Wonga [Wonga.co.za] is a prominent online lender offering quick and convenient short-term loans, promising fast approval and minimal paperwork – It has emerged as a key player in South Africa’s lending market. This review delves deep into Wonga’s offerings, dissecting every aspect from their loan products to customer service, ensuring you have all the information at your fingertips. Whether you’re considering a short-term loan to tide over an emergency or just curious about what this lender has to offer, this article aims to guide, inform, and help you make a well-informed decision.

Wonga offers personal loans ranging from R500 to R8 000 for returning customers, with repayment terms extending up to six months. New customers can apply for up to R4 000, repayable over a maximum of three months. If this sounds like a good deal, keep reading to find out everything you need to know about this lender and whether they’re the right option for you.

Wonga: Quick Overview

Loan amount: R500 – R8 000 (new customers up to R4 000)

Loan term: 4 days to 6 months

Interest rate: Up to 5% per month, regulated by NCR

Fees: Initiation fee and service fees included in total loan cost, displayed upfront

Loan types: Short-term personal loans

About Arcadia Finance

Arcadia Finance streamlines the loan acquisition journey, allowing clients to apply for free and receive offers from up to 19 diverse lenders. We partner exclusively with reputable, NCR-licensed lenders in South Africa, ensuring trust and reliability in your financial dealings.

Wonga Full Review

Wonga has been a prominent player in the South African short-term loan market, and its users often highlight several key aspects of their experience. The most frequently mentioned is the speed of service. Wonga’s online application process is streamlined, allowing customers to apply for loans quickly and receive decisions in a short time. This rapid turnaround is particularly appreciated by those in urgent need of funds.

Another aspect often praised is the transparency of their loan terms. Borrowers appreciate being able to see upfront the total cost of their loan, including interest and any fees, without any hidden charges. This transparency helps customers make more informed decisions and builds trust.

However, experiences aren’t universally positive. Some users have pointed out that the interest rates can be higher compared to traditional bank loans, which might not make Wonga the best choice for everyone. Additionally, while they offer flexibility in terms of loan amounts and repayment periods, this flexibility can also lead to borrowers opting for larger loans than necessary, potentially leading to repayment challenges.

Who Can Apply for a Wonga Loan?

Wonga’s target market is extensive, reaching out to anyone over the age of 18 who is a resident of South Africa. The primary requirement is a steady income, whether from employment or other consistent sources. This inclusivity makes their loans accessible to a broad spectrum of borrowers, including those who might not have access to traditional banking services.

Criteria for Potential Borrowers

To qualify for a their loan, applicants must meet specific criteria:

- Age and Residency: Applicants must be at least 18 years old and a resident of South Africa.

- Income: A steady income is crucial. This doesn’t necessarily mean a traditional job; it can include regular earnings from other sources.

- Bank Account and Mobile Phone: A valid South African bank account and a mobile phone number are required for the application.

- Credit History: This company will conduct a credit check. While they cater to a range of credit histories, a severely negative credit history might affect loan approval.

Differences from Other Loan Providers

Wonga stands out in several ways from other loan providers in South Africa. Firstly, their entire application process is online, making it convenient and accessible 24/7. This digital approach is a significant shift from the traditional, paperwork-heavy loan application processes of many banks.

Secondly, their flexibility in loan amounts and repayment terms is notable. Borrowers can choose exactly how much they want to borrow and for how long, within the given limits. This level of customization isn’t always available with other lenders, especially traditional banks that often have pre-set loan products.

Lastly, their approach to transparency and customer education is commendable. Their website and loan application process are designed to inform borrowers clearly about the cost of borrowing, repayment obligations, and any potential risks. This focus on education and transparency is a refreshing change in an industry often criticized for hidden fees and complex terms.

Wonga Loan: What Makes It Unique?

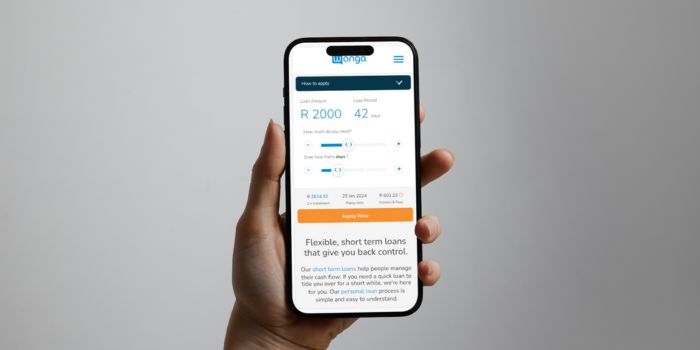

Wonga’s uniqueness in the South African loan market is primarily due to its approach to lending. Unlike traditional banks, this lender operates entirely online, offering a user-friendly, efficient, and fast service. This digital-first approach means that borrowers can apply for a loan from anywhere, at any time, without the need for physical paperwork or in-person visits to a bank branch.

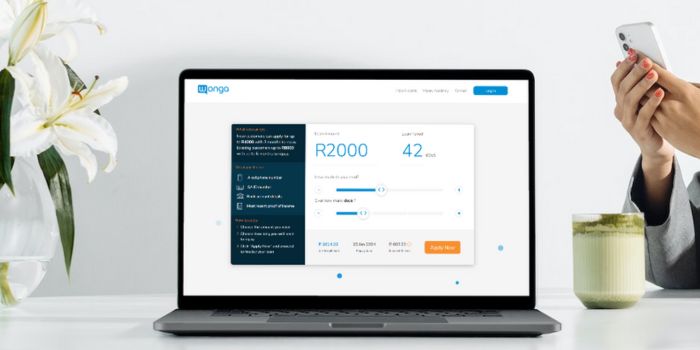

Another unique aspect of it is its transparent pricing structure. Borrowers can see the total cost of their loan upfront, including interest and fees, using an easy-to-understand calculator on their website. This level of transparency is a significant departure from the often complex and opaque pricing structures seen in the traditional lending sector.

Additionally, they caters to a wide range of borrowers, including those who might not have perfect credit histories. Their focus isn’t solely on the credit score but on the current affordability and financial behavior of the applicant. This inclusive approach opens doors for many who might otherwise struggle to secure funding.

Advantages of Wonga Compared to Others

- Speed and Convenience: The online application process is quick, straightforward, and can be completed in minutes.

- Flexible Loan Amounts and Terms: Borrowers have the freedom to choose how much they borrow and for how long, within the lender’s limits.

- Transparency: All costs are displayed upfront, with no hidden fees.

- Accessibility: Even those with less-than-perfect credit histories may be eligible for a loan.

Types of Loans Offered by Wonga

Wonga primarily focuses on short-term, personal loans. These loans are designed to help cover unexpected expenses or bridge a temporary gap in finances. They are not typically suited for long-term financial needs like home loans or auto loans.

Short-Term Loans

These loans are ideal for immediate, short-term funding needs, such as emergency expenses or unexpected bills. The loan amount is usually smaller, with a shorter repayment period.

Personal Loans

While still relatively short-term, these loans offer slightly larger amounts than typical payday loans and are suitable for covering more significant expenses like minor home repairs or essential appliance purchases.

Who Is Wonga Best For?

It is best for borrowers who:

- Need Small, Short-Term Loans

- Prefer a Fully Online Application Process

- Require Fast Loan Approval

- Want Transparent Loan Terms

- Have a Less-Than-Perfect Credit History

Is Wonga a Safe and Good Option?

Wonga is a registered South African lender regulated by the National Credit Regulator (NCR), specialising in short-term personal loans. New customers can apply for loans up to R4 000, while returning customers may borrow up to R8 000, with repayment terms ranging from 4 days to 6 months. The fully online application process requires a South African ID, proof of income, and a bank account for verification.

This lender focuses on transparency, ensuring borrowers see the total cost of their loan upfront, including interest and fees. Loan approvals are subject to affordability assessments and credit checks, but this company aims for fast processing times, often providing same-day payouts. This makes it a practical choice for borrowers needing quick, regulated financial assistance.

Requirements for a Wonga Loan

Applying for a loan with this lender requires meeting certain criteria and providing specific documentation. This process is designed to be straightforward, ensuring that potential borrowers can quickly understand what’s needed and whether they’re eligible.

To apply for their loan, you’ll typically need the following:

- Personal Identification: A valid South African ID document or Smart ID card.

- Proof of Income: Recent payslips or bank statements showing a steady income.

- Bank Details: Details of your active South African bank account where your salary is deposited.

- Contact Information: A valid South African mobile phone number and email address.

These documents help them assess your financial situation, ensuring that the loan is affordable for you and reducing the risk of financial strain.

Step-by-Step Guide to Applying for a Loan with Wonga

Step 1. Go to Wonga.co.za

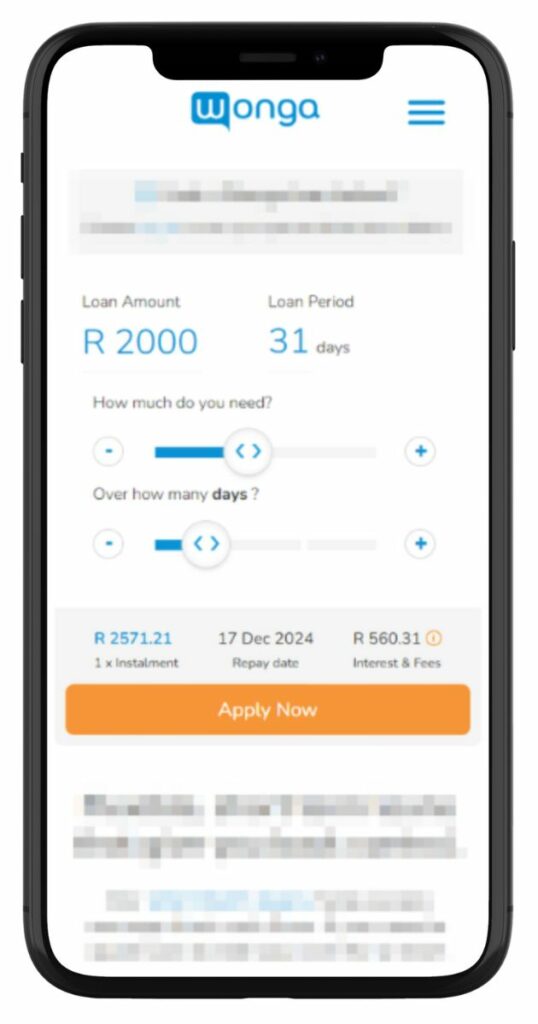

Step 2. Choose your desired loan amount and loan period, and check the repayment amount, date, and fees.

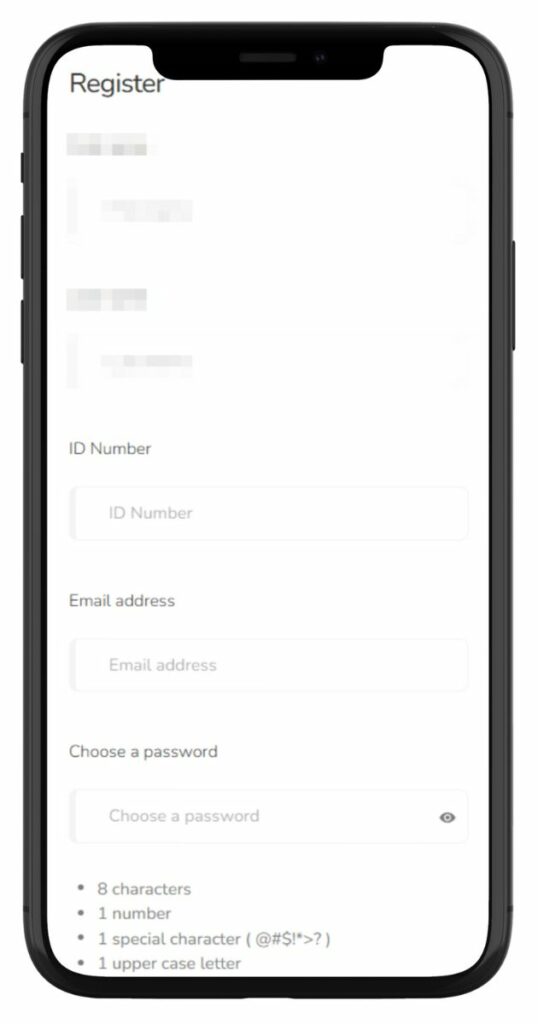

Step 3. Enter your first and last name in the registration form.

Step 4. Provide your ID number, email address, and create a strong password following the password criteria.

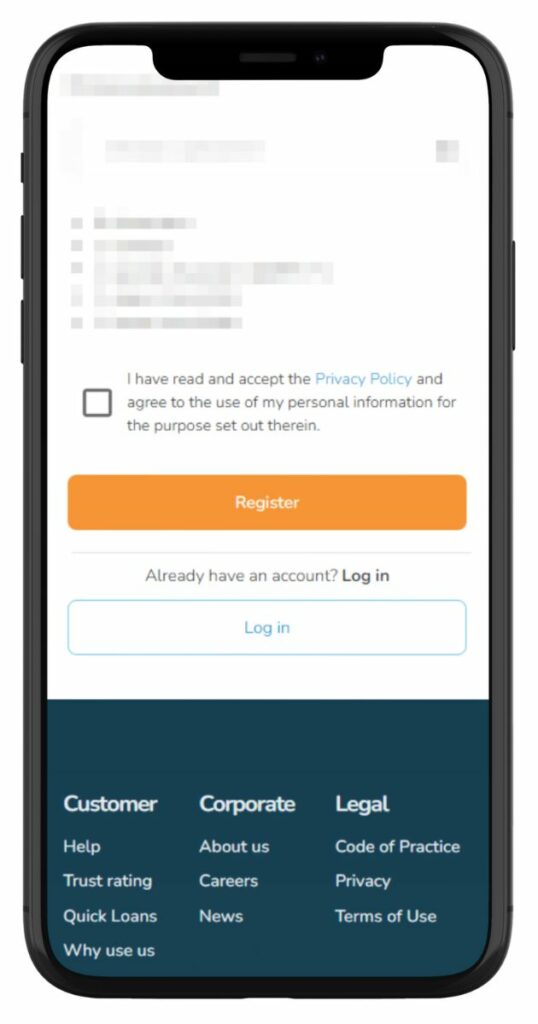

Step 5. Agree to the Privacy Policy, and tap “Register” to complete your application. Use the “Log in” option if registered.

Step 6. Enter additional personal and financial details.

Step 7. Double-check all information for accuracy.

Step 8. Click “Apply Now” to send your application.

Step 9. Wait for loan approval confirmation.

Step 10. Funds will be transferred upon approval.

Eligibility Check

Wonga provides several methods to help potential borrowers pre-check their eligibility:

- Online Loan Calculator: Before applying, use the loan calculator to see if the amount you wish to borrow aligns with your repayment capabilities.

- FAQ and Guidance: Their website includes a comprehensive FAQ section and guides that outline the basic requirements and eligibility criteria for a loan.

- Customer Support: If you’re unsure about your eligibility, you can contact their customer support for assistance and clarification.

Security and Privacy at Wonga

Ensuring Security of Personal and Financial Information

Wonga places a high priority on the security of its customers’ personal and financial information. In today’s digital age, where data breaches and online fraud are significant concerns, they adopt robust security measures to protect sensitive data. They employ advanced encryption technologies to safeguard the data transmitted between your device and their servers. This means that when you input your personal and financial details on their website, the information is encrypted, making it extremely difficult for unauthorized parties to intercept or access your data.

Their internal systems and applications are designed with security in mind, regularly updated to tackle new and emerging security threats. Their commitment to security extends beyond digital measures. They have strict policies and protocols in place for their staff, ensuring that your information is handled responsibly and only accessed by authorized personnel for legitimate business purposes.

Privacy Policies and Data Handling Practices

Wonga.co.za’s approach to privacy and data handling is transparent and user-focused. They understand the importance of privacy in financial dealings and are committed to handling customer data with the utmost care and respect. Their privacy policy, available on their website, outlines how they collect, use, store, and protect customer information.

This policy explains that personal data collected during the loan application process is used primarily to assess loan eligibility, manage the loan, and communicate with customers. They also emphasize their compliance with relevant data protection laws, ensuring that they meet legal standards for data privacy and protection.

This lender is clear about not sharing customer information with third parties without consent, except as required by law or as necessary to provide their services. This includes not selling personal data to marketers or other businesses. Customers are also given choices about how their information is used, with options to opt-out of certain types of data processing or marketing communications.

Loan Amounts Available from Wonga

The company provides an online platform where new customers can apply for loans up to R4 000, repayable over a maximum of three months, while returning customers may borrow up to R8 000 with repayment terms extending up to six months.

This lender stands out for its personalized approach to lending. Rather than a one-size-fits-all model, they create loan offers tailored to the individual’s financial situation and borrowing history. This customization ensures that the loan amount offered aligns with what the borrower can reasonably afford to repay, thereby promoting responsible lending practices. The final offer might depend on various factors, including credit score, income, and existing financial commitments.

Receiving Funds from Wonga

Average Processing Times

One of the key advantages of choosing Wonga is the speed at which they process loans. After completing the application and receiving approval, the disbursement of funds is typically swift. While exact times can vary, this company often prides itself on processing and transferring funds within a short timeframe, sometimes within the same day of the loan approval.

Factors Affecting Withdrawal Speed

Several factors can influence how quickly you receive your money:

- Time of Application: Applications submitted during business hours and on weekdays tend to be processed faster. Applications made over weekends or public holidays might face slight delays.

- Verification Process: The speed of the verification process for your documents and details can affect the overall processing time. Accurate and readily verifiable information can expedite this process.

- Banking Systems: The transfer speed can also depend on the banking systems involved. Some banks might process incoming transfers quicker than others.

Wonga Loan – Loan Overview

| Aspect | Details |

|---|---|

| Financial Institution | Privately Owned & Registered Credit Provider |

| Product | Short-term, unsecured personal loans |

| Minimum age | 18 years |

| Minimum amount | R500 |

| Maximum amount | R8 000 for existing customers |

| Minimum term | 4 days |

| Maximum term | 6 months |

| APR | Up to 5% per month |

| Monthly Interest Rate | Calculated based on loan amount and duration |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific financial circumstances |

| NCR Accredited | Yes |

| Our Opinion | ✔️ Fast approval process ✔️ Transparent cost structure ⚠️ High fees compared to other lenders ⚠️ Potential negative impact on credit score for missed payments |

| User Opinion | ✔️ Convenient and quick online application process ⚠️ Poor customer service with difficulties reaching representatives. ⚠️Lack of transparency leading to unexpected fees and charges. |

Repaying a Loan from Wonga

Repaying a loan from Wonga is designed to be as straightforward as the borrowing process. They typically set up a direct debit to collect repayments from the borrower’s bank account on the agreed dates. This automatic process ensures that payments are made on time, reducing the risk of late payments. Borrowers are advised to ensure they have sufficient funds in their account on the due dates to avoid any issues.

This lender also allows for flexibility in the repayment schedule. If a borrower finds they are able to repay their loan earlier than the scheduled date, they can do so without incurring additional fees for early repayment. This flexibility can be beneficial for those who wish to reduce their interest charges by settling the loan ahead of time.

Possible Fees and Penalties

It’s crucial for borrowers to understand the potential fees and penalties associated with their loan. Late payment fees may apply if borrowers fail to make their repayments on time. These fees can add up and increase the total cost of the loan. Additionally, missed payments can affect the borrower’s credit score, making it more challenging to obtain credit in the future.

This company emphasizes transparency in their fee structure, with all potential costs clearly outlined in the loan agreement. Borrowers are encouraged to read and understand these terms thoroughly before accepting the loan to avoid any surprises during the repayment phase.

Online Reviews of Wonga

Online reviews and customer testimonials provide valuable insights into the real-world experiences of Wonga borrowers. Generally, customers appreciate the ease and speed of the application process, noting how quick and simple it is to apply for and receive a loan. The clarity and upfront nature of the loan terms and fees are also frequently commended, with borrowers valuing the transparency provided by this lender.

However, some reviews point out the higher interest rates and fees compared to traditional bank loans. This aspect is often mentioned by customers who advise potential borrowers to consider the total cost of the loan when making their decision.

Another common theme in customer reviews is the quality of customer service. Many borrowers report positive interactions with this lender’s customer support team, highlighting their helpfulness and professionalism in addressing queries and concerns.

What Customers Say About Wonga

Great payday loans available to suit your pocket. Excellent service and friendly staff.

I have been using Wonga for more than 2 years. They are fast, efficient and pay out is same day you apply.

We had a client take our details and apply for a loan… these people are cons don’t fall for this scam you’re just getting yourself into trouble.

We had a client take our details and apply for a loan… these people are cons don’t fall for this scam you’re just getting yourself into trouble.

Customer Service at Wonga

Wonga’s approach to customer service is an integral part of their offering, focusing on accessibility and helpfulness. They provide several channels through which customers can reach out for support or with queries. This includes a dedicated customer service phone line, email support, and a comprehensive FAQ section on their website. Their customer service team is noted for being responsive and knowledgeable, ready to assist with any questions related to loan applications, repayment, and any issues that may arise during the loan term.

Contact Channels

Phone number:

Office: 0861 966 421

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturdays: 08:30 – 12:00

Postal address:

South Africa, Unit 204, 2nd Floor, Cape Quarter, 27 Somerset Road, Green Point, Cape Town, 8001, South Africa

For borrowers or potential customers who have further questions, Wonga encourages direct contact through their official channels. Whether it’s a query about how to apply, clarification on fees and charges, or guidance on choosing the right loan product, their team is prepared to provide detailed and clear answers. This direct line of communication ensures that customers can make informed decisions and feel supported throughout their borrowing journey.

Alternatives to Wonga

While Wonga.co.za is a popular choice for short-term loans in South Africa, there are several other options available in the market. This comparison can help potential borrowers find a loan that best fits their needs and financial situation.

A Side-by-Side Comparison of Wonga with Top Competitors

| Provider | Loan Amounts | Repayment Terms | Application Process | Unique Features |

|---|---|---|---|---|

| Wonga | R500 – R4 000 | Short-term, typically up to a month | Fast, flexible, and 100% online | Quick processing, no branch visits, transparent fees |

| Capfin | Up to R50 000 | Varies, with options for longer terms | Online application with a chance to win daily cash prizes | Larger loan amounts, daily winner of R10 000 |

| FNB | Varies | Varies | Comprehensive banking services including loans | Wide range of banking and lending services |

| LendPlus | R500 – R4 000 | 5 – 41 days | Online application | Quick processing within 1 hour |

| Blink Finance | Up to R8 000 | Short-term | 100% online application | Online and instant short-term loans |

| Izwe | Up to 250 000 | Up to 72 months | Online application | Quick and paperless application process |

| Dial Direct | R1 000 – R150 000 | 12 to 60 months | Online, quick decision, money within 24 hours | Flexible repayment options, fixed monthly repayments, optional Customer Protection Insurance, interest from as low as 15% |

History and Background of Wonga

Brief History and Establishment

Wonga was established with the aim of providing quick and easy short-term loan solutions to individuals. Since its inception, the company has focused on using technology to revolutionize the traditional lending process, making it more user-friendly, faster, and more accessible to a broad spectrum of borrowers.

Company’s Mission and Vision

This compmany’s mission has been to offer transparent, responsible, and efficient financial services. Their vision revolves around simplifying the borrowing process, using innovative technology to provide instant financial solutions, and maintaining transparency and customer trust.

Pros and Cons of Wonga

Pros of Wonga

- Speed and Convenience: Their application process is quick, easy, and entirely online, making it convenient for users.

- Transparency: Fees and interest rates are clearly stated upfront, providing borrowers with a clear understanding of the cost of their loan.

- Flexibility: Offers flexibility in terms of loan amounts and repayment periods, tailored to the borrower’s needs.

Cons of Wonga

- Interest Rates: The interest rates can be higher compared to traditional bank loans, particularly for longer-term borrowing.

- Loan Amounts: Maximum loan amounts might be lower than what can be obtained from traditional banks, limiting the suitability for those needing larger loans.

- Target Audience: Primarily focused on short-term lending, which might not be ideal for those seeking long-term financial solutions.

Conclusion

Wonga has established itself as a key player in the South African short-term loan market, known for its quick, transparent, and flexible lending services. While it offers several advantages like speed, transparency, and user-friendly technology, potential borrowers should also consider the higher interest rates and the short-term nature of its loan products. This lender is best suited for those in need of quick, short-term financial assistance and who are comfortable with the associated costs.

Frequently Asked Questions about Wonga

Wonga prides itself on its quick processing times, often providing loan decisions and funding within the same day of application.

They are known for their transparency, with all fees and charges clearly outlined upfront during the application process.

Yes, they allow early repayment of loans without any additional fees, potentially saving on interest costs.

This lender specializes in short-term loans, so it might not be the best option for those seeking long-term financial solutions.

Missing a repayment can result in additional fees and negatively impact your credit score. It’s important to contact their customer service team immediately if you anticipate difficulty in meeting your repayment obligations.