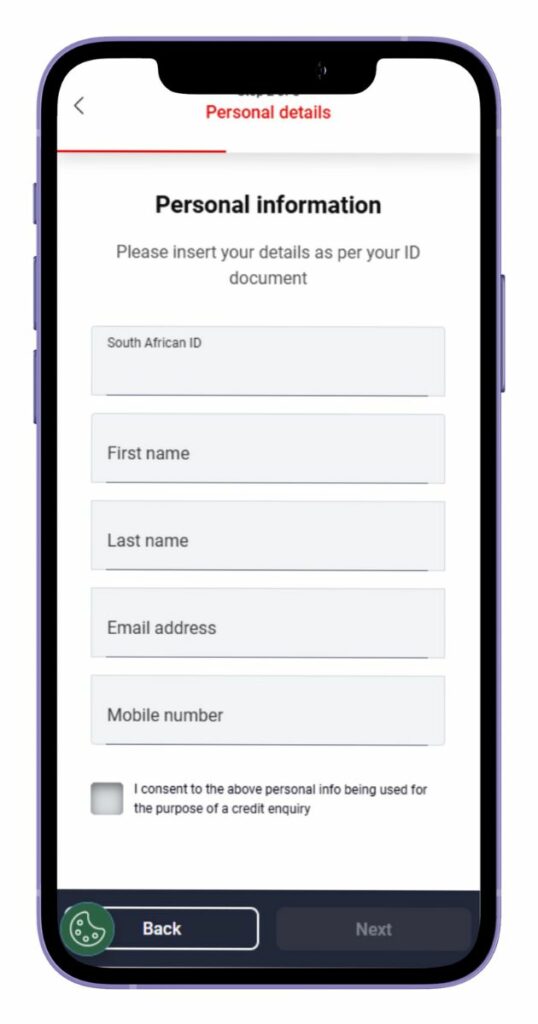

- Valid South African Identity Document (ID): Necessary for identity verification as a South African citizen.

- Recent Payslip: Your latest payslip (not older than one month) is needed. If your payslip includes a bonus, the previous month’s payslip may also be required.

- Bank Statements: A stamped bank statement showing your salary deposits for the last three consecutive months, which must not be older than 7 days at the time of submission.

- Proof of Address: A recent utility bill or similar document verifying your residential address.

Additional Requirements

- Affordability Check: Vodacom will perform an affordability assessment to determine if you can comfortably manage the monthly repayments.

- Credit Life Insurance: For loans with terms longer than 12 months, you may be required to obtain a credit life insurance policy to cover the loan in case of death, disability, or retrenchment.

Application Process

You can apply for a VodaLend loan through the Vodacom website or the VodaPay App. After submitting your application, you will receive a response regarding approval within a short timeframe. Funds will typically be available in your account within minutes upon successful approval.

Having all your documents ready before applying will help streamline the process and increase your chances of approval.

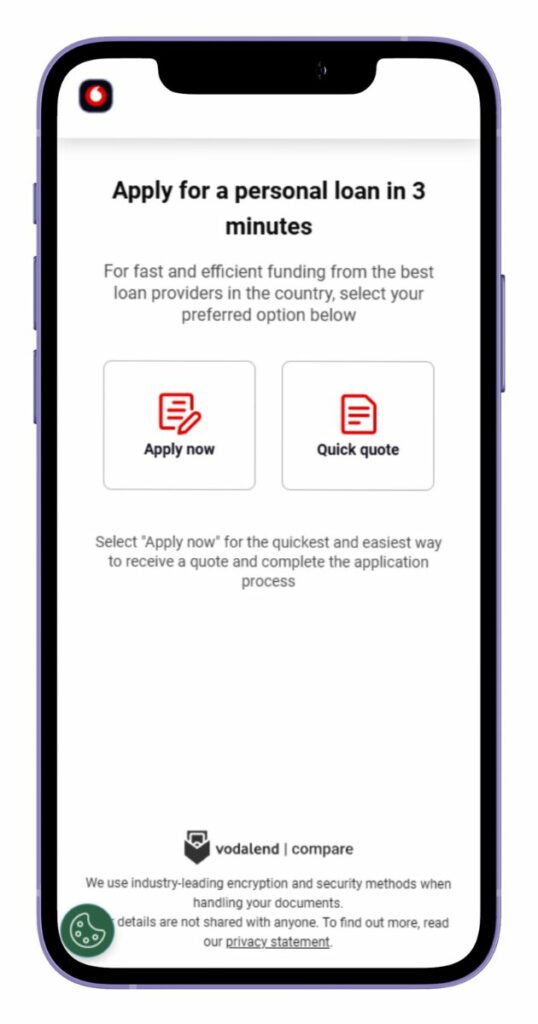

Step-by-Step Guide to Applying for a Loan at Vodacom

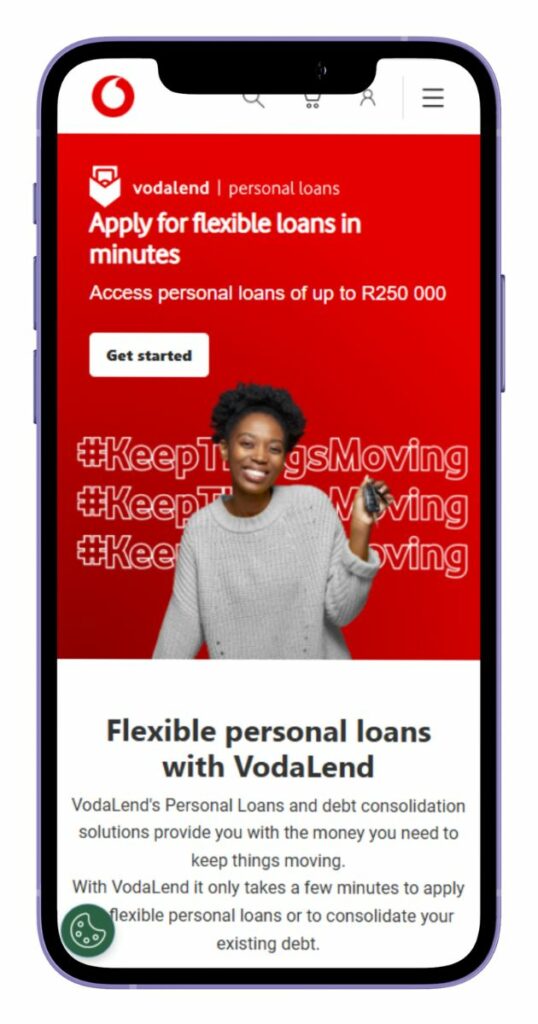

Step 1. Visit the Vodacom.co.za

Step 2. Click “Get started” to begin your loan application.

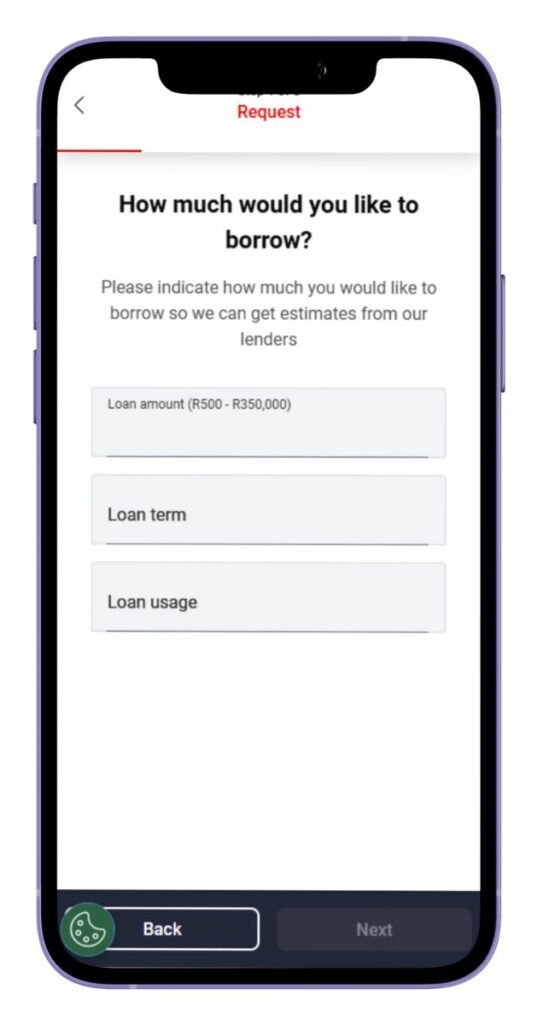

Step 3. Choose between “Short-term” or “Long-term” loan options.

Step 4. Select “Apply now” or “Quick quote” to proceed.

Step 5. Enter the loan amount, term, and usage details.

Step 6. Fill in your personal information and consent for a credit enquiry.

Step 7. Review your information and confirm to submit your loan application for review.

Step 8. Wait for a decision on your application, which typically takes just a few minutes.

Step 9. Once approved, the loan amount will be deposited directly into your bank account.

Eligibility Check

Vodacom offers straightforward tools and methods for checking eligibility for their VodaLend loans. Here are the available options:

- VodaPay App: The VodaPay app enables users to enter their details and receive a quick eligibility assessment based on income, credit score, and other relevant factors.

- Online Pre-Approval: On their website, users can complete a form with basic financial information to determine their likelihood of qualifying for a loan before submitting a full application.

- Credit and Affordability Assessment: During the loan application process, the lender automatically conducts a credit check and affordability assessment to ensure applicants meet the financial criteria.

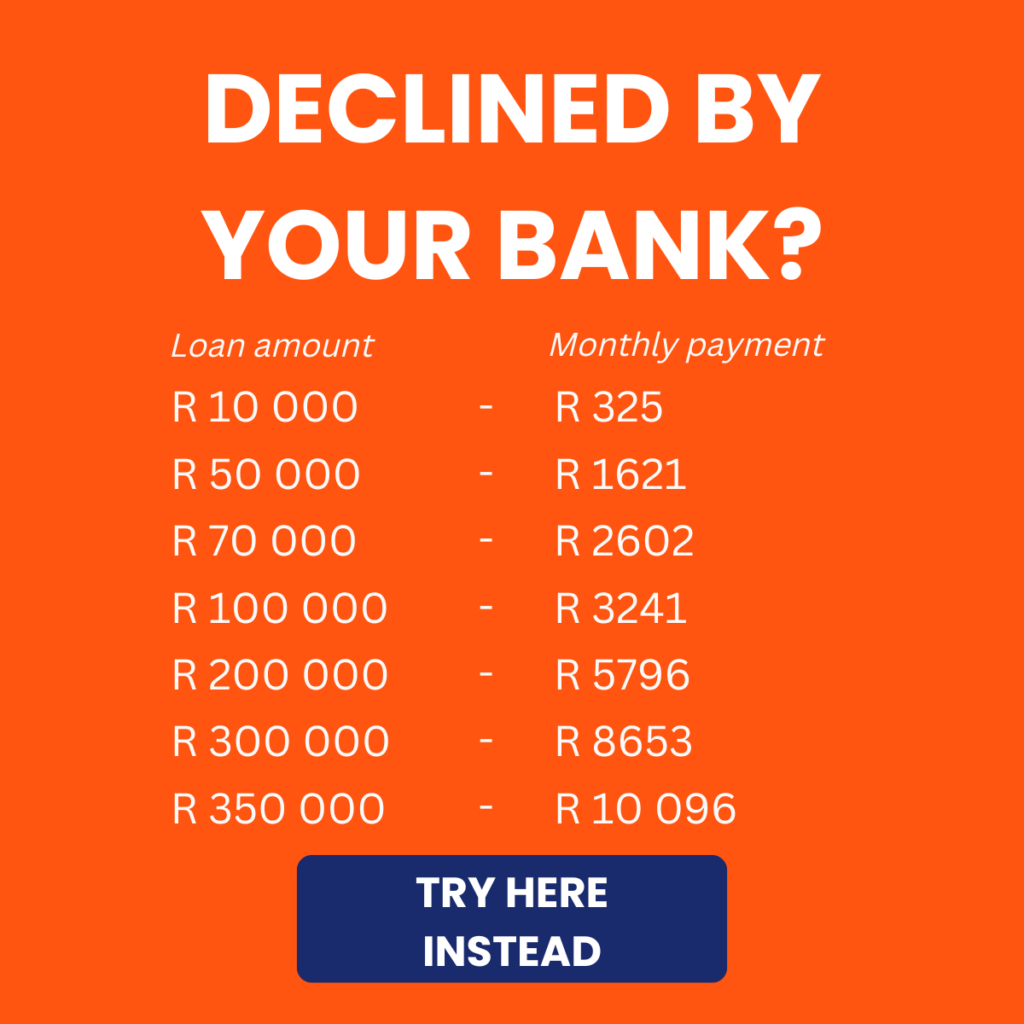

How Much Money Can I Request from Vodacom?

With Vodacom, you can request a personal loan ranging from a minimum of R500 to a maximum of R250,000. The specific amount you qualify for will depend on your income, credit score, and the affordability assessment conducted during the application process.

Receive Offers

Vodacom combines your personal financial data with a credit check to generate personalised loan offers. After providing details such as your income, employment status, and other essential information, this lender evaluates your application and presents loan offers tailored to your repayment capacity and credit risk profile. This approach ensures that the terms offered align with your financial situation.

How Long Does It Take to Receive My Money from Vodacom?

Once you submit your loan application and receive approval, the funds are usually deposited into your account within minutes. However, processing times may vary based on factors such as the accuracy of the information provided and the approval of your DebiCheck mandate, which is required for the loan disbursement. On average, applicants receive their funds within 10 to 15 minutes after approval.

The factors affecting withdrawal speed include:

- DebiCheck Mandate Approval: This must be verified before the funds are released.

- Bank Processing Delays: There may be slight delays in reflecting the funds in your account, depending on your bank.

- Verification of Documentation: Any delays in submitting the required documents (ID, payslip, bank statements) can slow down the process.

How Do I Repay My Loan from Vodacom?

This company provides flexible repayment options based on the loan terms you choose. Loan terms range from 3 to 72 months, allowing you to customise repayments according to your financial circumstances. Repayments are typically made through monthly debit orders linked to your bank account, ensuring a seamless process.

Possible fees and penalties include:

- Interest Charges: Interest rates range from 24% to 25% per annum, depending on your credit profile.

- Initiation Fees: An initiation fee of up to R1,050 (excluding VAT) is charged.

- Monthly Service Fees: A monthly administration fee of R60 (excluding VAT) applies.

- Late Payment Fees: Failing to make timely payments can result in additional penalties or increased interest charges.

Pros and Cons of Choosing Vodacom

Pros

- Fast Approval and Disbursement: Once your loan is approved, funds are typically deposited into your account within minutes, making it an excellent option for urgent financial needs.

- Flexible Repayment Terms: Customers can select repayment terms ranging from 3 to 72 months, providing flexibility in managing monthly payments.

- No Collateral Required: VodaLend offers unsecured loans, meaning no collateral is needed to qualify, which is beneficial for customers without assets.

- Early Repayment without Penalties: Customers can settle their loans early without incurring any additional fees, allowing for greater financial freedom.

- User-Friendly Application: Applications can be easily completed online through the VodaPay App or the Vodacom website, making the process convenient and accessible.

Cons

- High Interest Rates: Depending on your credit profile, interest rates can range from 24% to 25% per annum, which may be higher than those offered by some competitors.

- Unsecured Loan Only: Vodacom does not provide secured loan options, which means that loan amounts are typically capped at R250,000, limiting larger financial needs.

- Strict Eligibility Criteria: The affordability checks and credit score requirements may pose challenges for individuals with lower credit scores seeking to qualify.

- Additional Fees: The loan includes initiation fees, monthly service fees, and potential late payment penalties, which can increase the overall cost of borrowing.

Customer Service: Do You Have Further Questions for Vodacom?

If you have any questions about your loan application or need assistance, Vodacom offers several customer service options. You can access online support by reaching their team through live chat on the Vodacom website. Additionally, the VodaPay App allows you to manage your loan, track payments, and connect with customer service directly.

For more direct assistance, you can contact their financial services call centre at 086 010 2209. Vodacom’s customer service team is available to help with any queries, whether you need support with your loan application or guidance on your repayment options.

Vodacom Contact Channels

Phone number:

Customer Service Centre: 086 010 2209

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

Vodacom Corporate Park, 082 Vodacom Boulevard, Midrand, 1685, South Africa

Online Reviews of Vodacom

Customer reviews for Vodacom’s VodaLend services are mixed, with feedback mainly focusing on the loan approval process and customer service. Many customers appreciate the convenience and quick disbursement of funds once their loans are approved. Users have found the online application process to be straightforward, with prompt responses for smaller loan amounts.

However, some users express dissatisfaction, particularly regarding communication delays and issues encountered during the application process. Several customers have reported difficulties with the approval system, noting that the eligibility checks were unclear or that the outcomes of loan applications were not communicated effectively. Overall, while the service is convenient, there are concerns about the need for improvement in customer support and responsiveness.

Alternatives to Vodacom VodaLend

Several other credit comparison portals and lenders are available in South Africa, offering personal loan services similar to Vodacom VodaLend. Here are some popular alternatives:

Comparison Table

| Feature | Vodacom | Capitec Bank | African Bank | Nedbank | Ackermans | PEP Loans |

|---|---|---|---|---|---|---|

| Loan Type | Unsecured personal loans | Unsecured loans | Personal loans | Personal loans | Unsecured personal loans | Personal loans |

| Max Loan Amount | R250 000 | R250 000 | R350 000 | R300 000 | R50 000 | R50 000 |

| Approval Time | Within minutes (if eligible) | Within 48 hours | Same day approval | 1-2 days | Within 24 hours | Within 48 hours |

| Interest Rate | 24% – 25% per annum | Variable | Variable | Variable | Up to 5% monthly | 5% monthly or 24.5% annually |

| More Info | Capitec Review | African Bank Review | Nedbank Review | Ackermans Review | PEP Loans Review |

History and Background of Vodacom

Vodacom, one of South Africa’s leading telecommunications companies, has ventured into the financial services sector with the introduction of VodaLend. This loan service aligns with this lender’s goal of providing accessible and convenient financial products for both existing customers and those new to their services. In collaboration with prominent financial institutions such as Old Mutual, VodaLend offers a range of personal loans to assist individuals in managing unexpected expenses, consolidating debt, or fulfilling other financial obligations.

This loan provider is dedicated to empowering South Africans by delivering financial solutions that are readily available through digital platforms like the VodaPay app. Their focus is on promoting financial inclusion, particularly for individuals who are underbanked, ensuring they can effectively manage their financial responsibilities without unnecessary complications.

Conclusion

Vodacom offers a convenient and efficient service, especially for customers seeking quick, unsecured personal loans. Although the application process is straightforward, customer reviews indicate some challenges regarding communication and transparency in loan approval. For those willing to accept slightly higher interest rates, VodaLend can serve as a viable option for immediate financial solutions. However, alternatives such as Capitec or African Bank may provide more competitive rates and better customer service, depending on individual financial circumstances and loan requirements.

Frequently Asked Questions

You can apply for a loan of up to R250,000 through VodaLend. The specific amount you qualify for will depend on factors such as your income, credit score, and the results of your affordability assessment.

The approval process is typically fast, with funds potentially being disbursed within minutes after your application is approved. However, delays may occur due to document verification or other eligibility checks.

No, VodaLend provides unsecured personal loans, which means you do not need to offer any collateral to apply for or secure the loan.

You can apply for a loan through either their website or the VodaPay app. The application process involves entering your details, uploading the necessary documents, and submitting your application for review.

If you miss a loan payment, you may face late payment penalties and additional interest charges. It is important to keep track of your repayments to avoid incurring extra fees.