When it comes to choosing a loan, whether it’s for a new car, a dream home, or just managing those unexpected expenses, it’s crucial to find a lender that not only provides competitive rates but also understands your unique financial needs. Wesbank, a well-established name in South Africa’s financial landscape, has been catering to diverse financial requirements for years. This review dives deep into what Wesbank offers, especially focusing on its loan services.

Experiences with Wesbank

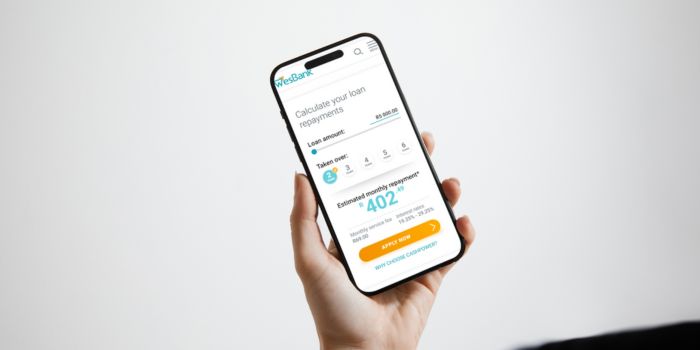

When it comes to borrowing from Wesbank, the experiences of customers can vary, but there’s a general trend towards satisfaction, particularly with their vehicle finance options. Many customers appreciate the straightforward application process and the clarity with which information is provided. One of the standout features often mentioned is Wesbank’s online calculator, which helps potential borrowers understand their likely repayments before they even apply. This tool is a hit for its user-friendliness and accuracy, giving customers a realistic expectation of their financial commitment.

However, it’s not all smooth sailing. Some customers have noted delays in the processing of their applications, especially during peak periods. This can be a bit of a setback for those needing quick approvals. On the customer service front, while many find Wesbank’s staff helpful and knowledgeable, there are instances where customers felt their queries weren’t resolved as quickly as they would have liked. It’s a mixed bag, but the overall sentiment leans towards a positive experience, particularly praised for their competitive interest rates and the variety of loan options available.

Who can apply for a Wesbank Loan?

Wesbank caters to a broad spectrum of borrowers, but like any financial institution, they have certain criteria that applicants need to meet. Generally, anyone who is over the age of 18, a resident of South Africa, and has a steady income can apply for a loan. This includes salaried individuals, self-employed professionals, and business owners. However, the key is not just having an income, but having a stable and sufficient income that can comfortably cover the loan repayments. Wesbank also requires applicants to have a good credit history, which means if you’ve been diligent with your finances, you’re more likely to get approved.

Criteria for Potential Borrowers

The criteria set by Wesbank for potential borrowers are fairly standard but worth noting. Firstly, a clear credit record is crucial. This means no defaults or a history of late payments. Your credit score plays a significant role in not just the approval of your loan, but also in the interest rate you’re offered. Secondly, proof of income is required. This is to ensure that you have the means to pay back the loan. For salaried individuals, recent payslips will do, while self-employed individuals might need to provide more detailed financial statements. Lastly, Wesbank will consider your existing financial obligations – like other loans or credit card debts – to assess your overall financial health.

Differences from Other Loan Providers

Wesbank sets itself apart from other loan providers in a few key ways. One of their most significant differentiators is their specialization in vehicle finance. They’re not just offering loans; they’re offering a tailored service that understands the nuances of financing a car, new or used. This specialization means they often have more competitive rates for vehicle loans compared to general personal loans from other banks.

Another difference is their approach to customer education and support. Wesbank’s website and their customer service team provide extensive information and guidance, helping customers make informed decisions. This level of support can be particularly beneficial for first-time borrowers who might find the world of finance daunting.

In terms of loan products, Wesbank offers a more personalized experience. They understand that not all borrowers are the same and therefore, offer more flexible terms and a variety of products to suit different needs. This flexibility and personalization make them stand out in a market that’s often seen as one-size-fits-all.

About Arcadia Finance

With Arcadia Finance, facilitate your loan sourcing from a range of banks and lenders. Just complete a free application and get options from up to 19 different lenders. All our partners are established, trustworthy lenders licensed by South Africa’s National Credit Regulator.

What Makes Wesbank Unique

Wesbank stands out in the South African financial services sector for several reasons. Firstly, their deep specialization in vehicle finance, which has been honed over decades, gives them an edge in understanding the automotive market’s nuances and customer needs. This expertise translates into tailored loan products, competitive interest rates, and a smoother approval process for car loans.

Another unique aspect of Wesbank is their commitment to technology and innovation. Their user-friendly online tools, like the loan calculator and the streamlined online application process, make it easy for customers to access services from the comfort of their homes. This focus on digital solutions caters to a growing segment of tech-savvy consumers who prefer online transactions.

Wesbank’s approach to customer education sets them apart. They provide extensive resources and guides to help customers understand the ins and outs of various financial products and services. This commitment to empowering customers with knowledge underscores their role as more than just a lender; they’re a partner in their customers’ financial journeys.

Advantages of Wesbank Compared

When compared to other financial institutions in South Africa, Wesbank boasts several advantages:

- Specialised Vehicle Finance: Wesbank’s longstanding focus on vehicle finance positions them as offering some of the most competitive rates and terms in this sector.

- Comprehensive Loan Range: In addition to car loans, Wesbank provides a variety of loan products, catering to a wide range of needs.

- Innovative Digital Tools: Wesbank stands out with its online loan calculator and application process, offering convenience and ease, thereby saving time and effort for customers.

- Customer Education and Support: Wesbank is committed to customer education through resources and knowledgeable staff, aiding customers in making informed financial decisions.

Types of Loans Offered by Wesbank

Personal Loans

Wesbank’s personal loans are unsecured, meaning they don’t require any collateral. These loans can be used for various purposes, from consolidating debt to funding a wedding. Ideal for immediate cash needs like home renovations, travel, or covering unexpected expenses.

Vehicle Finance

This flagship product offers loans for new and used vehicles. Wesbank provides finance options for private and commercial purchases. Specifically designed for buying cars, motorcycles, or commercial vehicles, whether from a dealer or a private seller.

Asset Finance

Asset finance aims to help businesses acquire equipment and machinery without paying the full price upfront. Useful for businesses looking to expand operations or upgrade their equipment, including heavy machinery, office equipment, or commercial vehicles.

Wesbank’s diverse range of loan products caters to a wide spectrum of needs, from individual borrowers to businesses. Their unique strengths in vehicle finance, coupled with innovative digital tools and a focus on customer education, make them a standout choice in the South African financial services market. Whether it’s a personal loan for a family holiday or a business loan for a new fleet of trucks, Wesbank’s tailored solutions and expert guidance ensure that their customers’ financial needs are well taken care of.

Simulation of a Loan at Wesbank

To apply for a loan with Wesbank, follow these steps:

- Eligibility Check: Before applying, ensure that you meet the eligibility criteria for a Wesbank loan. This usually involves age, income, credit history, and residency requirements.

- Loan Simulation: Use the loan simulation tool on the Wesbank website to get an estimate of the loan amount you may qualify for and the expected repayment terms. This can be found on their CashPower Personal Loans page.

- Document Preparation: Gather necessary documents such as proof of income, identification, and any other required paperwork. The specific documents needed will be listed on the Wesbank website or can be obtained by contacting their customer service.

- Application Submission: Submit your loan application. This can usually be done online through the Wesbank website. Navigate to the application page for detailed instructions and the online application form.

- Loan Review and Approval: Once submitted, Wesbank will review your application. This process includes a credit check and assessment of your financial situation.

- Loan Offer and Acceptance: If approved, Wesbank will provide you with a loan offer, detailing the amount, interest rate, and repayment terms. Review this offer carefully, and if acceptable, accept the terms to proceed.

- Disbursement of Funds: After acceptance, the loan amount will be disbursed into your account. The time frame for disbursement can vary and will be communicated by Wesbank.

- Repayment: Begin repaying the loan according to the agreed schedule. Ensure timely payments to avoid any penalties or negative impacts on your credit score.

Security and Privacy at Wesbank

In today’s digital age, the security and privacy of personal and financial information have become paramount. Wesbank recognizes this importance and has implemented robust measures to ensure that their customers’ data is protected at all times.

Ensuring Security of Personal and Financial Information

Wesbank employs a multi-layered approach to security. At the forefront is their use of advanced encryption technologies. When you access their online platforms, whether it’s to check your loan status or make a payment, your data is encrypted using industry-standard protocols. This ensures that any information transmitted between your device and Wesbank’s servers remains confidential and cannot be intercepted by malicious actors.

Wesbank has invested in state-of-the-art cybersecurity infrastructure to protect against potential threats. This includes firewalls, intrusion detection systems, and regular security audits. Their IT teams continuously monitor for any suspicious activities, ensuring that potential breaches are identified and addressed promptly.

Beyond the digital realm, Wesbank also takes physical security seriously. Their data centers, where critical customer information is stored, are equipped with advanced security measures. This includes 24/7 surveillance, biometric access controls, and regular security assessments to ensure that data remains safe from both digital and physical threats.

Privacy Policies and Data Handling Practices

Wesbank’s commitment to privacy is evident in its comprehensive privacy policy. This policy outlines how they collect, use, and store customer information. It’s crafted with transparency in mind, ensuring that customers are fully aware of how their data is handled.

Key aspects of Wesbank’s privacy policy include

Data Collection: Wesbank is clear about the types of data they collect. This typically includes personal details required for loan processing, such as name, address, and financial information. They also detail the reasons for collecting such data, ensuring there’s no ambiguity.

Data Usage: Wesbank uses customer data primarily for processing loan applications, managing accounts, and providing tailored financial services. They are explicit in stating that they do not sell customer data to third parties for marketing purposes.

Data Retention: Wesbank retains customer data only for as long as it’s necessary. This duration is typically dictated by regulatory requirements and the operational needs of the bank. Once data is no longer needed, it’s securely disposed of.

Data Sharing: While Wesbank does not sell customer data, there are instances where data might be shared with third parties. This is usually for operational purposes, such as credit checks. In such cases, Wesbank ensures that these third parties adhere to strict data protection standards.

Customers are also given control over their data. They have the right to access, modify, or even request the deletion of their data, in line with data protection regulations.

How Much Money Can I Request from Wesbank?

When considering a loan from Wesbank, it’s essential to understand both the minimum and maximum amounts you can request. These amounts can vary depending on the type of loan you’re applying for.

Minimum and Maximum Amounts

For personal loans, Wesbank typically offers loans starting from a minimum amount that can be as low as a few thousand Rand, suitable for covering smaller expenses or emergencies. On the higher end, the maximum loan amount can extend to several hundred thousand Rand, catering to more significant needs like home renovations or major purchases.

In the case of vehicle finance, the loan amount is generally higher, given the nature of the purchase. It’s tailored to the price of the vehicle, which means the maximum can go up substantially, often matching the value of new or used cars on the market.

Receiving Offers

Wesbank creates personalized loan offers based on several factors, including your credit history, income, and existing financial obligations. This personalization ensures that the loan offer you receive is tailored to your financial situation, helping you to borrow within your means and avoid overextending your finances.

How Long Does It Take to Receive My Money from Wesbank?

Average Processing Times

The time it takes to receive your money after applying for a loan with Wesbank can vary. On average, once your loan application is approved, the funds can be disbursed within a few business days. However, this timeline can be shorter or longer depending on various factors.

Factors Affecting Withdrawal Speed

Several factors can influence how quickly you receive your loan from Wesbank:

- Application Accuracy and Completeness: If your application is filled out accurately and all required documents are provided promptly, the processing can be quicker. Incomplete applications or missing documents can lead to delays.

- Type of Loan: Different types of loans may have different processing times. For instance, personal loans might be processed quicker than more complex loans like vehicle finance, which might require additional checks and verifications.

- Credit and Background Checks: The time it takes to perform credit and background checks can affect the overall processing time. If there are any issues or discrepancies in your credit history, this might prolong the process.

- Internal Processing: Each loan application goes through an internal review process at Wesbank, which includes the assessment of your financial stability and risk. The efficiency of these internal processes can also impact how quickly you receive your funds.

Repaying Your Loan from Wesbank

Repayment Options and Plans

Repaying a loan from Wesbank is designed to be as convenient and flexible as possible, with several options available to suit different financial situations. Typically, loan repayments are made monthly via direct debit from your bank account, ensuring that payments are consistent and on time. This method helps in managing your budget and ensures that you don’t miss any payments, which could lead to penalties.

Wesbank also offers different repayment plans. You can choose a plan with a term that suits your financial situation. Shorter loan terms generally have higher monthly payments but lower total interest, while longer terms spread out the payments but might incur more interest over time. Some loan products may allow for more flexibility, such as making additional payments or paying off the loan early without penalties, though this can vary depending on the specific terms and conditions of your loan.

Possible Fees and Penalties

It’s crucial to be aware of any fees and penalties that might be associated with your loan. Wesbank, like most lenders, charges fees for certain services or in the event of non-compliance with the loan terms. These can include initiation fees, service fees, and possibly early settlement charges if you decide to pay off your loan earlier than the agreed term.

Late payment penalties are another important consideration. If you miss a payment, you might be charged a late payment fee, and this could also impact your credit score. It’s always best to contact Wesbank directly if you’re facing financial difficulties that might affect your ability to make timely payments. They may be able to offer solutions or alternative arrangements to help manage your repayments more effectively.

Online Reviews of Wesbank

Online reviews provide valuable insights into the experiences of Wesbank customers. While individual experiences can vary, several common themes often emerge in customer feedback.

Positive Reviews

Many customers praise Wesbank for their efficient processing and approval times, especially in terms of vehicle finance. The ease of application and the helpfulness of the staff are frequently highlighted. Customers also appreciate the competitive interest rates and the variety of loan options available, allowing them to find a product that suits their specific needs.

Negative Reviews

On the other hand, some customers have expressed dissatisfaction, particularly regarding customer service experiences. Issues such as delayed responses to queries or difficulties in reaching the right department for assistance are occasionally mentioned. Additionally, some customers have faced challenges with the administrative or paperwork aspects of their loans, leading to frustration.

Customer Service at Wesbank

Customer service is a crucial aspect of any financial service provider, and Wesbank places significant emphasis on ensuring their customers receive adequate support. They offer various channels through which customers can get in touch, including phone support, email, and online chat options. For more direct assistance, customers can also visit physical branches or arrange face-to-face meetings with financial advisors.

Wesbank’s customer service is geared towards providing detailed and helpful responses to queries, whether it’s about loan applications, repayment plans, or general account management. They also have a comprehensive FAQ section on their website, covering a wide range of topics that can quickly address common concerns and questions.

Do You Have Further Questions for Wesbank?

If you have specific questions or need personalized advice, reaching out to Wesbank directly is the best course of action. You can contact their customer service team via the contact details provided on their website. For more complex issues or detailed financial guidance, it might be beneficial to schedule a consultation with one of their advisors.

Alternatives to Wesbank

When considering loans, it’s always wise to explore multiple options to ensure you find the best fit for your financial needs. South Africa has a variety of financial institutions and credit comparison portals that offer competitive loan products.

Comparison Table

To give you a clearer idea, here’s a simplified comparison table that outlines how Wesbank stacks up against other popular lenders:

| Lender | Loan Amount Range | Interest Rates (p.a.) | Repayment Period |

|---|---|---|---|

| Wesbank | R5,000 – R300,000 | 19.25% – 29.25% | 24 – 72 months |

| FinChoice | Up to R40,000 | From 24% | Up to 24 months |

| Capfin Loans | Up to R50,000 | Up to 29.25% | Up to 12 months |

| ABSA | Up to R350,000 | From 17.5% | Up to 84 months |

| Boodle | Up to R8,000 | Up to 60% | Up to 6 months |

| Vecto Finance | Up to R15,000 | From 26.9% to 28% | 6 to 18 months |

This table provides an overview of the different loan options available from these lenders, including the range of loan amounts, interest rates, and repayment periods. It’s important to remember that the actual terms you receive will depend on your individual financial situation and creditworthiness. For the most accurate and up-to-date information, it’s recommended to contact the lenders directly or visit their websites.

History and Background of Wesbank

Brief History and Establishment

Wesbank, a division of FirstRand Bank Limited, has a rich history dating back to 1970. Over the decades, it has established itself as a leading provider of vehicle and asset finance in South Africa. The company started with a focus on vehicle finance and has since expanded its offerings to include personal and business finance solutions, catering to a wide range of financial needs.

Company’s Mission and Vision

Wesbank’s mission and vision revolve around providing innovative and accessible financial solutions to its customers. They aim to be a trusted partner in helping individuals and businesses achieve their financial goals, emphasizing responsible lending and customer-centric services. Their vision includes being at the forefront of the financial services industry, adapting to changing market dynamics and customer needs.

Pros and Cons of Wesbank

Pros

- Specialization in Vehicle Finance: Wesbank is highly regarded for its expertise in vehicle finance, offering tailored solutions with competitive rates.

- Comprehensive Customer Service: With various channels for support and assistance, Wesbank stands out in customer service.

- Flexible Loan Products: Their range of loan products, including personal and asset finance, caters to diverse customer needs.

Cons

- Processing Times: Some customers have reported longer processing times, particularly during peak periods.

- Limited Global Presence: As a primarily South African institution, their services are more focused locally, which might not suit those looking for international financial services.

- Customer Service Variability: While generally strong, customer service experiences can vary, with some reports of delays or less satisfactory interactions.

As with any financial institution, individual experiences may vary, and it’s advisable to consider these factors when making financial decisions.

Conclusion

Wesbank, leveraging its extensive experience, especially in vehicle finance, emerges as a reliable and knowledgeable lender in the South African market. Their diverse range of products and commitment to customer service are commendable. However, as with any financial institution, there are areas where improvement is needed, notably in processing efficiency and consistency in customer service quality. Potential borrowers should carefully consider these factors alongside their personal financial needs and circumstances when deciding if Wesbank is the right choice for them.

Frequently Asked Questions about Wesbank

Wesbank offers a range of loan products, including vehicle finance, personal loans, and asset finance.

You can apply for a loan through Wesbank’s online platform, by phone, or by visiting one of their branches.

Wesbank’s interest rates are competitive, particularly in vehicle finance, but they vary based on the loan type and the borrower’s credit profile.

Yes, you can pay off your loan early, though it’s best to check if any early settlement fees apply.

Approval times can vary, but some customers have reported experiencing delays, particularly during peak periods.