YourLoan24 is a South African lender that provides quick and accessible personal loans to meet a range of financial needs. With a simplified application process and flexible terms, YourLoan24 is tailored for individuals seeking short-term financial assistance. This review will offer an in-depth analysis of its loan options, eligibility criteria, repayment terms, and overall suitability for South African borrowers, helping you determine if it aligns with your financial needs.

YourLoan24 – Loan Overview

| Name | YourLoan24 |

| Financial | Privately Owned & Registered Credit Provider |

| Product | Personal and Short-term Loans |

| Minimum age | 18 years |

| Minimum amount | R1 000 |

| Maximum amount | R200 000 |

| Minimum term | 1 month |

| Maximum term | 6 years (72 months) |

| APR | 15% – 28%* |

| Monthly Interest Rate | Typically varies by loan type and borrower profile |

| Early Settlement | Allowed without penalties |

| Repayment Flexibility | Tailored to meet specific borrower requirements |

| NCR Accredited | Yes |

| Our Opinion | ✅ Efficient and fast approval process ✅ Flexible loan terms based on individual financial needs ⚠️ Higher interest rates compared to some secured loans |

| User Opinion | ✅ Fast and convenient online process ⚠️ Rates can be higher for individuals with lower credit scores |

What Makes YourLoan24 Loans Unique?

YourLoan24 is distinguished by its emphasis on speed and accessibility, making it a reliable choice for borrowers in need of urgent financial solutions. The platform offers a fully online application process, allowing customers to apply for loans from the comfort of their homes, eliminating the need for extensive paperwork and lengthy waiting periods. In addition, YourLoan24 provides personalised loan amounts tailored to individual financial needs, making it suitable for a wide range of borrowers, from those seeking to cover unexpected expenses to those managing planned financial commitments.

A further advantage of YourLoan24 is its transparent fee structure and flexible repayment options. Borrowers can easily understand the costs involved, including interest rates and any additional fees, which are clearly stated before finalising the loan agreement. The lender also offers flexible repayment schedules, accommodating different income levels and budgeting needs, ensuring that borrowers are not burdened by repayment terms. These features combine to make YourLoan24 a practical and customer-friendly choice for South African borrowers.

About Arcadia Finance

Get the financial support you need with ease through Arcadia Finance. Choose from 19 reliable lenders, all regulated by South Africa’s National Credit Regulator, with zero application fees. Trust us for a smooth and secure loan process.

Types of Loans Offered by YourLoan24

YourLoan24 offers a range of loan options to meet various financial needs, ensuring that customers have the flexibility to select a product that suits their specific circumstances. Below is an overview of the loan types available through YourLoan24 and their potential uses:

Personal Loans

Personal loans are the primary offering from YourLoan24, designed to assist individuals with various financial needs. Whether it’s covering unexpected medical expenses, consolidating debt, or handling household repairs, these loans provide a quick and straightforward solution. Borrowers can access customised loan amounts based on their financial needs and eligibility, with flexible repayment terms to suit different situations.

Short-Term Loans

Short-term loans are ideal for those facing urgent financial challenges, such as covering bills, emergency travel costs, or unexpected repairs. These loans typically feature shorter repayment periods, allowing borrowers to resolve immediate financial gaps without long-term commitment.

Business Loans

For small business owners and entrepreneurs, YourLoan24 offers business loans to help manage cash flow, purchase equipment, or fund expansion projects. These loans are tailored to support business growth while maintaining manageable repayment terms.

Vehicle Financing

YourLoan24 also offers vehicle financing options for customers looking to purchase a new or used car. This loan type allows borrowers to spread the cost of the vehicle over a set period, making it more affordable while still enabling ownership of a reliable mode of transport.

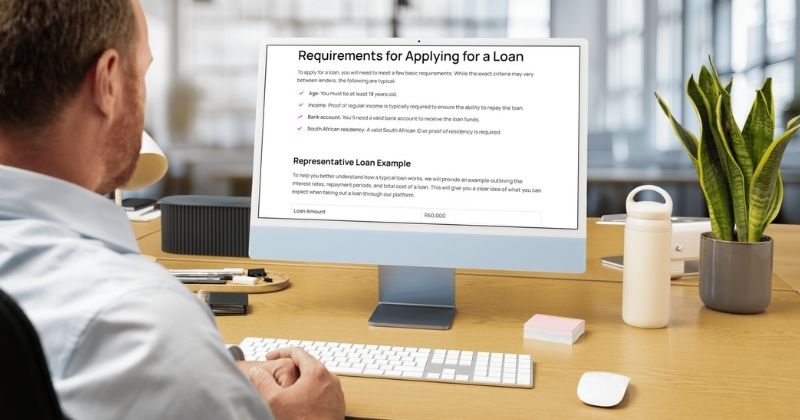

Requirements for a YourLoan24 Loan

To apply for a loan with YourLoan24, applicants need to meet specific requirements and provide certain documents. These include:

- Proof of Identity: Applicants must provide a valid South African ID to verify their identity and citizenship. This ensures that loans are only granted to South African residents.

- Proof of Income: Borrowers are required to submit recent payslips or bank statements that show consistent income. This documentation helps assess the applicant’s financial stability and their ability to repay the loan.

- Bank Account Details: An active South African bank account is necessary for receiving the loan funds. Applicants must ensure that their account is able to process electronic transfers.

- Contact Details: A valid phone number and email address are required for communication during the application process and for any future correspondence related to the loan.

Simulation of a Loan at YourLoan24

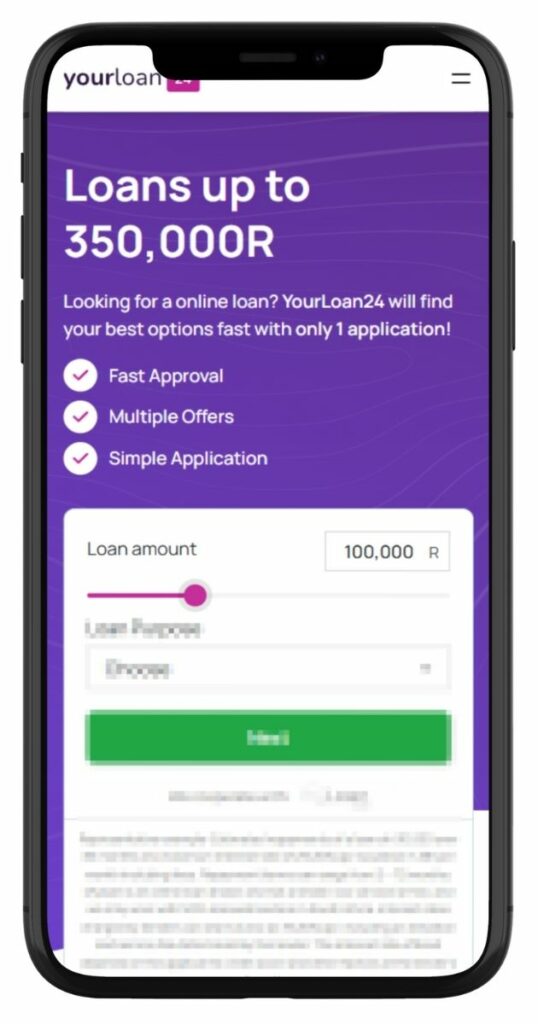

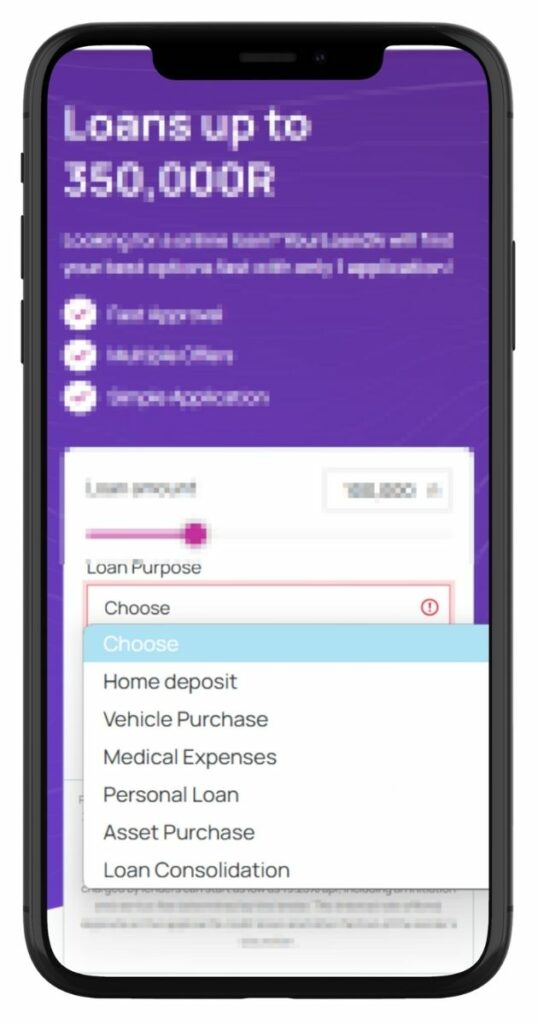

Step 1. Visit YourLoan24.co.za

Step 2. Select the loan amount using the slider.

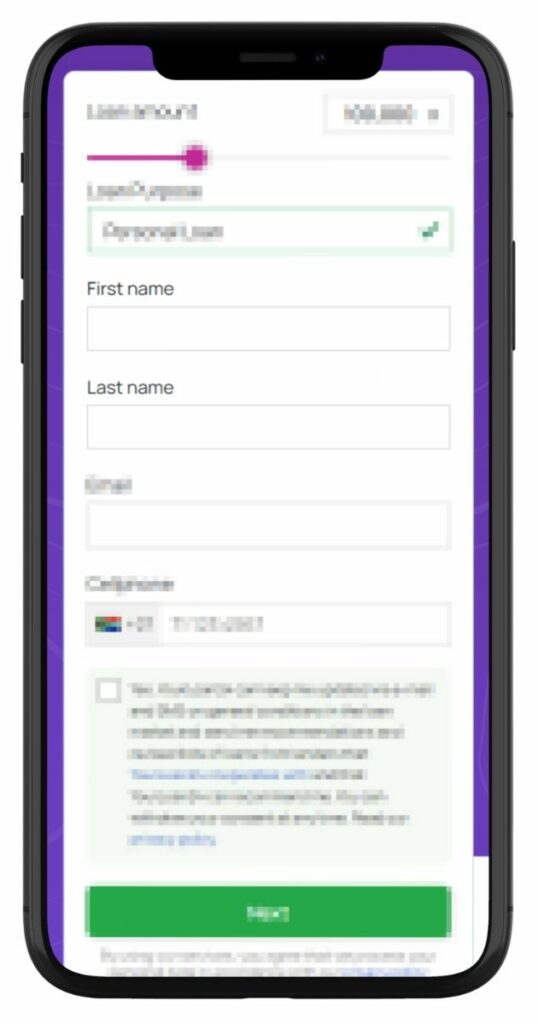

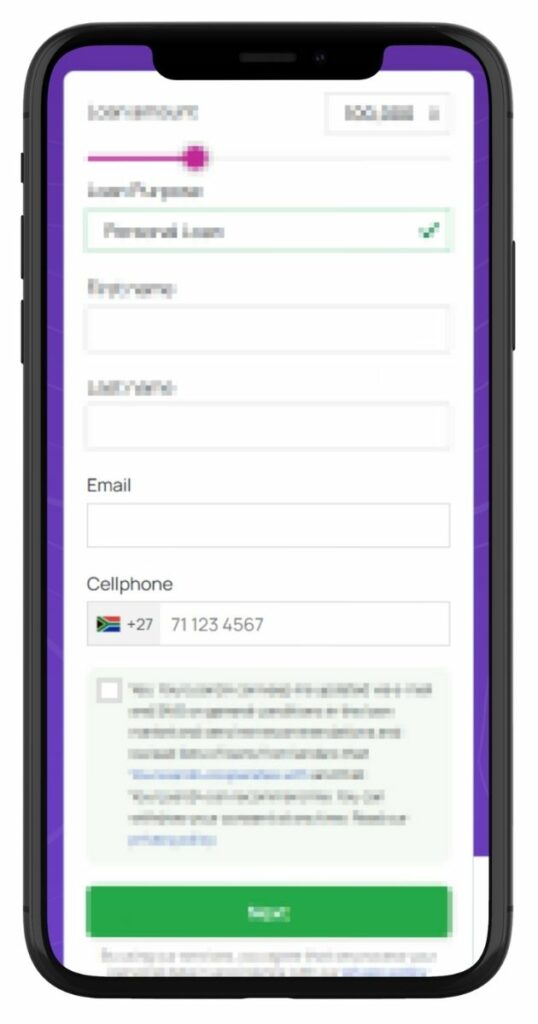

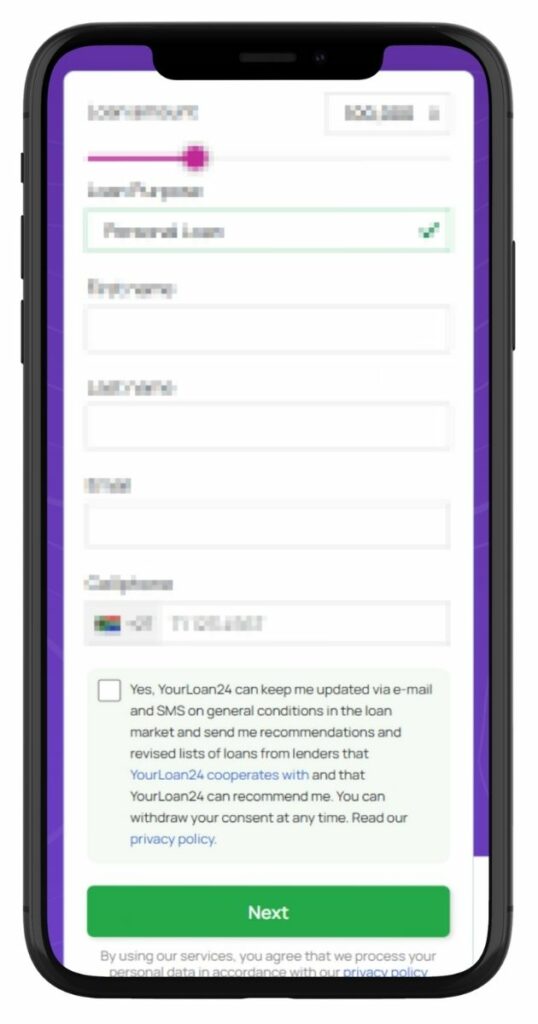

Step 3. Choose the loan purpose from the dropdown menu.

Step 4. Enter your first and last name.

Step 5. Provide your email address and cellphone number.

Step 6. Agree to the terms and conditions, then click “Next” to submit the application.

Step 6. Wait for feedback on approval.

Step 7. If approved, review the loan terms and accept the agreement.

Step 8. Receive the funds directly into your bank account.

Eligibility Check

YourLoan24 provides an online loan calculator that allows customers to estimate their repayment amounts based on the desired loan size and repayment term. In addition, applicants can use the pre-approval feature on the website to check their eligibility before submitting a full application. This tool saves time by confirming whether the applicant meets the basic requirements for a loan.

How Much Money Can I Request from YourLoan24?

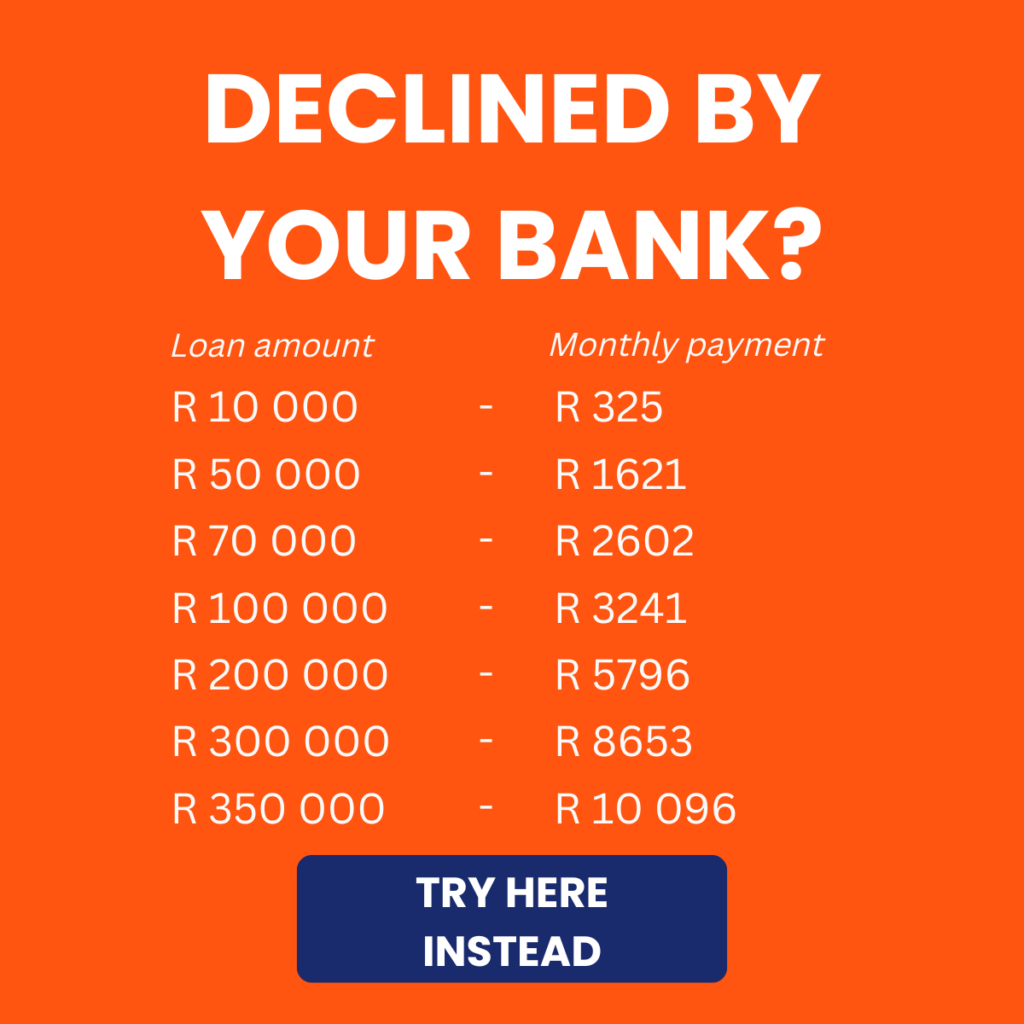

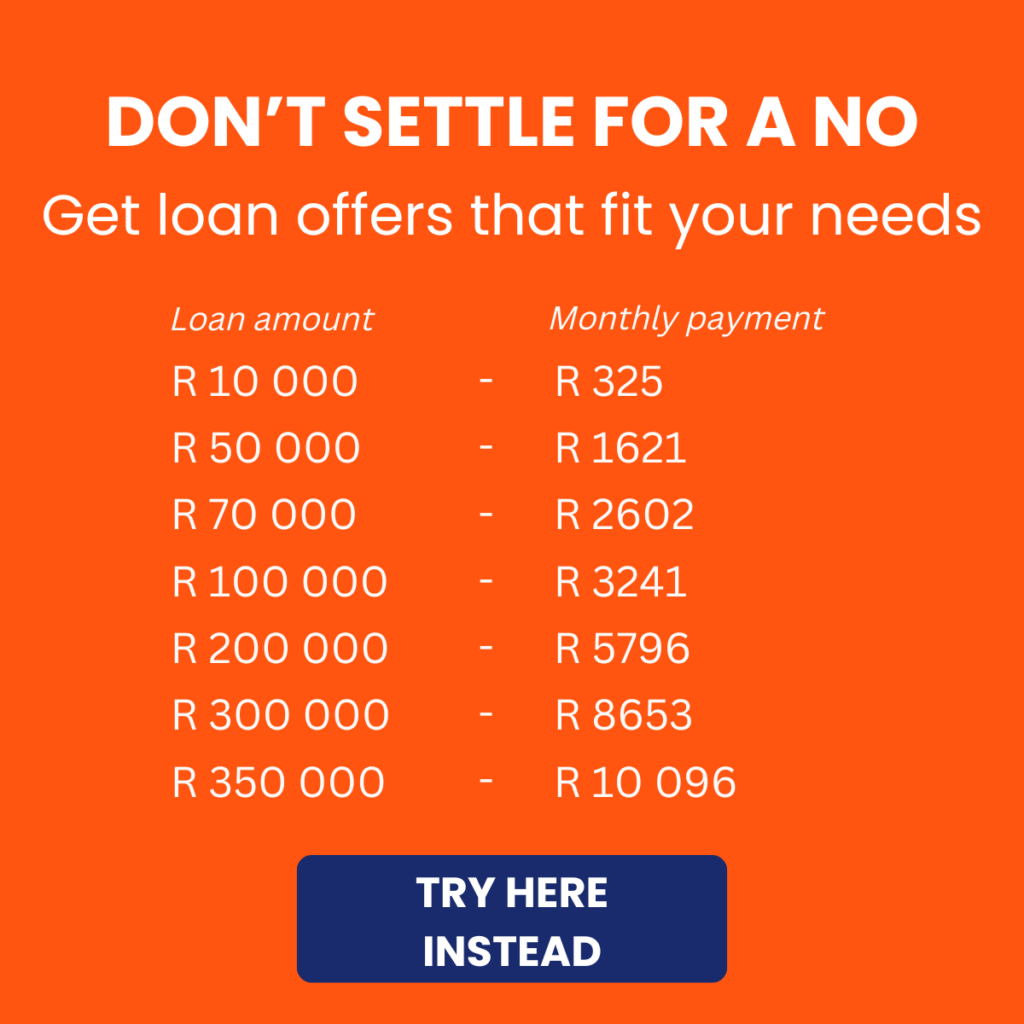

YourLoan24 offers loans to meet a variety of financial needs, with loan amounts ranging from a minimum of R1 000 for small, unexpected expenses, to a maximum of R100 000 for larger financial undertakings such as home improvements or vehicle repairs. The loan amount you qualify for depends on factors such as your income, credit history, and financial profile. YourLoan24 tailors its loan offerings to ensure borrowers are not overburdened with amounts that may be difficult to repay.

Receive Offers

YourLoan24 uses a personalised approach to provide loan offers that align with each applicant’s financial situation. Once you submit your application, the platform assesses factors such as your income, credit score, and requested loan amount. Based on this evaluation, it presents a tailored loan offer, including the interest rate, repayment period, and any associated fees. This ensures that each loan offer is manageable and suited to the borrower’s financial capacity, providing transparency throughout the process.

How Long Does It Take to Receive My Money from YourLoan24?

YourLoan24 is known for its quick processing times, with funds typically disbursed within 24 to 48 hours of loan approval. In some cases, borrowers may receive their money on the same day, depending on when the application is submitted and approved.

Several factors can influence the speed of disbursement:

- Submission of Complete Documents: Missing or incorrect documentation can delay processing.

- Bank Processing Times: While YourLoan24 transfers funds promptly, the speed at which banks process payments may vary.

- Application Time: Applications submitted during working hours are generally processed faster.

To minimise delays, borrowers are encouraged to ensure that all required documents are accurate and complete.

How Do I Repay My Loan from YourLoan24?

Repaying a loan with YourLoan24 is straightforward, with several convenient options available. Borrowers can choose debit order repayments, where monthly instalments are automatically deducted from their bank accounts on the agreed date, ensuring payments are made on time. Alternatively, repayments can be made manually via online banking or at a branch. In some cases, other payment channels, such as retail partner facilities, may also be available.

YourLoan24 maintains a transparent approach to fees and penalties. Late payments may incur additional charges, including late payment fees and potentially higher interest rates on overdue amounts. If you choose to settle your loan early, it’s advisable to review the terms of your agreement, as some lenders may apply early settlement fees. Staying informed about repayment terms helps avoid unnecessary costs and ensures a smooth repayment process.

Pros and Cons of Choosing YourLoan24

When considering YourLoan24 for your borrowing needs, it’s important to weigh both the advantages and disadvantages to determine if it’s the right fit for you.

Pros

- Fast Application Process: The online application system ensures quick processing, making it ideal for those who need urgent financial assistance.

- Flexible Loan Options: YourLoan24 offers a variety of loan amounts and repayment terms, catering to different financial needs and budgets.

- Transparent Fee Structure: Borrowers are clearly informed about all fees and interest rates before signing any agreement, reducing the risk of hidden costs.

- Accessibility: The fully digital platform allows customers across South Africa to apply for loans without needing to visit a branch.

- Pre-Approval Tools: The loan calculator and pre-approval features help borrowers assess their eligibility and expected repayment amounts before applying.

Cons

- Higher Interest Rates for Short-Term Loans: Short-term loans can carry higher interest rates compared to other financial products.

- Limited Loan Products: While YourLoan24 caters to personal and short-term loan needs, it may not provide options for more specialised loans like home loans or large business financing.

- Eligibility Requirements: Applicants with irregular income or poor credit histories may face challenges in qualifying for a loan.

Customer Service

If you have further questions about YourLoan24 or need assistance with your loan application, their customer support team is available to help. You can contact them via email for detailed queries and guidance. For more immediate assistance, you can call their helpline during business hours to speak directly with a representative. Alternatively, their website also provides a contact form and live chat feature, offering a convenient way to get quick answers to your questions.

Contact Channels

Phone number:

Office: 087 654 4868

Cell: 079 159 4389

Hours of operation:

Monday to Friday: 08:00 – 17:00

Saturday to Sunday: By appointment only

Postal address:

Office 2, DGE Building, 90 Sovereign Drive, Route 21 Corporate Park, Irene, South Africa

Online Reviews of YourLoan24

Customer reviews of YourLoan24 highlight several strengths and areas for improvement. Many borrowers appreciate the platform’s simple online application process, which allows for quick loan applications without extensive paperwork. The speed of loan approvals and disbursements is another common positive, especially for those who need funds urgently. Additionally, the transparent loan terms are often praised, with borrowers valuing the clarity around fees and interest rates before agreeing to the loan.

On the downside, some reviews mention that borrowers with lower credit scores may find it more challenging to get approval. A few customers have also reported delays during high-demand periods, although such instances appear to be exceptions. Overall, YourLoan24 has garnered a positive reputation for being a reliable and customer-focused lender, with many users recommending it for its efficiency and clear communication.

Alternatives to YourLoan24

For borrowers exploring other options, several credit platforms in South Africa offer similar services. These include well-known competitors with features that cater to various financial needs.

Comparison Table

| Feature | YourLoan24 | Wonga | Capitec Bank | Bayport | MTN MoMo Qwikloans | EasyPay |

|---|---|---|---|---|---|---|

| Loan Amount Range | R1 000 – R200 000 | R500 – R8 000 | R1 000 – R250 000 | R5 000 – R250 000 | R250 – R10 000 | R1 000 – R4 000 |

| Repayment Terms | 1 – 72 months | 1 – 6 months | 6 – 84 months | 6 – 84 months | Variable, based on loan agreement | 3 – 9 months |

| Application Process | Fully online | Fully online | Online or in-branch | Online or in-branch | Fully online | Online |

| Interest Rates | Transparent rates displayed | Higher for short-term loans | Competitive for personal loans | Varies based on loan size | Significantly lower than banks | Competitive |

| Approval Time | Within 24 hours | Same day | 1 – 3 days | 1 – 3 days | Instant, subject to eligibility | Same day (for qualifying applications) |

| Unique Feature | Tailored for flexibility | Rapid disbursement | Extensive loan options | Large loan amounts | Early settlement allowed without penalties | Integrated with EasyPay services (bills & loans) |

| Wonga Review | Capitec Review | Bayport Review | MTN MoMo Qwikloans Review | EasyPay Review |

History and Background of YourLoan24

YourLoan24 is an online loan comparison service owned by Karman Connect A/S, established in 2014. The company aims to make the loan market more fair and transparent for consumers, offering a platform where users can easily find and compare loan options. By leveraging extensive expertise in the loan market, YourLoan24 helps users save time and effort in finding the best loan that suits their needs.

The company’s mission is to assist individuals in securing the right loan quickly and at no cost. Through a user-friendly platform, customers can fill out their loan requirements and receive options from reliable, verified providers. YourLoan24 strives to simplify the borrowing process, ensuring that consumers have access to transparent and competitive financial products.

Conclusion

YourLoan24 provides a user-friendly platform for South African borrowers in need of personal loans. With an easy-to-navigate online application process, transparent fee structures, and flexible repayment options, it meets a variety of financial needs. Although some borrowers with lower credit scores may find it harder to qualify, overall customer feedback remains positive, praising the platform’s efficiency and reliability. For those considering loan options, YourLoan24 offers a practical and accessible solution within the South African lending market.

Frequently Asked Questions

YourLoan24 offers loans ranging from R1,000 to R200,000, depending on your financial needs and eligibility. The loan amount approved will depend on your income and creditworthiness.

The approval process typically takes up to 24 hours, provided all required documents and information are submitted correctly.

Repayment terms range from 1 to 72 months, giving borrowers the flexibility to choose a schedule that fits their financial situation.

Yes, YourLoan24 offers a fully online application process, allowing you to apply from anywhere with an internet connection.

No, there are no upfront fees to apply. However, loan-related costs such as initiation and service fees will be clearly outlined in the loan agreement before approval.

Fast, uncomplicated, and trustworthy loan comparisons

At Arcadia Finance, you can compare loan offers from multiple lenders with no obligation and free of charge. Get a clear overview of your options and choose the best deal for you.

Fill out our form today to easily compare interest rates from 16 banks and find the right loan for you.